7. Risk management

The BBVA Group understands the risk function as one of the essential and differentiating elements of its competitive strategy. In this context, the aim of the Global Risk Management (GRM) Corporate Area is to preserve the BBVA Group’s solvency, help define its strategy with respect to risk and assume and facilitate the development of its businesses. Its activity is governed by the following principles:

- The risk management function is single, independent and global.

- The risks assumed by the Group must be compatible with the capital adequacy target and must be identified, measured and assessed. Risk monitoring and management procedures and sound mechanisms of control and mitigation systems must likewise be in place.

- All risks must be managed integrally during their life cycle, and be treated differently depending on their nature and with active portfolio management based on a common measure (economic capital).

- It is each business area’s responsibility to propose and maintain its own risk profile, within its autonomy in the corporate action framework (defined as the set of risk control policies and procedures defined by the Group), using an appropriate risk infrastructure to control their risks.

- The infrastructures created for risk control must be equipped with means (in terms of people, tools, databases, information systems and procedures) that are sufficient for their purpose, so that there is a clear definition of roles and responsibilities, thus ensuring efficient allocation of resources among the corporate area and the risk units in business areas.

In the light of these principles, the BBVA Group has developed an integrated risk management system that is structured around three main components: a corporate risk governance scheme (with suitable segregation of duties and responsibilities); a set of tools, circuits and procedures that constitute the various risk management regimes; and an internal control system that is appropriate to the nature and size of the risks assumed.

The main risks associated with financial instruments are:

- Credit risk: This arises from the probability that one party to a financial instrument will fail to meet its contractual obligations for reasons of insolvency or inability to pay and cause a financial loss for the other party. This includes management of counterparty risk, issuer credit risk, liquidation risk and country risk.

-

Market risk: This is originated by the likelihood of losses in the value of the positions held as a result of changes in the market prices of financial instruments. It includes three types of risks:

- Interest-rate risk: This arises from variations in market interest rates.

- Currency risk: This is the risk resulting from variations in foreign-currency exchange rates.

- Price risk: This is the risk resulting from variations in market prices, either due to factors specific to the instrument itself, or alternatively to factors which affect all the instruments traded on a specific market.

- Liquidity risk: This arises from the possibility that a company cannot meet its payment commitments, or to do so must resort to borrowing funds under onerous conditions, or risking its image and the reputation of the entity.

- Operational risk: This arises from the possibility of human error, inadequate or faulty internal processes, system failures or external events. This definition includes the legal risk and excludes strategic and/or business risk and reputational risk.

Corporate governance system

The BBVA Group has developed a system of corporate governance that is in line with the best international practices and adapted to the requirements of the regulators in the country in which its different business units operate.

With respect to the risks assumed by the Group, the Board of Directors of the Bank is responsible for establishing the general principles that define the risk objectives profile of the entities, approving the management policies for control and management of these risks and ensuring regular monitoring of the internal systems of risk information and control. The Board is supported in this function by the Executive Committee and the Risk Committee. The main mission of the latter is to assist the Board in carrying out its functions associated with risk control and management.

The risk management and control function is distributed among the risk units within the business areas and the Corporate GRM Area, which ensures compliance with global policy and strategies. The risk units in the business areas propose and manage the risk profiles within their area of autonomy, though they always respect the corporate framework for action.

The Corporate GRM Area combines a vision by risk type with a global vision. It is divided into five units, as follows:

- Corporate Risk Management and Risk Portfolio Management: Responsible for management and control of the Group’s financial risks.

- Operational and Control Risk: Manages operational risk, internal risk control and the internal validation of the measurement models and the acceptance of new risks.

- Technology & Methodologies: Responsible for the management of the technological and methodological developments required for risk management in the Group.

- Technical Secretariat: Undertakes technical tests of the proposals made to the Risk Management Committee and the Risk Committee; prepares and promotes the regulations applicable to social and environmental risk management.

- Retail Banking: with responsibilities in Turkey, Switzerland and Asia, supports development and innovation in retail banking and provides support to the LOBs (Lines of Business) of insurance, asset management, consumer finance and payment channels. This unit centralizes non-banking risk management (insurance and funds) and management of the fiduciary risk of the Retail Banking businesses.

This structure gives the Corporate GRM Area reasonable security with respect to:

- integration, control and management of all the Group’s risks;

- the application throughout the Group of standard principles, policies and metrics; and

- the necessary knowledge of each geographical area and each business.

This organizational scheme is complemented by various committees, which include the following:

- The Global Risk Management Committee: This committee is made up of the risk managers from the risk units located in the business areas and the managers of the Corporate GRM Area units. Among its responsibilities are the following: establishing the Group’s risk strategy (especially as regards policies and structure of this function in the Group), presenting its proposal to the appropriate governing bodies for their approval, monitoring the management and control of risks in the Group and adopting any actions necessary.

- The GRM Management Committee: Made up of the executives of the Group’s risk unit and those responsible for risks in the different countries and business areas. It reviews the Group’s risk strategy and the general implementation of the main risk projects and initiatives in the business areas.

- The Risk Management Committee: Its permanent members are the Global Risk Management director, the Corporate Risk Management director and the Technical Secretariat. The other committee members propose the operations that are analyzed in its working sessions. The committee analyzes and, if appropriate, authorizes financial programs and operations within its scope and submits the proposals whose amounts exceed the set limits to the Risks Committee, when its opinion on them is favorable.

- The Assets and Liabilities Committee (ALCO): The committee is responsible for actively managing structural interest rate and foreign exchange risk positions, global liquidity and the Group’s capital base.

- The Global Corporate Assurance Committee: Its task is to undertake a review at both Group and business unit level of the control environment and the effectiveness of the operational risk internal control and management systems, as well as to monitor and analyze the main operational risks the Group is subject to, including those that are cross-cutting in nature. This committee is therefore the highest operational risk management body in the Group.

- The Technology and Methodologies Committee: The committee decides on the effectiveness of the models and infrastructures developed to manage and control risks that are integrated in the business areas, within the framework of the operational model of Global Risk Management.

- The New Businesses and Products Committees: Their functions are to analyze and, where appropriate, give technical approval to and implement new businesses, products and services prior to their marketing: to undertake subsequent control and monitoring of new authorized products; and to foster orderly business operations to ensure they develop in a controlled environment.

Tools, circuits and procedures

The BBVA Group has an established integrated risk management system that meets the needs derived from different types of risk to which it is subject. It is set out in a number of manuals. These manuals provide the measuring tools for the acceptance, assessment and monitoring of risks, define the circuits and procedures applicable to operations by entities and the criteria for their management.

The BBVA Group’s main activities with respect to the management and control of its risks are as follows:

- Calculation of exposure to risks of the different portfolios, taking into account any possible mitigating factors (guarantees, balance netting, collaterals, etc.).

- Calculation of the probabilities of default (hereinafter, “PD”).

- Estimation of the foreseeable losses in each portfolio, assigning a PD to new operations (rating and scoring).

- Measurement of the risk values of the portfolios in different scenarios through historical simulations.

- Establishment of limits to potential losses according to the different risks incurred.

- Determination of the possible impacts of structural risks on the Group’s consolidated income statement.

- Determination of limits and alerts to guarantee the Group’s liquidity.

- Identification and quantification of operational risks by business lines to make their mitigation easier through the appropriate corrective actions.

- Definition of efficient circuits and procedures to achieve the established objectives, etc.

Internal control system

The BBVA Group’s internal control system is based on the best practices developed in “Enterprise Risk Management – Integrated Framework” by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) as well as in “Framework for Internal Control Systems in Banking Organizations” by the Bank for International Settlements (BIS). The Group’s system for internal control is therefore part of the Integral Risk Management Framework.

This is the system within the Group that involves its Board of Directors, management and its entire staff. It is designed to identify and manage risks facing the Group entities in such a way as to ensure that the business targets established by the Group’s management are met. The Integrated Risk Management Framework is made up of specialized units (Compliance, Global Accounting & Information Management and Legal Services), and the Corporate Operational Risk Management and Internal Audit functions.

Among the principles underpinning the Internal Control system are the following:

- Its core element is the “process.”

- The form in which the risks are identified, assessed and mitigated must be unique for each process; and the systems, tools and information flows that support the internal control and operational risk activities must be unique, or at least be administered fully by a single unit.

- The responsibility for internal control lies with the Group’s business units, and at a lower level, with each of the entities that make them up. Each business unit’s Operational Risk Management Unit is responsible for implementing the system of control within its scope of responsibility and managing the existing risk by proposing any improvements to processes it considers appropriate.

- Given that some business units have a global scope of responsibility, there are cross-cutting control functions which supplement the control mechanisms mentioned earlier.

