With the aim of providing a better understanding of the area’s recurrent business, the results in the fourth quarter from the mark to market valuation of BBVA’s current stake in CNCB and the income by the equity method (excluding dividends) for previous periods, in both 2013 and 2012, have been classified as results from corporate operations within the Corporate Center.

Apart from the foregoing and the already noted negative impact of exchange rates, the most significant aspects of Eurasia’s income statement for 2013 are as follows:

- In the fourth quarter of the year, net interest income continued to be negatively affected by interest-rate movements in Turkey and their impact on customers spreads in Garanti. This is despite the slight improvement seen in the last weeks of the year, due to better performance in new loan origination and the easing of the increase in deposit costs. Nevertheless, the area’s net interest income increased by 14.7% compared to the figure for the same period in 2012, to €911m.

- Income from fees and commissions stands at €391m, down 10.1% over the year, influenced by lower revenue from wholesale banking customers. This heading has improved steadily throughout the year due to the more positive performance of Garanti, especially in those headings most closely related to business activities with its customers.

- A good performance by NTI, which totals €194m in 2013, up 54.2% on the amount for 2012, thanks to the excellent performance of the area’s Global Markets unit.

- As a result of the above, gross income in Eurasia stands at €1,721m in 2013, up 8.6% year-on-year.

- Operating expenses continue to be held in check. They declined 1.4% over the last twelve months to €733m, despite the effect of the expansion plans implemented by Garanti during the year. In fact, since the close of 2012, the Turkish bank’s branch network has increased by 65 and the number of ATMs by 495; the costs resulting from the launch of i-Garanti before the summer should also be taken into account.

Garanti. Significant data 31-12-13 (1)

|

|

31-12-13 |

|---|---|

| Financial statements (million euros) |

|

| Attributable profit | 1,186 |

| Total assets | 66,508 |

| Loans and advances to customers | 40,085 |

| Deposits from customers | 34,309 |

| Relevant ratios (%) |

|

| Efficiency ratio (2) | 49.6 |

| NPA ratio | 2.1 |

| Other information |

|

| Number of employees | 18,738 |

| Number of branches | 1,001 |

| Number of ATMs | 4,003 |

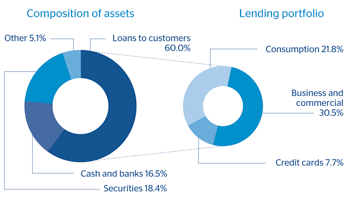

Garanti. Composition of assets and lending portfolio (1)(December 2013) |

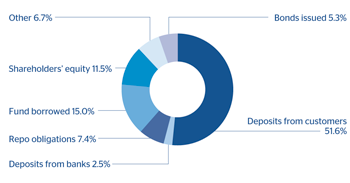

Garanti. Composition of liabilities (1)(December 2013) |

|---|---|

(1) Garanti Bank only. |

(1) Garanti Bank only. |

- Impairment losses on financial assets as of December stand at €330m, up 3.8% on the amount for the same period in 2012. This rise was due to the greater generic provisions arising from increased activity in Garanti and new regulations in Turkey, which came into force recently, increasing the percentage of generic provisions for the credit card and consumer loan portfolios.

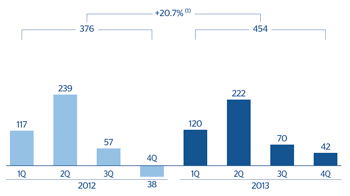

- Overall, Eurasia generated a net attributable profit in 2013 of €454m, up 20.7% on 2012. Of these, €267m (58.9%) come from Garanti’s contribution.

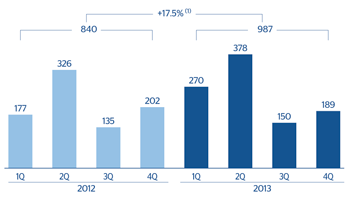

Eurasia. Operating income(Million euros) |

Eurasia. Net attributable profit(Million euros) |

|---|---|

(1) At current exchange rates: +11.4%. |

(1) At current exchange rates: +12.4%. |

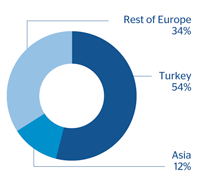

Eurasia. Gross income breakdown by geography(31-12-2013) |

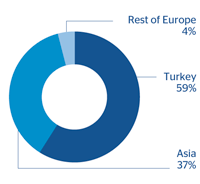

Eurasia. Net attributable profit by geography(31-12-2013) |

|---|---|

|

|