1. Introduction, basis for the presentation of the consolidated financial statements and internal control of financial information

1.1 Introduction

Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter “the Bank” or “BBVA") is a private-law entity subject to the laws and regulations governing banking entities operating in Spain. It carries out its activity through branches and agencies across the country and abroad.

The Bylaws and other public information are available for consultation at the Bank’s registered address (Plaza San Nicolás, 4 Bilbao) and on its official website: www.bbva.com.

In addition to the transactions it carries out directly, the Bank heads a group of subsidiaries, jointly controlled and associated entities which perform a wide range of activities and which together with the Bank constitute the Banco Bilbao Vizcaya Argentaria Group (hereinafter, “the Group” or “the BBVA Group”). In addition to its own individual financial statements, the Bank is therefore required to prepare the Group’s consolidated financial statements.

As of December 31, 2012, the BBVA Group was made up of 320 fully consolidated and 29 proportionately consolidated companies, as well as 102 companies accounted for using the equity method (see Notes 3 and 17 Appendices II to VII).

The BBVA Group’s consolidated financial statements for the years ended December 31, 2011 and 2010 were approved by the shareholders at the Bank’s Annual General Meetings (“AGM”) held on March 16, 2012 and March 11, 2011, respectively.

The consolidated financial statements of the BBVA Group and the separate financial statements of the Bank and of nearly all the Group companies for the year ended December 31, 2012 have not yet been approved by their shareholders at the respective Annual General Meetings. However, the Bank’s Board of Directors considers that the aforementioned financial statements will be approved without any changes.

1.2 Basis for the presentation of the consolidated financial statements

The BBVA Group’s consolidated financial statements are presented in accordance with the International Financial Reporting Standards endorsed by the European Union (hereinafter, “EU-IFRS”) required to be applied as of the close of the year 2012 under the Bank of Spain Circular 4/2004, of 22 December (and as amended thereafter), and with any other legislation governing financial reporting applicable to the Group.

The BBVA Group’s consolidated financial statements for the year ended December 31, 2012 were prepared by the Bank’s Directors (at the Board of Directors meeting held on January 31, 2013) by applying the principles of consolidation, accounting policies and valuation criteria described in Note 2, so that they present fairly the Group’s consolidated equity and financial position as of December 31, 2012, together with the consolidated results of its operations and cash flows generated during year ended on that date.

These consolidated financial statements were prepared on the basis of the accounting records kept by the Bank and each of the other entities in the Group. Moreover, they include the adjustments and reclassifications required to harmonize the accounting policies and valuation criteria used by most of the Group (see Note 2.2).

All effective accounting standards and valuation criteria with a significant effect in the consolidated financial statements were applied in their preparation.

The amounts reflected in the accompanying consolidated financial statements are presented in millions of euros, unless it is more convenient to use smaller units. Some items that appear without a total in these consolidated financial statements do so because of the size of the units used. Also, in presenting amounts in millions of euros, the accounting balances have been rounded up or down. It is therefore possible that the amounts appearing in some tables are not the exact arithmetical sum of their component figures.

The percentage changes in amounts have been calculated using figures expressed in thousands of euros.

1.3 Comparative information

The information contained in these consolidated financial statements for 2011 and 2010 is presented solely for the purpose of comparison with information relating to December 31, 2012. It does not constitute the consolidated financial statements for the BBVA Group for 2011 and 2010.

As mentioned in Note 3, the on-balance figures for the companies related to the pension businesses sold in Latin America have been reclassified under the headings "Non-current assets held for sale" and "Liabilities associated with non-current assets held for sale” of the consolidated balance sheet as of December 31 2012, and the earnings of these companies for 2012 have been registered under the heading “Income from discontinued transactions” in the accompanying consolidated income statement. In accordance with IFRS-5, and to make it easier to compare this information across different years, the earnings from these companies for the years 2011 and 2010 have been reclassified under the heading “Income from discontinued transactions” in the accompanying consolidated income statements.

As mentioned in Note 6, in 2012 minor changes are made to the business segments in the BBVA Group with respect to the structure in place in 2011 and 2010, although they do not have any significant impact on the consolidated income statements or the information by business segments. To make it easier to compare this information across different years, the figures for 2011 and 2010 have been reworked according to the criteria used in 2012, as established by IFRS 8, “Operating segments.”

