Spain highlights in the second quarter

- Deposits in the retail segment perform well.

- Strong operating income.

- Increased impairment of assets related to real-estate.

Industry Trends

In the second quarter of 2012, financial institutions continued to operate in a difficult environment influenced basically by three external factors:

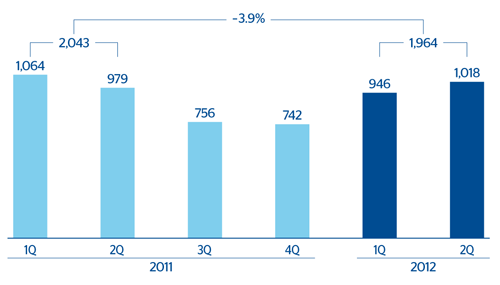

- Stagnation in the Spanish economy, which continues to limit the business volume of financial institutions. In particular, the necessary deleveraging process in the private sector continues.

- Ongoing uncertainty in Europe. The markets are waiting for a much more ambitious roadmap for a common European project.

- Major reforms in the Spanish financial sector, including:

- Following the first Royal Decree-Law 2/2012 of February, a second Royal Decree-Law 18/2012 came into force in May, designed to provision for “non-problematic” real estate assets on the balance sheets of financial institutions. This involves setting aside greater provisions to increase the coverage of real estate risk.

- In early June, the Eurogroup approved a loan of up to €100bn to restructure the Spanish financial system.

- Finally, also in June, the results of the stress tests carried out on the Spanish financial system as a whole were made public. Two independent international consultants have identified the system’s capital deficit under a very adverse scenario. The estimate of the additional capital requirements for the country’s financial industry in this scenario is under €100bn (between €51bn and €62bn). The results of the exercise make clear that BBVA is one of the few Spanish banks that does not need additional capital under any stress scenario.

These new demands and exercises in transparency are highlighting the difference between banks. Overall, the Spanish financial industry is taking firm steps on the path toward its necessary restructuring, adjustment and consolidation. The following operations are of particular note in this respect in the second quarter of 2012: the intervention of Bankia; the completion of the acquisition of Banca Cívica by CaixaBank and the announced merger of Ibercaja, Caja3 and Liberbank. The auctions of CatalunyaCaixa and Banco de Valencia have been postponed awaiting the results of the assessment of their capital deficits, which will probably be announced after the summer.

In the first half of 2012 a supplier payment mechanism has also been implemented. This plan will mean a liquidity injection into the Spanish productive system of between an estimated 0.4 and 1 percentage point of GDP. It will therefore have an impact on the industry as a whole and on the employment of SMEs and the self-employed.

Finally, with respect to asset quality, NPA in the sector increased by more than 1 percentage point since the close of 2011, and now stands at over 8.9% (using May data, the latest available information). This increase is due not only to the worsening quality of loan portfolios, but also to the aforementioned deleveraging process in the economy, which affects the denominator part of the NPA ratio.