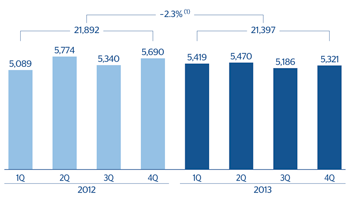

Gross income

(Million euros)

BBVA obtained gross income of €5,321m between October and December 2013, an increase of €135m on the previous quarter. This positive performance was once more boosted by recurring revenue (net interest income plus income from fees and commissions).

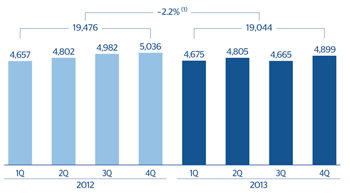

Net interest income totals €3,760m, the highest quarterly figure in 2013. It has recovered the upward trend after a decline in the previous quarter, basically as a result of the elimination of the “floor clauses” on May 9. The favorable performance now is basically due to the improvement in the cost of funding (wholesale and retail) and strong activity in emerging markets and the United States. As a result, cumulative net interest income for the year stands at €14,613m, down 3.4% on the figure for the same period in 2012. Excluding the exchange-rate effect, this heading has grown by 2.7% over the same period.

Quarterly income from fees and commissions totals €1,139m, also the highest figure registered in 2013. For the year as a whole, it amounts to €4,431m, a year-on-year increase of 1.8%. This is despite the coming into force in some geographical areas of laws restricting some types of fees, which have had a negative impact on this heading.

Overall, the Group has demonstrated a high level of resilience and great capacity to generate recurring revenues, which over the year as a whole amounted to €19,044m. This figure is 2.2% down on the same period in 2012, but up 3.5% excluding the exchange-rate effect.

Net interest income plus fees and commissions

(Million euros)

Breakdown of yields and costs

|

|

4Q13 | 3Q13 | 2Q13 | 1Q13 | ||||

|---|---|---|---|---|---|---|---|---|

|

|

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

| Cash and balances with central banks | 4.9 | 0.85 | 4.2 | 0.89 | 4.2 | 0.99 | 5.2 | 0.95 |

| Financial assets and derivatives | 26.7 | 2.99 | 27.0 | 2.74 | 27.4 | 2.78 | 26.8 | 2.77 |

| Loans and advances to credit institutions | 4.5 | 1.98 | 4.5 | 1.28 | 4.4 | 1.57 | 4.4 | 1.54 |

| Loans and advances to customers | 56.2 | 5.63 | 56.5 | 5.50 | 56.2 | 5.58 | 55.9 | 5.55 |

| Euros | 32.6 | 2.62 | 33.3 | 2.65 | 33.4 | 2.97 | 34.0 | 3.08 |

| Domestic | 27.0 | 3.04 | 27.1 | 3.09 | 27.6 | 3.41 | 28.1 | 3.47 |

| Other | 5.6 | 0.61 | 6.2 | 0.72 | 5.8 | 0.85 | 5.8 | 1.23 |

| Foreign currencies | 23.6 | 9.80 | 23.3 | 9.58 | 22.8 | 9.43 | 22.0 | 9.37 |

| Other assets | 7.8 | 0.29 | 7.8 | 0.27 | 7.8 | 0.25 | 7.7 | 0.29 |

| Total assets | 100.0 | 4.11 | 100.0 | 3.97 | 100.0 | 4.03 | 100.0 | 3.99 |

| Deposits from central banks and credit institutions | 14.5 | 1.82 | 14.3 | 1.90 | 14.1 | 2.00 | 16.0 | 1.87 |

| Deposits from customers | 50.7 | 1.65 | 49.5 | 1.64 | 48.1 | 1.70 | 46.7 | 1.70 |

| Euros | 26.3 | 1.20 | 25.9 | 1.21 | 24.6 | 1.35 | 24.0 | 1.28 |

| Domestic | 19.3 | 1.33 | 18.6 | 1.39 | 17.7 | 1.56 | 16.6 | 1.51 |

| Other | 7.0 | 0.87 | 7.2 | 0.75 | 7.0 | 0.83 | 7.3 | 0.77 |

| Foreign currencies | 25.2 | 1.75 | 23.6 | 2.11 | 23.5 | 2.06 | 22.7 | 2.13 |

| Debt certificates and subordinated liabilities | 14.0 | 2.63 | 15.4 | 2.83 | 16.2 | 2.77 | 16.5 | 2.73 |

| Other liabilities | 13.1 | 1.28 | 13.0 | 1.04 | 14.0 | 0.88 | 13.7 | 1.06 |

| Equity | 7.6 | - | 7.8 | - | 7.6 | - | 7.2 | - |

| Total liabilities and equity | 100.0 | 1.64 | 100.0 | 1.66 | 100.0 | 1.67 | 100.0 | 1.69 |

| Net interest income/Average total assets (ATA) |

|

2.47 |

|

2.31 |

|

2.36 |

|

2.30 |

The quarter was positive for NTI thanks once more to positive market activity and good management of structural risks. In 2013, this heading amounted to €2,527m, 43.0% above the figure for the same period the previous year.

The dividends heading has registered a figure of €114m for the quarter. Of particular importance has been the remuneration from the stake in Telefónica, which was suspended temporarily in July 2012 and paid again in November 2013, as planned. In the year as a whole, total dividends received amounted to €365m.

Income by the equity method stands at €53m in the fourth quarter and €72m in 2013 as a whole. These figures do not include the earnings from CNCB, as with the aforementioned signing of the agreement with CITIC, BBVA’s current stake in CNCB is now considered available-for-sale. To guarantee a homogenous comparison, the historical series have been reconstructed, transferring the income by the equity method (excluding dividends) from CNCB corresponding to previous quarters to the new heading of earnings from corporate operations, as mentioned at the start of this chapter.

Lastly, other operating income and expenses, at a negative €353m in the quarter and a negative €612m for the year as a whole, continues to reflect the good performance of the insurance business in all the geographical areas, although also a more negative effect than in 2012 of hyperinflation in Venezuela. Also influencing negatively is the increased contribution to the deposit guarantee schemes in the different regions where BBVA operates, including the exceptional payment in the fourth quarter to the Spanish Deposit Guarantee Fund in compliance with Royal Decree-Law 6/2013, dated March 22.

In conclusion, gross income performed well in 2013, at €21,397m, a year-on-year decline of 2.3%, but an increase of 2.6% not taking into account currency depreciation.