As of 31-Dec-2013 the area’s performing loans totaled €39,272m, rising again by 2.3% in the quarter and by 9.4% over the year. This increase was widespread across all of the Bank’s portfolios. Lending to corporates (commercial) increased by 3.4% over the quarter and 14.7% since the end of 2012, while residential mortgages (residential real estate) grew by 2.1% and 10.1%, respectively over the same period. There was also an increase in consumer loans (up 1.4% in the quarter and 5.9% over the year) and a recovery in the construction real estate portfolio (up 4.6% in the quarter, but down 4.6% compared to the figure for December 2012), after several quarters of falling balances.

The main indicators of the area’s asset quality and risk management improved significantly in the quarter, with the NPA ratio down 22 basis points to 1.2% and the coverage ratio up 14 percentage points to 134%.

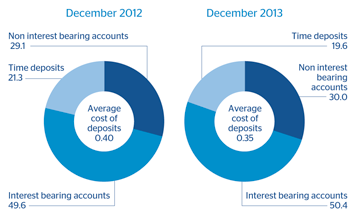

Customer deposits under management, at €38,448m as of December 31, 2013, also increased significantly over the quarter, by 4.3% (up 6.5% on the figure as of 31-Dec-2012). These positive figures are due to the favorable performance of lower-cost deposits, specifically current and savings accounts, which are up 3.4% since the close of September 2013 and 7.2% since the end of December 2012. In contrast, time deposits remained practically stable in the quarter and are down 3.2% for the year as a whole.

The United States. Performing loans breakdown(December 2013) |

The United States. Breakdown of customer depostis under management(December 2013) |

|---|---|

|

|

BBVA Compass. Loan mix(Percentage) |

BBVA Compass. Deposit mix(Percentage) |

|---|---|

|

|