- The Operational Risk Management Committee in each business unit is responsible for approving suitable mitigation plans for each existing risk or weakness. This committee structure culminates at the Group’s Global Corporate Assurance Committee.

- The specialized units promote policies and draw up internal regulations. It is the responsibility of the Corporate Risk Area to develop them further and apply them.

Risk concentrations

In the trading area, limits are approved each year by the Board of Directors’ Risk Committee on exposures to trading, structural interest rate, structural exchange rate, equity and liquidity; this applies both to the banking entities and to the asset management, pension and insurance businesses. These limits factor in many variables, including economic capital and earnings volatility criteria, and are reinforced with alert triggers and a stop-loss scheme.

In relation to credit risk, maximum exposure limits are set by customer and country; generic limits are also set for maximum exposure to specific operations or products. Limits are allocated based on iso-risk curves, determined as the sum of maximum foreseeable losses and economic capital, and its ratings-based equivalence in terms of gross nominal exposure.

There is a threshold in terms of a maximum risk concentration level of 10% of Group equity: up to this level the authorization of new risks requires in-depth knowledge of the client, and the markets and sectors in which it operates.

For retail portfolios, potential concentrations of risk in geographical areas or certain risk profiles are analyzed in relation to overall risk and earnings volatility; where appropriate, the mitigating measures considered most appropriate are established.

7.1 Credit risk

7.1.1 Maximum credit risk exposure

The BBVA Group’s maximum credit risk exposure by headings in the balance sheet as of December 31, 2012, 2011 and 2010 is given below. It does not recognize the availability of collateral or other credit enhancements to guarantee compliance with payment obligations. The details are broken down by financial instruments and counterparties.

In the case of financial assets recognized in the consolidated balance sheets, exposure to credit risk is considered equal to its gross accounting value, not including certain valuation adjustments (impairment losses, derivatives and others), with the sole exception of trading and hedging derivatives.

The maximum credit risk exposure on financial guarantees granted is the maximum that the Group would be liable for if these guarantees were called in, and that is their carrying amount.

Our calculation of risk exposure for derivatives is based on the sum of two factors: the derivatives market value and their potential risk (or "add-on").

The first factor, market value, reflects the difference between original commitments and market values on the reporting date (mark-to-market). As indicated in Note 2.2.1 to the Consolidated Financial Statements, derivatives are accounted for as of each reporting date at fair value according to IAS 39.

The second factor, potential risk (‘add-on’), is an estimate (using our internal models) of the maximum increase to be expected on risk exposure over a derivative market value (at a given statistical confidence level) as a result of future changes in valuation prices in the residual term to final maturity of the transaction.

The consideration of the potential risk ("add-on") relates the risk exposure to the exposure level at the time of a customer’s default. The exposure level will depend on the customer’s credit quality and the type of transaction with such customer. Given the fact that default is an uncertain event which might occur any time during the life of a contract, the Group has to consider not only the credit exposure of the contract on the reporting date, but also the potential changes in exposure during the life of the contract. This is especially important for derivative contracts, whose valuation changes substantially throughout time, depending on the fluctuation of market prices.

Credit risk originating from the derivatives in which the Group operates is mitigated through the contractual rights existing for offsetting accounts at the time of their settlement. This has reduced the Group’s exposure to credit risk to €43,133 million as of December 31, 2012 (€37,817 million and €27,026 million as of December 31, 2011 and 2010, respectively).

Download Excel

Download Excel

| Maximum Credit Risk Exposure | Notes | Millions of Euros | ||

|---|---|---|---|---|

| 2012 | 2011 | 2010 | ||

| Financial assets held for trading |

|

28,066 | 20,975 | 24,358 |

| Debt securities | 10 | 28,066 | 20,975 | 24,358 |

| Government |

|

23,411 | 17,989 | 20,397 |

| Credit institutions |

|

2,548 | 1,882 | 2,274 |

| Other sectors |

|

2,107 | 1,104 | 1,687 |

| Other financial assets designated at fair value through profit or loss |

|

753 | 708 | 691 |

| Debt securities | 11 | 753 | 708 | 691 |

| Government |

|

174 | 129 | 70 |

| Credit institutions |

|

45 | 44 | 87 |

| Other sectors |

|

534 | 535 | 535 |

| Available-for-sale financial assets |

|

66,612 | 52,008 | 50,602 |

| Debt securities | 12 | 66,612 | 52,008 | 50,602 |

| Government |

|

42,762 | 35,801 | 33,074 |

| Credit institutions |

|

13,224 | 7,137 | 11,235 |

| Other sectors |

|

10,626 | 9,070 | 6,293 |

| Loans and receivables |

|

396,468 | 388,949 | 373,037 |

| Loans and advances to credit institutions | 13.1 | 26,447 | 26,013 | 23,604 |

| Loans and advances to customers | 13.2 | 366,047 | 359,855 | 347,210 |

| Government |

|

35,043 | 35,090 | 31,224 |

| Agriculture |

|

4,886 | 4,841 | 3,977 |

| Industry |

|

32,789 | 37,217 | 36,578 |

| Real estate and construction |

|

49,305 | 50,989 | 55,854 |

| Trade and finance |

|

52,158 | 55,748 | 53,830 |

| Loans to individuals |

|

154,383 | 139,063 | 135,868 |

| Other |

|

37,483 | 36,907 | 29,879 |

| Debt securities | 13.3 | 3,974 | 3,081 | 2,223 |

| Government |

|

2,375 | 2,128 | 2,040 |

| Credit institutions |

|

576 | 631 | 6 |

| Other sectors |

|

1,023 | 322 | 177 |

| Held-to-maturity investments | 14 | 10,162 | 10,955 | 9,946 |

| Government |

|

9,210 | 9,896 | 8,792 |

| Credit institutions |

|

393 | 451 | 552 |

| Other sectors |

|

560 | 608 | 602 |

| Derivatives (trading and hedging) |

|

59,755 | 57,077 | 44,762 |

| Subtotal |

|

561,816 | 530,672 | 503,396 |

| Valuation adjustments |

|

403 | 594 | 299 |

| Total Financial Assets Risk |

|

562,219 | 531,266 | 503,695 |

| Financial guarantees (Bank guarantees, letter of credits,..) |

|

39,540 | 39,904 | 36,441 |

| Drawable by third parties |

|

86,227 | 88,978 | 86,790 |

| Government |

|

1,360 | 3,143 | 4,135 |

| Credit institutions |

|

1,946 | 2,417 | 2,303 |

| Other sectors |

|

82,921 | 101,314 | 80,352 |

| Other contingent commitments |

|

6,871 | 4,787 | 3,784 |

| Total Contingent Risks and Commitments | 34 | 132,638 | 133,670 | 127,015 |

| Total Maximum Credit Exposure |

|

694,857 | 664,936 | 630,710 |

7.1.2 Mitigation of credit risk, collateralized credit risk and other credit enhancements

In most cases, maximum credit risk exposure is reduced by collateral, credit enhancements and other actions which mitigate the Group’s exposure. The BBVA Group applies a credit risk hedging and mitigation policy deriving from a banking approach focused on relationship banking. The existence of guarantees could be a necessary but not sufficient instrument for accepting risks, as the assumption of risks by the Group requires prior verification of the debtor’s capacity for repayment, or that the debtor can generate sufficient resources to allow the amortization of the risk incurred under the agreed terms.

The policy of accepting risks is therefore organized into three different levels in the BBVA Group:

- Analysis of the financial risk of the operation, based on the debtor’s capacity for repayment or generation of funds;

- The constitution of guarantees that are adequate, or at any rate generally accepted, for the risk assumed, in any of the generally accepted forms: monetary, secured, personal or hedge guarantees; and finally,

- Assessment of the repayment risk (asset liquidity) of the guarantees received.

The procedures for the management and valuation of collaterals are set out in the Internal Manuals on Credit Risk Management Policies and Procedures (retail and wholesale), which establish the basic principles for credit risk management, including the management of collaterals assigned in transactions with customers.

The methods used to value the collateral are in line with the best market practices and imply the use of appraisal of real-estate collateral, the market price in market securities, the trading price of shares in mutual funds, etc. All the collaterals assigned must be properly drawn up and entered in the corresponding register. They must also have the approval of the Group’s legal units.

The following is a description of the main types of collateral for each financial instrument class:

- Financial instruments held for trading: The guarantees or credit enhancements obtained directly from the issuer or counterparty are implicit in the clauses of the instrument.

- Trading and hedging derivatives: In derivatives, credit risk is minimized through contractual netting agreements, where positive- and negative-value derivatives with the same counterparty are offset for their net balance. There may likewise be other kinds of guarantees, depending on counterparty solvency and the nature of the transaction.

The BBVA Group has a broad range of credit derivatives. The Group uses credit derivatives to mitigate credit risk in its loan portfolio and other cash positions and to hedge risks assumed in market transactions with other clients and counterparties.