1.4 Seasonal nature of income and expenses

The nature of the most significant operations carried out by the BBVA Group’s entities is mainly related to traditional activities carried out by financial institutions, which are not significantly affected by seasonal factors.

1.5 Responsibility for the information and for the estimates made

The information contained in the BBVA Group’s consolidated financial statements is the responsibility of the Group’s Directors.

Estimates have to be made at times when preparing these consolidated financial statements in order to calculate the registered amount of some assets, liabilities, income, expenses and commitments. These estimates relate mainly to the following:

- Impairment on certain financial assets (see Notes 7, 8, 12, 13, 14 and 17).

- The assumptions used to quantify certain provisions (see Notes 18, 24 and 25) and for the actuarial calculation of post-employment benefit liabilities and commitments (see Note 26).

- The useful life and impairment losses of tangible and intangible assets (see Notes 16, 19, 20 and 22).

- The valuation of goodwill (see Notes 17 and 20).

- The fair value of certain unlisted financial assets and liabilities in organized markets (see Notes 7, 8, 10, 11, 12 and 15).

Although these estimates were made on the basis of the best information available as of December 31, 2012 on the events analyzed, future events may make it necessary to modify them (either up or down) over the coming years. This would be done prospectively in accordance with applicable standards, recording the effects of changes in the estimates in the corresponding consolidated income statement.

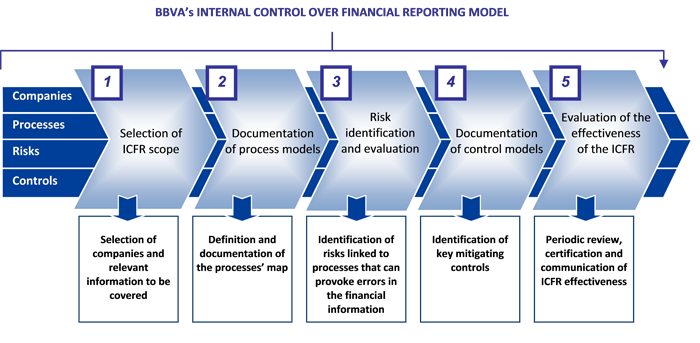

1.6 Control of the BBVA Group’s financial reporting

The financial information prepared by the BBVA Group is subject to a system of internal control (hereinafter the "Internal Control over Financial Reporting" or "ICFR"). Its aim is to provide reasonable security with respect to its reliability and integrity, and to ensure that the transactions carried out and processed use the criteria established by the Group’s management and comply with applicable laws and regulations.

The ICFR was developed by the Group’s management in accordance with international standards established by the Committee of Sponsoring Organizations of the Treadway Commission (hereinafter, "COSO"). This stipulates five components that must form the basis of the effectiveness and efficiency of systems of internal control:

- Assessment of all of the risks that could arise during the preparation of financial information.

- Design the necessary controls to mitigate the most critical risks.

- Monitoring of the controls to ensure they perform correctly and are effective over time.

- Establishment of an appropriate system of information flows to detect and report system weaknesses or flaws.

- Establishment of a suitable control environment to track all of these activities.

The ICFR is a dynamic model that evolves continuously over time to reflect the reality of the Group’s business at any time, together with the risks affecting it and the controls designed to mitigate these risks. It is subject to continuous evaluation by the internal control units located in the Group’s different entities.

The internal control units comply with a common and standard methodology issued by the corporate internal control units, which also perform a supervisory role over them, as set out in the following diagram:

As well as the evaluation by the Internal Control Units, ICFR Model is subject to regular evaluations by the Group’s Internal Audit Department and external auditors. It is also supervised by the Audit and Compliance Committee of the Bank’s Board of Directors. As of the date of preparation of these consolidated financial statements, no weaknesses were detected that could have a material or significant impact on the BBVA Group consolidated financial statements for the year 2012.

The description of the Internal Financial Reporting Control system is detailed in the Annual Corporate Governance Report included in the consolidated Management Report that accompanies the consolidated financial statements for 2012.

1.7 Mortgage market policies and procedures

The information on “Mortgage market policies and procedures” (for the granting of mortgage loans and for debt issues secured by such mortgage loans) required by Bank of Spain Circular 5/2011, applying Royal Decree 716/2009, dated April 24 (which developed certain aspects of Act 2/1981, dated 25 March, on the regulation of the mortgage market and other mortgage and financial market regulations), is set out in more detail in the Bank’s individual Financial Statements for 2012.