After reaching an agreement to sell the Puerto Rico business to Oriental Financial Group, the assets of this unit have been classified as non-current assets held for sale. Therefore, all data mentioned hereinafter refers to BBVA Compass, which at 30-Jun-2012 represents 83% of the area’s assets, 80% of net attributable profit, and 87% of loans.

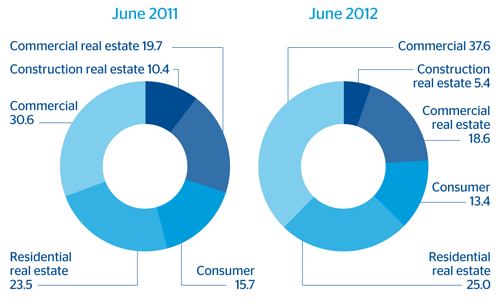

Against the macroeconomic and industry background described above, total gross lending to customers of BBVA Compass totaled €35,035m as of 30-Jun-2012, a year-on-year increase of 6.5%, and up 3.1% over the quarter. The increase is mainly the result of higher commercial loans, which were up over the quarter by 8.5%, and by 37.5% over the last 12 months. These loans have been boosted by lending linked to healthcare and public finance, as well as increased activity with auto dealerships. In contrast, development and construction real estate loans continue to decline, with a quarter-on-quarter fall of 24.0% (down 39.8% year-on-year).

Credit quality in the area improved significantly over the quarter. The NPA ratio fell to 2.8% at the close of June 2012, a decline of 44 basis points on the ratio for March 2012 (also due to the sale of the Puerto Rican subsidiary). The coverage ratio improved on the figure as of 31-Mar-2012 by 6.8 percentage points, and closed the first half of the year at 82%.

Customer deposits remained relatively flat over the quarter (down 1.7%), with a year-on-year increase of 1.6%. BBVA Compass recently launched a suite of liability products that target a wide range of demographics.