Derivatives may follow different settlement and netting agreements, under the rules of the International Swaps and Derivatives Association (ISDA). The most common types of settlement triggers include bankruptcy of the reference credit institution, acceleration of indebtedness, failure to pay, restructuring, repudiation and dissolution of the entity. Since the Group typically confirms over 99% of our credit derivative transactions in the Depository Trust & Clearing Corporation (DTCC), substantially our entire credit derivatives portfolio is registered and matched against our counterparties.

- Other financial assets designated at fair value through profit or loss and Available-for-sale financial assets: The guarantees or credit enhancements obtained directly from the issuer or counterparty are inherent to the structure of the instrument.

-

Loans and receivables:

- Loans and advances to credit institutions: These usually only have the counterparty’s personal guarantee.

- Loans and advances to customers: Most of these operations are backed by personal guarantees extended by the counterparty. There may also be collateral to secure loans and advances to customers (such as mortgages, cash guarantees, pledged securities and other collateral), or to obtain other credit enhancements (bonds, hedging, etc.).

- Debt securities: The guarantees or credit enhancements obtained directly from the issuer or counterparty are inherent to the structure of the instrument.

- Held-to-maturity investments: Guarantees or credit enhancements obtained directly from the issuer or counterparty are inherent to the structure of the instrument.

- Financial guarantees, other contingent risks and drawable by third parties: These have the counterparty’s personal guarantee.

The Group’s collateralized credit risk as of December 31, 2012, 2011 and 2010, excluding balances deemed impaired, is broken down in the table below:

Download Excel

Download Excel

|

|

Millions of Euros | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| Mortgage loans | 139,228 | 130,703 | 132,630 |

| Operating assets mortgage loans | 4,357 | 3,732 | 3,638 |

| Home mortgages | 120,133 | 109,199 | 108,224 |

| Rest of mortgages (1) | 14,738 | 17,772 | 20,768 |

| Secured loans, except mortgage | 28,465 | 29,353 | 18,155 |

| Cash guarantees | 419 | 332 | 281 |

| Secured loan (pledged securities) | 997 | 590 | 563 |

| Rest of secured loans (2) | 27,049 | 28,431 | 17,310 |

| Total | 167,693 | 160,056 | 150,785 |

As of December 31, 2012, the average weighted amount of mortgages pending loan amortization is 51% of the collateral pledged (see Appendix XII), compared to 52% as of December 31, 2011 and 53% as of December 31, 2010.

7.1.3 Credit quality of financial assets that are neither past due nor impaired

The BBVA Group has tools (“scoring” and “rating”) that enable it to rank the credit quality of its operations and customers based on an assessment and its correspondence with the probability of default (“PD”) scales. To analyze the performance of PD, the Group has a series of tracking tools and historical databases that collect the pertinent information generated internally, which can basically be grouped together into scoring and rating models.

Scoring

Scoring is a decision-making model that contributes to both the arrangement and management of retail loans: consumer loans, mortgages, credit cards for individuals, etc. Scoring is the tool used to decide to whom a loan should be assigned, what amount should be assigned and what strategies can help establish the price, because it is an algorithm that sorts transactions by their credit quality. This algorithm enables the BBVA Group to assign a score to each transaction requested by a customer, on the basis of a series of objective characteristics that have statistically been shown to discriminate between the quality and risk of this type of transactions. The advantage of scoring lies in its simplicity and homogeneity: all that is needed is a series of objective data for each customer, and this data is analyzed automatically using an algorithm.

There are three types of scoring, based on the information used and on its purpose:

- Reactive scoring: measures the risk of a transaction requested by an individual using variables relating to the requested transaction and to the customer’s socio-economic data available at the time of the request. The new transaction is approved or rejected depending on the score given.

- Behavioral scoring: scores transactions for a given product in an outstanding risk portfolio of the entity, enabling the credit rating to be tracked and the customer’s needs to be anticipated. It uses transaction and customer variables available internally. Specifically, variables that refer to the behavior of both the product and the customer.

- Proactive scoring: gives a score at customer level using variables related to the individual’s general behavior with the entity, and to his/her payment behavior in all the contracted products. The purpose is to track the customer’s credit quality and it is used to pre-grant new transactions.

Rating

Rating tools, as opposed to scoring tools, do not assess transactions but focus on the rating of customers instead: companies, corporations, SMEs, public authorities, etc. A rating tool is an instrument that, based on a detailed financial study, helps determine a customer’s ability to meet his/her financial obligations. The final rating is usually a combination of various factors: on the one hand, quantitative factors, and on the other hand, qualitative factors. It is a middle road between an individual analysis and a statistical analysis.

The main difference between ratings and scorings is that the latter are used to assess retail products, while ratings use a wholesale banking customer approach. Moreover, scorings only include objective variables, while ratings add qualitative information. And although both are based on statistical studies, adding a business view, rating tools give more weight to the business criterion compared to scoring tools.

For portfolios where the number of defaults is very low (sovereign risk, corporates, financial entities, etc.) the internal information is supplemented by “benchmarking” of the external rating agencies (Moody’s, Standard & Poor’s and Fitch). To this end, each year the PDs compiled by the rating agencies at each level of risk rating are compared, and the measurements compiled by the various agencies are mapped against those of the BBVA master rating scale.

Once the probability of default of a transaction or customer has been calculated, a "business cycle adjustment" is carried out. This is a means of establishing a measure of risk that goes beyond the time of its calculation. The aim is to capture representative information of the behavior of portfolios over a complete economic cycle. This probability is linked to the Master Rating Scale prepared by the BBVA Group to enable uniform classification of the Group’s various asset risk portfolios.

The table below shows the abridged scale used to classify the BBVA Group’s outstanding risk as of December 31, 2012:

Download Excel

Download Excel

| Internal rating Reduced List (17 groups) |

"Probability of default (basic points)" |

||

|---|---|---|---|

| Average | Minimum from >= | Maximum | |

| AAA | 1 | - | 2 |

| AA+ | 2 | 2 | 3 |

| AA | 3 | 3 | 4 |

| AA- | 4 | 4 | 5 |

| A+ | 5 | 5 | 6 |

| A | 8 | 6 | 9 |

| A- | 10 | 9 | 11 |

| BBB+ | 14 | 11 | 17 |

| BBB | 20 | 17 | 24 |

| BBB- | 31 | 24 | 39 |

| BB+ | 51 | 39 | 67 |

| BB | 88 | 67 | 116 |

| BB- | 150 | 116 | 194 |

| B+ | 255 | 194 | 335 |

| B | 441 | 335 | 581 |

| B- | 785 | 581 | 1,061 |

| C | 2,122 | 1,061 | 4,243 |

The table below outlines the distribution of exposure, including derivatives, by internal ratings, to corporates, financial entities and institutions (excluding sovereign risk), of the main BBVA Group entities as of December 31, 2012 and 2011:

Download Excel

Download Excel

|

|

2012 | 2011 | ||

|---|---|---|---|---|

| Amount (Millions of Euros) |

% | Amount (Millions of Euros) |

% | |

| AAA/AA+/AA/AA- | 24,091 | 9.95% | 47,047 | 18.42% |

| A+/A/A- | 73,526 | 30.37% | 94,192 | 36.88% |

| BBB+ | 31,951 | 13.20% | 23,685 | 9.27% |

| BBB | 23,410 | 9.67% | 10,328 | 4.04% |

| BBB- | 26,788 | 11.07% | 10,128 | 3.97% |

| BB+ | 15,185 | 6.27% | 12,595 | 4.93% |

| BB | 10,138 | 4.19% | 11,361 | 4.45% |

| BB- | 8,493 | 3.51% | 14,695 | 5.75% |

| B+ | 8,504 | 3.51% | 10,554 | 4.13% |

| B | 8,246 | 3.41% | 11,126 | 4.36% |

| B- | 5,229 | 2.16% | 6,437 | 2.52% |

| CCC/CC | 6,501 | 2.69% | 3,266 | 1.28% |

| Total | 242,064 | 100.00% | 255,414 | 100.00% |

These different levels and their probability of default were calculated by using as a reference the rating scales and default rates provided by the external agencies Standard & Poor’s and Moody’s. These calculations establish the levels of probability of default for the BBVA Group’s Master Rating Scale. Although this scale is common to the entire Group, the calibrations (mapping scores to PD sections/Master Rating Scale levels) are carried out at tool level for each country in which the Group has tools available.

