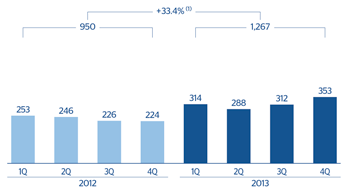

Earnings in this area in 2013 show great strength in each one of the lines of the income statement. This is the result of a strategy based on prioritizing profitability over volume, efficient management and an increase in transversality and diversification of geographical areas, of products and customers. All this has led to a cumulative net attributable profit of €1,267m, a year-on-year increase of 33.4%.

On the revenue side, gross income amounts to €3,036m, a 20.2% increase over the same period the previous year. Most of this growth stems from the Global Transactional Banking and Global Markets units.

Another reason for the improved earnings in CIB has been the efforts made to control costs. At year-end, total operating expenses stood at €900m, a year-on-year increase of 4.0%. These efforts to keep expenses under control are even more relevant taking into account the Bank’s ongoing commitment to innovation and, thus, the investments it makes to be at the cutting edge of technology. In addition, BBVA carries out this activity not only in mature markets, but also in emerging geographical areas with high inflation rates and which are undergoing various expansion and development plans. Thus, operating income totals €2,136m euros, up 28.6% on the figure for the same period in 2012, which brings the efficiency ratio to 29.6%, at similar levels to the first nine months of 2013, i.e. an improvement of 3.9 percentage points over the ratio reported in 2012.

Lastly, compared to the average for previous quarters, there has been a decline in impairment losses on financial assets, which is why this heading’s accumulated amount to December is still below the levels for the same period in 2012: €94m (down 43.1% year-on-year).

CIB. Operating income(Million euros at constant exchange rates) |

CIB. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: +20.9%. |

(1) At current exchange rates: +26.9%. |