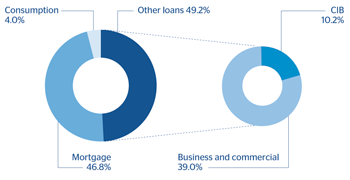

Against this background, performing loans in the area amounted to €165,813m as of 31-Dec-2013, implying a decline of 4.6% over the quarter and 10.2% over the last twelve months.

As stated above, in terms of asset quality, the upward trend in the NPA ratio continues, largely due to the declining lending volumes, as non-performing loans fell during the last quarter. In the year-on-year comparison, the rise in the NPA ratio is also due to the impact of the classification of refinanced loans made in the third quarter. As of 31-Dec-2013, this ratio stood at 6.4% (6.2% as of 30-Sep-2013). The coverage ratio has remained stable over the period, ending at 41%, as at the end of September.

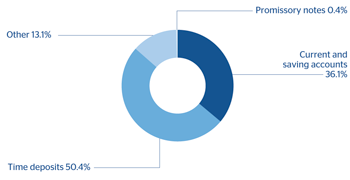

However, from the standpoint of liabilities, the performance of customer funds continues being very positive. As of 31-Dec-2013, BBVA managed €190.508m in customer deposits, promissory notes, mutual and pension funds, which implies year-on-year growth of 11.1% and of 3.5% on the close of the previous quarter.

Customer deposits under management rose 2.8% since September 2013 and 10.4% over the last twelve months. Current accounts report the higher growth over the quarter (up 5.3%), while time deposits have grown the most over the last 12 months (up 18.9%). The area has managed to cope with a very demanding year in terms of maturities, thanks to its adequate commercial policy and the high capillarity of its network, as well as the promotion of multi-channel banking, enabling it to reach deposit renewal rates of over 80% every month.

Spain. Banking activity. Performing loans breakdown(December 2013) |

Spain. Banking activity. Breakdown of customer deposits under management(December 2013) |

|---|---|

|

|

In off-balance-sheet funds, BBVA has performed well in both mutual and pension funds, which increased by 8.8% and 2.8%, respectively, during the quarter, and by 16.6% and 10.0%, respectively, over the year. In an environment of very low interest rates, BBVA is actively selling a diversified mutual fund catalog to customers with the right investor profile. As a result, BBVA has maintained its position as the top manager in both mutual and pension funds in Spain, with market shares of 16.4% in mutual funds (according to the latest information available as of November) and 20.4% in pensions (according to data published by Inverco in September).