7.1.4 Policies for preventing excessive risk concentration

In order to prevent the build-up of excessive concentrations of credit risk at the individual, country and sector levels, the BBVA Group maintains maximum permitted risk concentration indices updated at individual and portfolio sector levels tied to the various observable variables within the field of credit risk management. The limit on the Group’s exposure or financial commitment to a specific customer therefore depends on the customer’s credit rating, the nature of the risks involved, and the Group’s presence in a given market, based on the following guidelines:

- The aim is, as far as possible, to combine the customer’s credit needs (commercial/financial, short-term/long-term, etc.) with the interests of the Group.

- Any legal limits that may exist concerning risk concentration are taken into account (relationship between risks with a customer and the capital of the entity that assumes them), the markets, the macroeconomic situation, etc.

- To undertake a proper management of risk concentration, and if necessary generate actions on such risks, a number of different levels of monitoring have been established according to the amount of global risks maintained with the same customer. Any risk concentrations with the same customer or group that may generate losses of more than €18 million are authorized and monitored by the Risk Committee of the Bank’s Board of Directors.

7.1.5 Sovereign risk exposure

Sovereign risk management

The risk associated with the transactions involving sovereign risk is identified, measured, controlled and tracked by a centralized unit integrated in the BBVA Group’s Risk Area. Its basic functions involve the preparation of individual reports on the countries where sovereign risk exists (called “financial programs”), tracking such risks, assigning ratings to these countries and, in general, supporting the Group in terms of reporting requirements for any transactions involving sovereign risk. The risk policies established in the financial programs are approved by the relevant risk committees.

The country risk unit tracks the evolution of the risks associated with the various countries to which the Group are exposed (including sovereign risk) on an ongoing basis in order to adapt its risk and mitigation policies to any macroeconomic and political changes that may occur. Moreover, it regularly updates its internal ratings and forecasts for these countries. The internal rating assignment methodology is based on the assessment of quantitative and qualitative parameters which are in line with those used by certain multilateral organizations such as the International Monetary Fund (IMF) and the World Bank (WB), rating agencies and export credit organizations.

The table below provides a breakdown of exposure to financial instruments, as of December 31, 2012 and 2011, by type of counterparty and the country of residence of such counterparty. The below figures do not take into account valuation adjustments, impairment losses or loan-loss provisions:

Download Excel

Download Excel

| Risk Exposure by countries | Millions of Euros | ||||

|---|---|---|---|---|---|

| 2012 | |||||

| Sovereign Risk (*) |

Financial Institutions | Other Sectors | Total | % | |

| Spain | 62,558 | 11,839 | 182,786 | 257,183 | 51.3% |

| Turkey | 3,900 | 405 | 10,241 | 14,546 | 2.9% |

| United Kingdom | 2 | 7,754 | 2,421 | 10,177 | 2.0% |

| Italy | 4,203 | 405 | 3,288 | 7,896 | 1.6% |

| Portugal | 443 | 590 | 5,763 | 6,796 | 1.4% |

| France | 1,739 | 3,327 | 2,633 | 7,699 | 1.5% |

| Germany | 1,298 | 1,125 | 742 | 3,165 | 0.6% |

| Ireland | - | 280 | 457 | 737 | 0.1% |

| Greece | - | - | 99 | 99 | 0.0% |

| Rest of Europe | 1,776 | 2,526 | 5,897 | 10,199 | 2.0% |

| Europe | 75,919 | 28,251 | 214,327 | 318,497 | 63.5% |

| Mexico | 25,059 | 5,494 | 36,133 | 66,686 | 13.3% |

| The United States | 3,942 | 3,805 | 42,235 | 49,982 | 10.0% |

| Rest of countries | 7,521 | 5,521 | 53,612 | 66,654 | 13.3% |

| Total Rest of Countries | 36,523 | 14,820 | 131,980 | 183,322 | 36.5% |

| Total Exposure to Financial Instruments | 112,442 | 43,071 | 346,307 | 501,819 | 100.0% |

Download Excel

Download Excel

| Risk Exposure by countries | Millions of Euros | ||||

|---|---|---|---|---|---|

| 2011 | |||||

| Sovereign Risk (*) |

Financial Institutions | Other Sectors | Total | % | |

| Spain | 56,473 | 6,883 | 178,068 | 241,424 | 51.1% |

| Turkey | 3,414 | 220 | 8,822 | 12,456 | 2.6% |

| United Kingdom | 120 | 7,381 | 3,566 | 11,067 | 2.3% |

| Italy | 4,301 | 492 | 4,704 | 9,497 | 2.0% |

| Portugal | 279 | 829 | 6,715 | 7,824 | 1.7% |

| France | 619 | 1,903 | 3,038 | 5,561 | 1.2% |

| Germany | 592 | 1,048 | 911 | 2,551 | 0.5% |

| Ireland | 7 | 183 | 212 | 401 | 0.1% |

| Greece | 109 | 5 | 32 | 146 | 0.0% |

| Rest of Europe | 739 | 4,419 | 6,072 | 11,230 | 2.4% |

| Europe | 66,654 | 23,363 | 212,141 | 302,157 | 63.9% |

| Mexico | 22,875 | 5,508 | 31,110 | 59,493 | 12.6% |

| The United States | 3,501 | 3,485 | 42,589 | 49,576 | 10.5% |

| Rest of countries | 7,281 | 3,803 | 50,563 | 61,647 | 13.0% |

| Total Rest of Countries | 33,657 | 12,796 | 124,262 | 170,716 | 36.1% |

| Total Exposure to Financial Instruments | 100,311 | 36,159 | 336,403 | 472,873 | 100.0% |

The exposure to sovereign risk set out in the above table includes positions held in government debt securities in countries where the Group operates. They are used for ALCO’s management of the interest-rate risk on the balance sheets of the Group’s entities in these countries, as well as for hedging of pension and insurance commitments by insurance companies within the BBVA Group.

Sovereign risk exposure in Europe

The European sovereign debt crisis deepened in 2011. Contagion of the financial tension during the year extended, first, to countries on the European periphery; and subsequently, as doubts increased about the capacity of governments in the euro zone to resolve the crisis, even to some core countries in Europe with sounder finances.

As part of the exercise carried out by the European Banking Authority (EBA) (see Note 33) to assess the minimum capital levels of European banking groups, as defined in the European Union’s Capital Requirement Directive (CRD), certain information on the exposure of the Group’s credit institutions to European sovereign risk as of September 30, 2011 was published on December 8, 2011. The table below provides a breakdown of the exposure of the Group’s credit institutions to European sovereign risk as of December 31, 2012 and 2011, by type of financial instrument and the country of residence of the counterparty. The below figures do not take into account valuation adjustments, impairment losses or loan-loss provisions.

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Union Countries (1) | Millions of Euros | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2012 | |||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total | Contingent risks and commitments | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | |||||

| Spain | 5,022 | 19,751 | 6,469 | 26,624 | 285 | 5 | 58,156 | 1,595 | 86.6% |

| Italy | 610 | 811 | 2,448 | 97 | - | (3) | 3,963 | - | 5.9% |

| France | 1,445 | - | 254 | - | - | (2) | 1,697 | - | 2.5% |

| Germany | 1,291 | - | - | - | (4) | (1) | 1,286 | - | 1.9% |

| Portugal | 51 | 18 | 15 | 359 | - | - | 443 | 17 | 0.7% |

| United Kingdom | - | - | - | - | (19) | - | (19) | 1 | 0.0% |

| Greece | - | - | - | - | - | - | - | - | 0.0% |

| Hungary | - | 66 | - | - | - | - | 66 | - | 0.1% |

| Ireland | - | - | - | - | - | - | - | - | 0.0% |

| Rest of European Union | 1,066 | 379 | 24 | 78 | - | 1 | 1,548 | - | 2.3% |

| Total Exposure to Sovereign Counterparties (European Union) | 9,485 | 21,025 | 9,210 | 27,158 | 262 | - | 67,140 | 1,613 | 100.0% |

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Union Countries (1) | Millions of Euros | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2011 | |||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total | Contingent risks and commitments | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | |||||

| Spain | 4,366 | 15,225 | 6,520 | 26,637 | 96 | - | 52,844 | 3,455 | 89.1% |

| Italy | 350 | 634 | 2,956 | 184 | - | (23) | 4,101 | - | 6.9% |

| France | 513 | 6 | 69 | - | (3) | (2) | 583 | - | 1.0% |

| Germany | 338 | 12 | 254 | - | - | (3) | 601 | - | 1.0% |

| Portugal | 39 | 11 | 13 | 216 | - | (1) | 278 | 65 | 0.5% |

| United Kingdom | - | 120 | - | - | (3) | - | 117 | 1 | 0.2% |

| Greece | - | 10 | 84 | 15 | - | (8) | 101 | - | 0.2% |

| Hungary | - | 53 | - | - | - | - | 53 | - | 0.1% |

| Ireland | - | 7 | - | - | - | 1 | 8 | - | 0.0% |

| Rest of European Union | 155 | 351 | - | 130 | - | 2 | 638 | 4 | 1.1% |

| Total Exposure to Sovereign Counterparties (European Union) | 5,761 | 16,429 | 9,896 | 27,182 | 89 | (34) | 59,323 | 3,525 | 100.0% |

