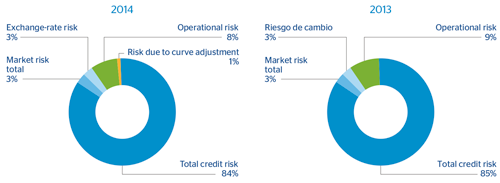

Below is the total of capital requirements broken down by risk type as of December 31, 2014 and 2013.

The total amount for credit risk includes the positions in securitizations (standardized and advanced approach) and equity portfolio.

CHART 4: Capital requirements by risk type

As can be seen, the main risk for the Group continues to be Credit, followed by Operational Risk. A new point is credit valuation adjustment risk arising from derivatives, as established by the CRR, accounts for 1% of total requirements.

TABLE 11: Capital requirements by risk type

2014

(Millions of euros)

| Exposure categories and risk types | Capital Amount |

|---|---|

| Credit risk | 14,194 |

| Central governments or central banks | 2,388 |

| Regional governments or local authorities | 264 |

| Public sector entities | 107 |

| Multilateral Development Banks | 2 |

| Institutions | 211 |

| Corporates | 5,314 |

| Retail | 2,458 |

| Secured by mortgages on immovable property | 1,581 |

| Exposures in default | 436 |

| Items associated with particularly high risk | 12 |

| Covered bonds | 10 |

| Short-term claims on institutions and corporate | 34 |

| Collective investments undertakings (CIU) | 1 |

| Other exposures | 1,378 |

| Securitized positions | 85 |

| Securitized positions | 85 |

| Total credit risk by the standardized approach | 14,279 |

| Credit risk | 7,589 |

| Central governments or central banks | 30 |

| Institutions | 994 |

| Corporates | 4,880 |

| Retail | 1,685 |

| Of which: Secured by real estate collateral | 834 |

| Of which: Qualifying revolving retail | 576 |

| Of which: Other retail assets | 275 |

| Equity | 1,749 |

| By method: |

|

| Of which: Simple Method | 787 |

| Of which: PD/LGD Method | 833 |

| Of which: Internal Models | 129 |

| By nature: |

|

| Of which: Exchange-traded equity instruments | 822 |

| Of which: Non-trading equity instruments in sufficiently diversified portfolios | 927 |

| Securitized positions | 57 |

| Total credit risk by the advanced measurement approach | 9,395 |

| TOTAL CREDIT RISK | 23,674 |

| Standardized: | 234 |

| Of which: Price Risk from fixed-income positions | 202 |

| Of which: Price risk for securitizations | 2 |

| Of which: Correlation price risk | 6 |

| Of which: Price Risk from equity portfolios | 24 |

| Advanced: Market Risk | 712 |

| TOTAL TRADING-BOOK ACTIVITY RISK | 946 |

| EXCHANGE RATE RISK (STANDARDIZED APPROACH) | 732 |

| RISK DUE TO CVA ADJUSTMENT | 360 |

| OPERATIONAL RISK | 2,352 |

|

CAPITAL REQUIREMENTS |

28,064 |

2013

| Exposure categories and risk types | Capital Amount |

|---|---|

| Credit risk | 13,295 |

| Central governments or central banks | 1,489 |

| Regional governments or local authorities | 164 |

| Public sector entities | 112 |

| Multilateral Development Banks | 1 |

| Institutions | 342 |

| Corporates | 5,197 |

| Retail | 2,586 |

| Secured by mortgages on immovable property | 1,549 |

| Exposures in default | 728 |

| Items associated with particularly high risk | 93 |

| Covered bonds | 15 |

| Short-term claims on institutions and corporate | 18 |

| Collective investments undertakings (CIU) | 21 |

| Other exposures | 981 |

| Securitized positions | 138 |

| Securitized positions | 138 |

| Total credit risk by the standardized approach | 13,433 |

| Credit risk | 7,376 |

| Central governments or central banks | 17 |

| Institutions | 992 |

| Corporates | 4,488 |

| Retail | 1,879 |

| Of which: Secured by real estate collateral | 1,018 |

| Of which: Qualifying revolving retail | 612 |

| Of which: Other retail assets | 249 |

| Equity | 1,079 |

| By method: |

|

| Of which: Simple Method | 151 |

| Of which: PD/LGD Method | 821 |

| Of which: Internal Models | 107 |

| By nature: |

|

| Of which: Exchange-traded equity instruments | 670 |

| Of which: Non-trading equity instruments in sufficiently diversified portfolios | 408 |

