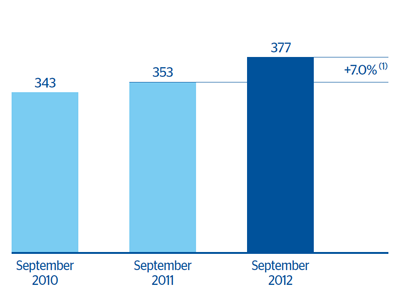

At the close of 30-Sep-2012, gross customer lending amounted to €377 billion, up 7.0% year-on-year and 2.3% quarter-on-quarter. Excluding the balances from Unnim, this heading grew moderately over the year by 1.8%, but fell by 2.6% over the quarter.

By business areas, the disparity between emerging and developed countries seen in previous quarters continued:

- In Spain, excluding Unnim, the loan book shrank (down 6.1% year-on-year and down 5.5% quarter-on-quarter) in line with the necessary process of deleveraging in the economy. Including the balances from the Catalan bank, there was a rise of 3.2% over the last 12 months and 3.9% over the quarter.

- In Eurasia this heading fell by 7.7% on the figure at the close of September 2011 and 4.6% on the close of June 2012, due to the reduction of the wholesale customer’s loan portfolio. Retail loans grew by 4.9% over the last 12 months and remain at very similar levels to 30-Jun-2012. Notable again this quarter was the positive performance of balances from Turkey, which were up 22.8% on the figure for the same date last year.

- At the end of September 2012, lending in Mexico was up year-on-year by 11.5% (up 2.2% over the quarter), strongly supported by the retail segment.

- There was also a significant rise in South America (up 19% year-on-year and 3.9% quarter-on-quarter). Once again, this growth has been leveraged on the private individuals segment, thanks to the positive performance of consumer lending and credit cards.

- Finally, in the United States, BBVA Compass is still posting steady growth in lending, with a year-on-year growth of 4.5% (up 10.5% excluding non performing loans). It is worth noting that loans to the commercial and residential real estate segment continue to drive growth in the bank’s lending activity.

To sum up, the domestic sector continues to be immersed in a deleveraging process and has grown as a consequence of the incorporation of the Unnim balances, while the non-domestic sector has increased by 9.3% since the close of September 2011.

Non-performing loans totaled €20 billion as of 30-Sep-2012, a rise of 26.4% in year-on-year terms and 22.1% since Jun-30-2012. As can be seen in the accompanying table for customer lending, this upward trend derives from the domestic sector and is largely due to the incorporation of Unnim, and to a lesser extent to the worsening NPA ratios in Spain, in line with existing forecasts. It is important to highlight the fact that Unnim’s non-performing balances have a high coverage ratio and that the construction real estate portfolio, foreclosed assets and assets purchased by the Catalan bank are guaranteed by an asset protection scheme (EPA) covering 80% of real losses in these assets.