The following table provides a breakdown of the notional value of the CDS in which the Group’s credit institutions act as sellers or buyers of protection against the sovereign risk of European countries:

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Countries | Millions of Euros | |||

|---|---|---|---|---|

| 2012 | ||||

| Credit derivatives (CDS) and other contracts in which the Group act as a protection seller | Credit derivatives (CDS) and other contracts in which the Group act as a protection buyer | |||

| Notional value | Fair value | Notional value | Fair value | |

| Spain | 68 | 14 | 97 | (9) |

| Italy | 518 | (22) | 444 | 19 |

| Germany | 216 | (1) | 219 | - |

| France | 196 | (1) | 134 | (1) |

| Portugal | 91 | (6) | 89 | 6 |

| Poland | - | - | - | - |

| Belgium | 281 | (4) | 232 | 5 |

| United Kingdom | 56 | 1 | 64 | (1) |

| Greece | 18 | - | 18 | - |

| Hungary | 2 | - | - | - |

| Ireland | 82 | - | 82 | - |

| Rest of European Union | 149 | 2 | 155 | (2) |

| Total exposure to Sovereign Counterparties | 1,677 | (17) | 1,534 | 17 |

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Countries | Millions of Euros | |||

|---|---|---|---|---|

| 2011 | ||||

| Credit derivatives (CDS) and other contracts in which the Group act as a protection seller | Credit derivatives (CDS) and other contracts in which the Group act as a protection buyer | |||

| Notional value | Fair value | Notional value | Fair value | |

| Spain | 20 | 2 | 20 | (2) |

| Italy | 283 | 38 | 465 | (61) |

| Germany | 182 | 4 | 184 | (6) |

| France | 102 | 3 | 123 | (6) |

| Portugal | 85 | 21 | 93 | (22) |

| Poland | - | - | - | - |

| Belgium | - | - | - | - |

| United Kingdom | 20 | 2 | 20 | (2) |

| Greece | 53 | 25 | 66 | (33) |

| Hungary | - | - | 2 | - |

| Ireland | 82 | 10 | 82 | (9) |

| Rest of European Union | 294 | 31 | 329 | (29) |

| Total exposure to Sovereign Counterparties | 1,119 | 136 | 1,382 | (170) |

The main counterparties of these CDS are credit institutions with a high credit quality. The CDS contracts are standard in the market, with the usual clauses covering the events that would trigger payouts.

As can be seen in the above tables, exposure to sovereign risk in Europe is concentrated in Spain. As of December 31, 2012 and 2011, the breakdown of total exposure faced by the Group’s credit institutions to Spain and other countries, by maturity of the financial instruments, is as follows:

Download Excel

Download Excel

| Maturities of sovereign risks European Union | Millions of Euros | |||||||

|---|---|---|---|---|---|---|---|---|

| 2012 | ||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | ||||

| Spain |

|

|

|

|

|

|

|

|

| Up to 1 Year | 2,183 | 1,944 | 2 | 10,267 | 35 | - | 14,431 | 21.5% |

| 1 to 5 Years | 1,832 | 12,304 | 1,239 | 4,409 | 26 | - | 19,810 | 29.5% |

| Over 5 Years | 1,007 | 5,503 | 5,228 | 11,948 | 224 | 5 | 23,915 | 35.6% |

| Rest of Europe |

|

|

|

|

|

|

|

|

| Up to 1 Year | 2,564 | 46 | 33 | 369 | 7 | - | 3,019 | 4.5% |

| 1 to 5 Years | 952 | 190 | 1,927 | 34 | (19) | (5) | 3,079 | 4.6% |

| Over 5 Years | 947 | 1,038 | 781 | 131 | (11) | - | 2,886 | 4.3% |

| Total Exposure to European Union Sovereign Counterparties | 9,485 | 21,025 | 9,210 | 27,158 | 262 | - | 67,140 | 100.0% |

Download Excel

Download Excel

| Maturities of sovereign risks European Union | Millions of Euros | |||||||

|---|---|---|---|---|---|---|---|---|

| 2011 | ||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | ||||

| Spain |

|

|

|

|

|

|

|

|

| Up to 1 Year | 2,737 | 779 | 36 | 9,168 | 1 | - | 12,721 | 21.4% |

| 1 to 5 Years | 1,025 | 11,630 | 1,078 | 4,265 | 67 | - | 18,065 | 30.5% |

| Over 5 Years | 604 | 2,816 | 5,406 | 13,204 | 27 | - | 22,057 | 37.2% |

| Rest of Europe |

|

|

|

|

|

|

|

|

| Up to 1 Year | 684 | 219 | 72 | 370 | 3 | (1) | 1,347 | 2.3% |

| 1 to 5 Years | 297 | 267 | 2,439 | 38 | (1) | (17) | 3,023 | 5.1% |

| Over 5 Years | 414 | 718 | 865 | 137 | (8) | (15) | 2,111 | 3.6% |

| Total Exposure to European Union Sovereign Counterparties | 5,761 | 16,429 | 9,896 | 27,182 | 89 | (33) | 59,324 | 100.0% |

Valuation and impairment methods

The valuation methods used to assess the instruments that are subject to sovereign risks are the same ones used for other instruments included in the relevant portfolios and are detailed in Note 8 to these consolidated interim financial statements. They take into account the exceptional circumstances that have taken place over the last two years in connection with the sovereign debt crisis in Europe.

Specifically, the fair value of sovereign debt securities of European countries has been considered equivalent to their listed price in active markets (Level 1 as defined in Note 8).

Reclassification of securities between portfolios

Note 14 describes the reclassification carried out in the third quarter of 2011, in accordance with IFRS-7, amounting to €1,817 million in sovereign debt securities issued by Italy, Greece and Portugal from the heading “Available-for-sale financial assets” to the heading “Held-to-maturity investments” of the consolidated balance sheet.

7.1.6 Financial assets past due but not impaired

The table below provides details of financial assets past due as of December 31, 2012, 2011 and 2010, but not considered to be impaired, listed by their first past-due date:

Download Excel

Download Excel

| Financial Assets Past Due but Not Impaired 2012 | Millions of Euros | ||

|---|---|---|---|

| Less than 1 Month Past-Due |

1 to 2 Months Past-Due |

2 to 3 Months Past-Due |

|

| Loans and advances to credit institutions | 21 | - | - |

| Loans and advances to customers | 1,075 | 623 | 312 |

| Government | 90 | 213 | 6 |

| Other sectors | 985 | 410 | 306 |

| Debt securities | - | - | - |

| Total | 1,075 | 623 | 312 |

Download Excel

Download Excel

| Financial Assets Past Due but Not Impaired 2011 | Millions of Euros | ||

|---|---|---|---|

| Less than 1 Month Past-Due |

1 to 2 Months Past-Due |

2 to 3 Months Past-Due |

|

| Loans and advances to credit institutions | - | - | - |

| Loans and advances to customers | 1,998 | 392 | 366 |

| Government | 186 | 47 | 23 |

| Other sectors | 1,812 | 345 | 343 |

| Debt securities | - | - | - |

| Total | 1,998 | 392 | 366 |

Download Excel

Download Excel

| Financial Assets Past Due but Not Impaired 2010 | Millions of Euros | ||

|---|---|---|---|

| Less than 1 Month Past-Due |

1 to 2 Months Past-Due |

2 to 3 Months Past-Due |

|

| Loans and advances to credit institutions | - | - | - |

| Loans and advances to customers | 1,082 | 311 | 277 |

| Government | 122 | 27 | 27 |

| Other sectors | 960 | 284 | 250 |

| Debt securities | - | - | - |

| Total | 1,082 | 311 | 277 |

7.1.7 Impaired assets and impairment losses

The table below shows the composition of the impaired financial assets and risks as of December 31, 2012, 2011 and 2010, broken down by heading in the accompanying consolidated balance sheet:

