The most significant events that influence the Group’s capital base in the third quarter of 2012 are summarized below:

- As of 30-Sep-2012 the Group continues to comply with the EBA’s capital recommendations.

- The generation of operating income has enabled BBVA to absorb the impact of loan-loss provisions to cover the impairment of assets related to the real estate sector in Spain.

- The increase in risk-weighted assets (RWA), derived from the incorporation of Unnim and the growth in Latin America, has been compensated to a great extent by the fall of lending in Spain and in the CIB portfolios of developed countries.

- The impact of the incorporation of Unnim is practically neutral in terms of core capital. The negative effect in the quarter (10 basis points) will be offset by the exchange offer for the hybrid instruments held by Unnim retail customers in the month of October.

- BBVA comfortably passed the stress test exercise conducted by Oliver Wyman. This confirms once again its capacity to generate capital even in very adverse economic scenarios.

According to Basel II criteria, the Group’s capital base stood at €44,467m at the close of September, up 3.8% on the figure reported at the end of June 2012, largely due to the increase in Tier II eligible capital. RWA totaled €335,203m. Their increase over the quarter is basically due to the incorporation of Unnim.

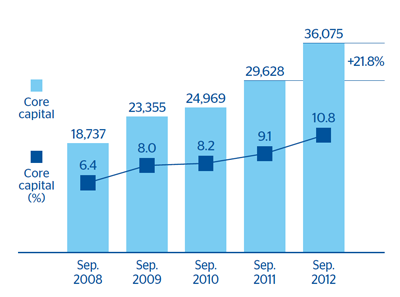

With respect to the components of the capital base, the evolution of the core capital was very flat, with a slight increase of €150m since 30-Jun-2012 to €36,075m. As a result, the core and Tier I ratios as of 30-Sep-2012 stood at 10.8%, the same level posted at the end of the first half of 2012.

In the same period, other eligible capital amounted to €1,552m, primarily due to BBVA Bancomer’s subordinated debt issue. As a result, the Tier II ratio closed the quarter at 2.5%, compared with 2.1% on 30-Jun-2012.

In summary, the Group has increased the BIS II ratio to 13.3% as of 30-Sep-2012, and continues to exceed the 9% minimum core capital ratio required by the EBA.