| Securitized positions | 95 |

| Total credit risk by the advanced measurement approach | 8,550 |

| TOTAL CREDIT RISK | 21,983 |

| Standardized: | 224 |

| Of which: Price Risk from fixed-income positions | 190 |

| Of which: Correlation price risk | 12 |

| Of which: Price Risk from equity portfolios | 22 |

| Advanced: Market Risk | 616 |

| TOTAL TRADING-BOOK ACTIVITY RISK | 840 |

| EXCHANGE RATE RISK (STANDARDIZED APPROACH) | 780 |

| RISK DUE TO CVA ADJUSTMENT | 2,421 |

| OPERATIONAL RISK | -122 |

|

CAPITAL REQUIREMENTS |

25,902 |

Below is a breakdown of the amount (in terms of original exposure, EAD and RWAs) of the above table that would correspond to counterparty risk:

TABLE 12: Positions subject to counterparty risk in terms of EO, EAD and RWAs

(Millions of euros)

| Exposure categories and risk types | 2014 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

Securities financing transactions | Derivatives and transactions with deferred settlement | From contractual netting between products | ||||||

|

|

EO | EAD | RWAs | EO | EAD | RWAs | EO | EAD | RWAs |

| Central governments or central banks | 9,278 | 6,616 | 133 | 46 | 46 | 19 | 510 | 177 | 5 |

| Regional governments or local authorities | - | - | - | 42 | 42 | 8 | 61 | 61 | 12 |

| Public sector entities | - | - | - | - | - | - | - | - | - |

| Multilateral Development Banks | - | - | - | - | - | - | - | - | - |

| Institutions | 658 | 644 | 163 | 3,507 | 3,507 | 286 | 1,598 | 1,591 | 470 |

| Corporates | 36 | 32 | 32 | 1,190 | 1,190 | 1,187 | 947 | 947 | 946 |

| Retail | 1 | 0 | 0 | 95 | 95 | 70 | 11 | 11 | 7 |

| Secured by mortgages on immovable property | - | - | - | - | - | - | - | - | - |

| Exposures in default | - | - | - | 0 | 0 | 0 | 3 | 3 | 4 |

| Items associated with particularly high risk | - | - | - | - | - | - | - | - | - |

| Covered bonds | - | - | - | - | - | - | - | - | - |

| Short-term claims on institutions and corporate | 34 | 34 | 34 | - | - | - | - | - | - |

| Collective investments undertakings (CIU) | 105 | 31 | 6 | 0 | 0 | 0 | - | - | - |

| Other exposures | 0 | 0 | - | 48 | 48 | 0 | 0 | 0 | 0 |

| Total credit risk by the standardized approach | 10,112 | 7,357 | 369 | 4,927 | 4,927 | 1,570 | 3,130 | 2,791 | 1,444 |

| Central governments or central banks | - | - | - | 3 | 3 | 0 | 24 | 24 | 5 |

| Institutions | 54,922 | 54,922 | 1,096 | 1,743 | 1,743 | 619 | 12,714 | 12,714 | 1,466 |

| Corporates | 1,917 | 1,917 | 70 | 763 | 763 | 564 | 3,251 | 3,251 | 2,305 |

| Retail | - | - | - | 2 | 2 | 1 | 5 | 5 | 3 |

| Of which: Secured by real estate collateral | - | - | - | - | - | - | - | - | - |

| Of which: Qualifying revolving retail | - | - | - | - | - | - | - | - | - |

| Of which: Other retail assets | - | - | - | 2 | 2 | 1 | 5 | 5 | 3 |

| Total credit risk by the advanced measurement approach | 56,839 | 56,839 | 1,165 | 2,510 | 2,510 | 1,184 | 15,994 | 15,994 | 3,779 |

| TOTAL CREDIT RISK | 66,951 | 64,196 | 1,535 | 7,438 | 7,438 | 2,754 | 19,124 | 18,785 | 5,223 |

The amounts shown in the table above on credit risk include the counterparty risk in trading-book activity as shown below:

TABLE 13: Amounts of counterparty risk in the trading book

| Counterparty Risk Trading Book Activities | Capital amount | |

|---|---|---|

| 2014 | 2013 | |

| 233 | 203 | |

| Advanced Measurement Approach | 391 | 433 |

| Total | 624 | 636 |

The Group currently has a totally residual amount of capital requirements for trading-book activity liquidation risk.