Download Excel

Download Excel

| Impaired Risks. Breakdown by Type of Asset and by Sector |

Millions of Euros | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| Asset Instruments Impaired |

|

|

|

| Available-for-sale financial assets | 90 | 125 | 140 |

| Debt securities | 90 | 125 | 140 |

| Loans and receivables | 20,325 | 15,685 | 15,472 |

| Loans and advances to credit institutions | 28 | 28 | 101 |

| Loans and advances to customers | 20,287 | 15,647 | 15,361 |

| Debt securities | 10 | 10 | 10 |

| Total Asset Instruments Impaired (1) | 20,415 | 15,810 | 15,612 |

| Contingent Risks Impaired |

|

|

|

| Contingent Risks Impaired (2) | 317 | 219 | 324 |

| Total impaired risks (1) + (2) | 20,732 | 16,029 | 15,936 |

| Of which: |

|

|

|

| Government | 165 | 135 | 124 |

| Credit institutions | 73 | 84 | 129 |

| Other sectors | 20,177 | 15,590 | 15,360 |

| Mortgage | 13,843 | 9,639 | 8,627 |

| With partial secured loans | 113 | 83 | 159 |

| Rest | 6,221 | 5,868 | 6,574 |

| Contingent Risks Impaired | 317 | 219 | 324 |

| Total impaired risks (1) + (2) | 20,732 | 16,029 | 15,936 |

The changes in 2012, 2011 and 2010 in the impaired financial assets and contingent risks are as follows:

Download Excel

Download Excel

| Changes in Impaired Financial Assets and Contingent Risks | Millions of Euros | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| Balance at the beginning | 16,029 | 15,936 | 15,928 |

| Additions (A) | 14,484 | 13,045 | 13,207 |

| Decreases (B) | (8,293) | (9,079) | (9,138) |

| Cash collections and return to performing | (6,018) | (6,044) | (6,267) |

| Foreclosed assets (1) | (1,105) | (1,417) | (1,513) |

| Real estate assets received in lieu of payment (2) | (1,170) | (1,618) | (1,358) |

| Net additions (A)+(B) | 6,191 | 3,966 | 4,069 |

| Amounts written-off | (4,393) | (4,093) | (4,307) |

| Exchange differences and other | 2,905 | 221 | 246 |

| Balance at the end | 20,732 | 16,029 | 15,936 |

Below are details of the impaired financial assets as of December 31, 2012, 2011 and 2010, classified by geographical area and by the time since their oldest past-due amount or the period since they were deemed impaired:

Download Excel

Download Excel

| Impaired Assets by Geographic Area and Time Since Oldest Past-Due Amount 2012 | Millions of Euros | ||||

|---|---|---|---|---|---|

| Less than 6 Months Past-Due |

6 to 9 Months Past-Due |

9 to 12 Months Past-Due |

More than 12 Months Past-Due |

Total | |

| Spain | 6,495 | 1,742 | 1,575 | 6,297 | 16,109 |

| Rest of Europe | 495 | 75 | 54 | 317 | 941 |

| Mexico | 941 | 112 | 153 | 289 | 1,495 |

| South America | 840 | 115 | 41 | 116 | 1,112 |

| The United States | 639 | 26 | 13 | 80 | 758 |

| Rest of the world | - | - | - | 1 | 1 |

| Total | 9,409 | 2,070 | 1,836 | 7,100 | 20,415 |

Download Excel

Download Excel

| Impaired Assets by Geographic Area and Time Since Oldest Past-Due Amount 2011 | Millions of Euros | ||||

|---|---|---|---|---|---|

| Less than 6 Months Past-Due |

6 to 9 Months Past-Due |

9 to 12 Months Past-Due |

More than 12 Months Past-Due |

Total | |

| Spain | 4,640 | 1,198 | 1,187 | 4,482 | 11,507 |

| Rest of Europe | 217 | 38 | 41 | 235 | 531 |

| Mexico | 809 | 141 | 130 | 199 | 1,280 |

| South America | 767 | 66 | 38 | 109 | 980 |

| The United States | 634 | 211 | 117 | 549 | 1,511 |

| Rest of the world | - | - | - | 1 | 1 |

| Total | 7,068 | 1,653 | 1,514 | 5,572 | 15,810 |

Download Excel

Download Excel

| Impaired Assets by Geographic Area and Time Since Oldest Past-Due Amount 2010 | Millions of Euros | ||||

|---|---|---|---|---|---|

| Less than 6 Months Past-Due |

6 to 9 Months Past-Due |

9 to 12 Months Past-Due |

More than 12 Months Past-Due |

Total | |

| Spain | 5,279 | 1,064 | 798 | 4,544 | 11,685 |

| Rest of Europe | 106 | 24 | 24 | 55 | 209 |

| Mexico | 753 | 60 | 69 | 324 | 1,206 |

| South America | 720 | 51 | 31 | 74 | 876 |

| The United States | 1,110 | 84 | 111 | 331 | 1,636 |

| Rest of the world | - | - | 1 | - | - |

| Total | 7,968 | 1,284 | 1,034 | 5,327 | 15,612 |

Below are details of the impaired financial assets as of December 31, 2012, 2011 and 2010, classified by type of loan according to its associated guarantee, and by the time since their oldest past-due amount or the period since they were deemed impaired:

Download Excel

Download Excel

| Impaired Assets by Type of Guarantees and Time Since Oldest Past-Due Amount 2012 | Millions of Euros | ||||

|---|---|---|---|---|---|

| Less than 6 Months Past-Due |

6 to 9 Months Past-Due |

9 to 12 Months Past-Due |

More than 12 Months Past-Due |

Total | |

| Unsecured loans | 3,948 | 563 | 432 | 1,325 | 6,267 |

| Mortgage | 5,156 | 1,507 | 1,405 | 5,775 | 13,843 |

| Residential mortgage | 1,601 | 529 | 474 | 1,738 | 4,343 |

| Commercial mortgage (rural properties in operation and offices, and industrial buildings) | 725 | 256 | 193 | 1,097 | 2,271 |

| Other than those currently use as a family residential property of the borrower | 742 | 335 | 321 | 1,177 | 2,575 |

| Plots and other real estate assets | 2,088 | 386 | 416 | 1,763 | 4,654 |

| Other partially secured loans | 113 | - | - | - | 113 |

| Others | 192 | - | - | - | 192 |

| Total | 9,409 | 2,070 | 1,836 | 7,100 | 20,415 |

Download Excel

Download Excel

| Impaired Assets by Type of Guarantees and Time Since Oldest Past-Due Amount 2011 | Millions of Euros | ||||

|---|---|---|---|---|---|

| Less than 6 Months Past-Due |

6 to 9 Months Past-Due |

9 to 12 Months Past-Due |

More than 12 Months Past-Due |

Total | |

| Unsecured loans | 3,414 | 598 | 534 | 1,541 | 6,087 |

| Mortgage | 3,570 | 1,055 | 979 | 4,033 | 9,639 |

| Residential mortgage | 1,080 | 390 | 357 | 1,373 | 3,200 |

| Commercial mortgage (rural properties in operation and offices, and industrial buildings) | 630 | 210 | 160 | 795 | 1,795 |

| Other than those currently use as a family residential property of the borrower | 490 | 138 | 167 | 659 | 1,454 |

| Plots and other real estate assets | 1,370 | 317 | 295 | 1,206 | 3,188 |

| Other partially secured loans | 83 | - | - | - | 83 |

| Others | - | - | - | - | - |

| Total | 7,067 | 1,653 | 1,513 | 5,574 | 15,810 |

Download Excel

Download Excel

| Impaired Assets by Type of Guarantees and Time Since Oldest Past-Due Amount 2010 | Millions of Euros | ||||

|---|---|---|---|---|---|

| Less than 6 Months Past-Due |

6 to 9 Months Past-Due |

9 to 12 Months Past-Due |

More than 12 Months Past-Due |

Total | |

| Unsecured loans | 4,309 | 338 | 271 | 1,710 | 6,628 |

| Mortgage | 3,301 | 946 | 763 | 3,617 | 8,627 |

| Residential mortgage | 629 | 304 | 271 | 1,472 | 2,676 |

| Commercial mortgage (rural properties in operation and offices, and industrial buildings) | 561 | 128 | 100 | 602 | 1,391 |

| Other than those currently use as a family residential property of the borrower | 701 | 132 | 99 | 593 | 1,525 |

| Plots and other real estate assets | 1,410 | 382 | 293 | 950 | 3,035 |

| Other partially secured loans | 159 | - | - | - | 159 |

| Others | 198 | - | - | - | 198 |

| Total | 7,967 | 1,284 | 1,034 | 5,327 | 15,612 |

Below is the accumulated financial income accrued as of 31 December, 2012, 2011 and 2010 with origin in the impaired assets that, as mentioned in Note 2.2.1, are not recognized in the accompanying consolidated income statements as there are doubts as to the possibility of collection:

Download Excel

Download Excel

|

|

Millions of Euros | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| Financial Income from Impaired Assets | 2,405 | 1,908 | 1,717 |

As of December 31, 2012, 2011 and 2010, the non-performing loan and coverage ratios (see Appendix XII) of the transactions registered under the "Loans and advances to customers” and “Contingent risk" headings of the accompanying consolidated balance sheets are:

