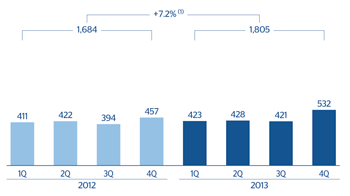

At the end of 2013, BBVA in Mexico reported a net attributable profit of €1,805m, a year-on-year growth of 7.2%. Some of the most important factors accounting for this business performance are given below.

Cumulative net interest income amounts to €4,484m, up 7.7% year-on-year, on the back of higher lending and deposit volumes and good management of customer spreads. This performance in net interest income by BBVA Bancomer compares positively with that of its most important peers. In fact its net interest income over ATA (according to local accounting data) was 5.6%, more than 30 basis points above the market average, according to CNBV at the close of November 2013. Income from fees and commissions was up 10.7% over the year, boosted by more credit card transactions and increased revenue from the bank’s participation in market issuance by its corporate customers. It was a positive year for NTI, albeit more moderate than in 2012 (down 4.3%). Lastly, the other income/expenses heading, which basically includes revenue from the insurance business, has increased by 13.7% during the year. As a result, gross income amounted to €6,201m, an increase of 8.1% on the figure for the same period in 2012.

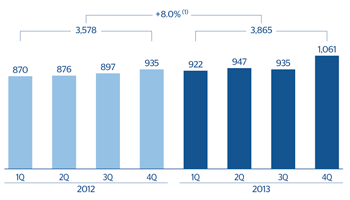

Operating expenses rose 8.2% in 2013 to €2,335m. This increase is largely the result of the implementation of the area’s “Investment Plan” aimed at remodeling the branch network, launching investment projects in technology and constructing new corporate headquarters, as well as developing other strategies to boost commercial activity. Despite this, the efficiency ratio is virtually unchanged (37.7% compared with 37.6% in 2012), making the bank one of the most efficient in the Mexican banking sector. These income and expenses figures have resulted in operating income ending the year at €3,865m euros, up 8.0% on the 2012 figure.

Lastly, impairment losses on financial assets stood at €1,439m, an increase of 9.4%, very much in line with the growth in activity over the year. BBVA’s cumulative risk premium in Mexico is at a very similar level to that of previous quarters: 3.57%.

Mexico. Operating income(Million euros at constant exchange rate) |

Mexico. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: +7.7%. |

(1) At current exchange rate: +6.8%. |