Download Excel

Download Excel

| BBVA Group Ratios | Percentage (%) | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| NPA ratio | 5.1 | 4.0 | 4.1 |

| NPA coverage ratio | 72 | 61 | 62 |

7.1.8 Impairment losses

Below is a breakdown of the provisions registered on the accompanying consolidated balance sheets to cover estimated impairment losses as of December 31, 2012, 2011 and 2010 in financial assets and contingent risks, according to the different headings under which they are classified in the accompanying consolidated balance sheet:

Download Excel

Download Excel

| Impairment losses and provisions for contingent risks | Notes | Millions of Euros | ||

|---|---|---|---|---|

| 2012 | 2011 | 2010 | ||

| Available-for-sale portfolio | 12 | 342 | 569 | 619 |

| Loans and receivables | 13 | 14,534 | 9,469 | 9,473 |

| Loans and advances to customers | 13.2 | 14,484 | 9,409 | 9,396 |

| Loans and advances to credit institutions | 13.1 | 33 | 47 | 67 |

| Debt securities | 13.3 | 17 | 12 | 10 |

| Held to maturity investment | 14 | - | 1 | 1 |

| Impairment losses |

|

14,876 | 10,039 | 10,093 |

| Provisions to Contingent Risks and Commitments | 25 | 341 | 291 | 264 |

| Total |

|

15,217 | 10,330 | 10,357 |

| Of which: |

|

|

|

|

| For impaired portfolio |

|

10,117 | 7,058 | 7,507 |

| For currently non-impaired portfolio |

|

5,100 | 3,272 | 2,850 |

Below are the changes in 2012, 2011 and 2010 in the estimated impairment losses, broken down by the headings in the accompanying consolidated balance sheet:

Download Excel

Download Excel

| 2012 | Notes | Millions of Euros | ||||

|---|---|---|---|---|---|---|

| Available-for-sale portfolio | Held to maturity investment | Loans and receivables | Contingent Risks and Commitments | Total | ||

| Balance at the beginning |

|

569 | 1 | 9,469 | 291 | 10,329 |

| Increase in impairment losses charged to income |

|

74 | 1 | 10,578 | 105 | 10,757 |

| Decrease in impairment losses credited to income |

|

(31) | (0) | (2,304) | (44) | (2,379) |

| Impairment losses (net)(*) | 48-49 | 43 | 1 | 8,273 | 61 | 8,378 |

| Entities incorporated/disposed in the year |

|

1 | - | 2,066 | 5 | 2,073 |

| Transfers to written-off loans |

|

(18) | - | (4,125) | - | (4,143) |

| Exchange differences and other |

|

(254) | (1) | (1,150) | (16) | (1,420) |

| Balance at the end |

|

342 | 0 | 14,534 | 341 | 15,217 |

Download Excel

Download Excel

| 2011 | Notes | Millions of Euros | ||||

|---|---|---|---|---|---|---|

| Available-for-sale portfolio | Held to maturity investment | Loans and receivables | Contingent Risks and Commitments | Total | ||

| Balance at the beginning |

|

619 | 1 | 9,473 | 264 | 10,356 |

| Increase in impairment losses charged to income |

|

62 | - | 6,041 | 17 | 6,121 |

| Decrease in impairment losses credited to income |

|

(37) | - | (1,513) | (24) | (1,574) |

| Impairment losses (net)(*) | 48-49 | 25 | - | 4,528 | (6) | 4,547 |

| Entities incorporated/disposed in the year |

|

- | - | 305 | 12 | 318 |

| Transfers to written-off loans |

|

(75) | - | (4,039) | - | (4,114) |

| Exchange differences and other |

|

- | - | (798) | 22 | (776) |

| Balance at the end |

|

569 | 1 | 9,469 | 291 | 10,330 |

Download Excel

Download Excel

| 2010 | Notes | Millions of Euros | ||||

|---|---|---|---|---|---|---|

| Available-for-sale portfolio | Held to maturity investment | Loans and receivables | Contingent Risks and Commitments | Total | ||

| Balance at the beginning |

|

449 | 1 | 8,805 | 243 | 9,498 |

| Increase in impairment losses charged to income |

|

187 | - | 7,020 | 62 | 7,268 |

| Decrease in impairment losses credited to income |

|

(32) | - | (2,204) | (40) | (2,276) |

| Impairment losses (net)(*) | 48-49 | 155 | - | 4,816 | 22 | 4,993 |

| Transfers to written-off loans |

|

(57) | - | (4,431) | - | (4,488) |

| Exchange differences and other |

|

72 | - | 283 | (1) | 354 |

| Balance at the end |

|

619 | 1 | 9,473 | 264 | 10,357 |

The changes in 2012, 2011 and 2010 in financial assets derecognized from the accompanying consolidated balance sheet as their recovery is considered unlikely (hereinafter “write-offs”) is shown below:

Download Excel

Download Excel

| Changes in Impaired Financial Assets Written-Off from the Balance Sheet | Millions of Euros | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| Balance at the beginning | 15,871 | 13,367 | 9,833 |

| Increase: | 4,364 | 4,284 | 4,788 |

| Decrease: | (1,754) | (1,895) | (1,447) |

| Re-financing or restructuring | (9) | (4) | (1) |

| Cash recovery | (337) | (327) | (253) |

| Foreclosed assets | (133) | (29) | (5) |

| Sales of written-off | (284) | (840) | (342) |

| Debt forgiveness | (541) | (604) | (217) |

| Time-barred debt and other causes | (450) | (91) | (629) |

| Net exchange differences | 785 | 115 | 193 |

| Balance at the end | 19,266 | 15,871 | 13,367 |

As indicated in Note 2.2.1, although they have been derecognized from the balance sheet, the BBVA Group continues to attempt to collect on these write-offs, until the rights to receive them are fully extinguished, either because it is time-barred debt, the debt is forgiven, or other reasons.

7.2 Market risk

As well as the most common market risks (mentioned earlier), other market risks have to be considered for the administration of certain positions: credit spread risk, basis risk, volatility and correlation risk.

Value at Risk (VaR) is the basic measure to manage and control the BBVA Group’s market risks. It estimates the maximum loss, with a given confidence level, that can be produced in market positions of a portfolio within a given time horizon. VaR is calculated in the Group at a 99% confidence level and a 1-day time horizon.

BBVA and BBVA Bancomer have received approval from the Bank of Spain to use a model developed by the BBVA Group to calculate bank capital requirements for market risk. This model estimates VaR in accordance with the “historical simulation” methodology, which involves estimating the losses or gains that would have been produced in the current portfolio if the changes in market conditions occurring over a specific period of time were repeated. Using this information, it infers the maximum foreseeable loss in the current portfolio with a given level of confidence. It has the advantage of precisely reflecting the historical distribution of the market variables and not requiring any assumption of specific probability distribution. The historical period used in this model is two years.

In addition, the Bank follows the guidelines set out by Spanish and European authorities regarding other metrics to meet the Bank of Spain’s regulatory requirements. The new measurements of market risk for the trading portfolio include the calculation of stressed VaR (which quantifies the level of risk in extreme historical situations) and the quantification of default risks and downgrading of credit ratings of bonds and credit portfolio derivatives.

The limits structure of the BBVA Group’s market risk determines a system of VaR and economic capital limits by market risk for each business unit, with specific ad-hoc sub-limits by type of risk, activity and trading desk.

Validity tests are performed periodically on the risk measurement models used by the Group. They estimate the maximum loss that could have been incurred in the positions assessed with a certain level of probability (backtesting), as well as measurements of the impact of extreme market events on risk positions (stress testing). As an additional control measure, backtesting is conducted at trading desk level in order to enable more specific monitoring of the validity of the measurement models.

Trends in market risk

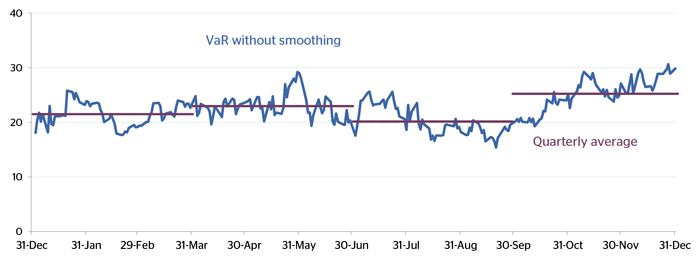

The changes in the BBVA Group’s market risk in 2012, measured as VaR without smoothing (see Appendix XII) with a 99% confidence level and a 1-day horizon, are as follows:

The average VaR in 2012 stood at €22 million, compared with €24 million and €33 million in 2011 and 2010. The number of risk factors currently used to measure portfolio risk is around 2,200. This number is dynamic and varies according to the possibility of doing business with other underlying assets and markets.

As of year-end 2012, 2011 and 2010, VaR amounted to €30 million, €18 million and €28 million, respectively. These figures can be broken down as follows:

Download Excel

Download Excel

| VaR by Risk Factor | Millions of Euros | ||

|---|---|---|---|

| 2012 | 2011 | 2010 | |

| Interest/Spread risk | 35 | 27 | 29 |

| Currency risk | 3 | 3 | 3 |

| Stock-market risk | 3 | 7 | 4 |

| Vega/Correlation risk | 9 | 4 | 12 |

| Diversification effect(*) | (19) | (23) | (21) |

| Total | 30 | 18 | 28 |

| VaR average in the period | 22 | 24 | 33 |

| VaR max in the period | 31 | 36 | 41 |

| VaR min in the period | 15 | 16 | 25 |

Stress testing is carried out using historical crisis scenarios. The base historical scenario is the collapse of Lehman Brothers in 2008.

Economic crisis scenarios are also prepared ad hoc for each of the BBVA Group’s treasuries and updated monthly. The most significant market risk positions are identified for these scenarios, and an assessment is made of the impact that movements of market variables may have on them. The economic scenarios are established and analyzed by the Market Stress Committee.

BBVA continues to work on improving and enriching the information provided by the stress exercises. It prepares scenarios that are capable of detecting the possible combinations of impacts on market variables that may significantly affect the result of trading portfolios, thus completing the information provided by VaR and the historical scenarios and operating as an alert indicator that complements the normal policies of risk measurement and control.

By type of market risk assumed by the Group’s trading portfolio, as of December 31, 2012, the main risks are interest-rate and credit spread risks, which increased by €8 million on the figure for December 31, 2011. Currency risk remained at the same level and volatility and correlation risk increased by €5 million. Equity risk fell by €4 million.

The average daily change in VaR in 2012 on 2011 is basically due to Global Market Europe reducing its average risk by 14% in 2012 (with an average daily VaR of €13.8 million). Global Market Bancomer, Global Market South America and Compass increased their average risk by 13% and 17%, respectively (with an average daily VaR in 2012 of €5.1 million and €3.5 million, respectively).

The internal market risk model is validated periodically by backtesting. In 2012, portfolio losses in BBVA S.A. only exceeded the daily VaR on one occasion and in Bancomer they were never greater than the daily VaR, thus validating the proper operation of the model throughout the period according to Basel criteria. This is why no significant changes have been made to the methodology of measurement or to the parameters of the current measurement model.

Structural interest-rate risk

The aim of on-balance-sheet interest-rate risk management is to maintain the BBVA Group’s exposure to market interest-rate fluctuations at levels in keeping with its risk strategy and profile. In pursuance of this, the Assets and Liabilities Committee (ALCO) undertakes active balance sheet management through operations intended to optimize the levels of risk borne according to expected earnings and respect the maximum levels of accepted risk.

ALCO uses the interest-rate risk measurements performed by the corporate GRM area. Acting as an independent unit, the Risk Area periodically quantifies the impact that a variation of 100 basis points in market interest rates would have on the BBVA Group’s net interest income and economic value.

In addition, the Group performs probability calculations that determine the economic capital (maximum loss of economic value) and risk margin (maximum estimated loss of net interest income) originating from structural interest-rate risk in banking activity (excluding the Treasury area), based on interest rate curve simulation models. The Group regularly performs stress tests and sensitivity analyses to complement its assessment of its interest-rate risk profile.

All these risk measurements are subsequently analyzed and monitored. The levels of risk assumed and the degree of compliance with the limits authorized by the Executive Committee are reported to the various managing bodies of the BBVA Group.

Below are the average interest-rate risk exposure levels in terms of sensitivity of the main financial institutions in the BBVA Group in 2012:

Download Excel

Download Excel

| Sensitivity to interest-rate analysis - 2012 | Impact on Net Interest Income (*) | Impact on Economic Value (**) | ||

|---|---|---|---|---|

| 100 Basis-Point Increase | 100 Basis-Point Decrease | 100 Basis-Point Increase | 100 Basis-Point Decrease | |

| Europe | (3.52)% | 4.31% | 0.74% | (1.03)% |

| BBVA Bancomer | 2.50% | (2.50)% | 0.42% | (0.29)% |

| BBVA Compass | 5.49% | (5.98)% | 6.02% | (11.25)% |

| BBVA Chile | (1.97)% | 1.95% | (11.19)% | 10.16% |

| BBVA Colombia | 2.21% | (2.23)% | 0.19% | (0.61)% |

| BBVA Banco Continental | 1.34% | (1.41)% | (5.05)% | 4.97% |

| BBVA Banco Provincial | 2.13% | (2.03)% | 0.27% | (0.34)% |

| BBVA Banco Francés | 0.71% | (0.72)% | (0.96)% | 0.97% |

| BBVA Group | 0.88% | (0.71)% | 1.02% | (1.92)% |

As part of the measurement process, the BBVA Group has established the assumptions regarding the movement and behavior of certain items, such as those relating to products with no explicit or contractual maturity. These assumptions are based on studies that estimate the relationship between the interest rates on these products and market rates. They enable specific balances to be classified into trend-based balances (long-term) and seasonal or volatile balances (short-term residual maturity).

Structural currency risk

Structural currency risk is basically caused by exposure to variations in currency exchange rates that arise in the BBVA Group’s foreign subsidiaries and the provision of funds to foreign branches financed in a different currency to that of the investment.

Structural exchange-rate risk management in BBVA aims to minimize the potential negative impact from fluctuations in exchange rates on the capital ratios and on the contribution to earnings of international investments maintained on a long-term basis by the Group.

The Corporate Risk Management (“CRM”) area acts as an independent unit responsible for monitoring and analyzing risks, standardizing risk management metrics and providing tools that can anticipate potential deviations from targets. It also monitors the level of compliance with established risk limits, and reports regularly to the Risk Management Committee (“RMC”), the Board of Directors’ Risk Committee and the Executive Committee, particularly in the case of deviations in the levels of risk assumed.

The Balance Sheet Management unit, through the Assets and Liabilities Committee (“ALCO”), designs and executes the risk mitigation strategies with the main objective of minimizing the effect of exchange rate fluctuations on capital adequacy ratios, as well as assuring the equivalent value in euros of the foreign-currency earnings of the Group’s various subsidiaries, and adjusting transactions according to market expectations and risk mitigation measures costs. The Balance Sheet Management area carries out this work by ensuring that the Group’s risk profile is, at all times, adapted to the framework defined by the limits structure authorized by the Executive Committee. To do so, it uses risk metrics obtained according to the corporate model designed by the corporate GRM area.

The corporate model is based on simulating exchange rate scenarios, based on historical trends for the past five years (based on weekly data), and evaluating the impact on capital ratios, equity and the Group’s income statement.

The risk mitigation measures aimed at reducing exchange-rate risk exposures are considered in calculating risk estimates. Diversification resulting from investments in different geographical areas is also considered, through the analysis of historical correlations between different currencies.

Our model provides a distribution of the impact on three core elements (capital ratios, equity and the Group’s income statement) and helps determine their maximum adverse deviation for a particular confidence level and time horizon (of 3, 6 or 12 months), depending on market liquidity in each currency.

The Executive Committee authorizes the system of limits and alerts for these risk measurements, which include a sub-limit on the economic capital (an unexpected loss arising from the currency risk of investments financed in foreign currency).

In order to try to mitigate our model’s limitations, the risk measurements are complemented with analyses of scenarios, stress testing and back-testing, thus giving a more complete overview of the Group’s exposure to structural exchange-rate risk.

In 2012, in a context characterized by market volatility and uncertainty, a policy of prudence has been maintained, which has moderated the risk assumed despite the growing contribution of the “non-euro” area to the Group’s earnings and equity. The risk mitigation level of the carrying value of the BBVA Group’s holdings in foreign currency has remained at 42% on average. The estimated exposure coverage of 2012 earnings in foreign currency has been 47%.

In 2012, the average asset exposure sensitivity to a 1% depreciation in exchange rates stood at €188 million, with 33% in the Mexican peso, 25% in South American currencies, 23% in Asian and Turkish currencies, and 16% in the US dollar.

Structural equity risk

The BBVA Group’s exposure to structural equity risk is basically derived from investments in industrial and financial companies with medium- and long-term investment horizons. This exposure is mitigated through net short positions held in derivatives of their underlying assets, used to limit portfolio sensitivity to potential falls in prices.

The aggregate sensitivity of the BBVA Group’s consolidated equity to a 1% fall in the price of shares stood at €34 million as of December 31, 2012, and its impact on consolidated earnings for the year is estimated at €3 million. These figures are estimated taking into account the exposure in shares valued at market prices or, if not applicable, at fair value (except for the positions in the Treasury Area portfolios) and the net delta-equivalent positions in options on their underlying assets.