The highlights in the second quarter of 2012 that affected the Group’s capital base are summed up below:

- As it was expected, the results of the independent evaluation carried out recently of the Spanish financial system’s loan portfolio risk showed that the BBVA Group did not need additional capital. This would be the case even under the highstress scenario assumed by Oliver Wyman and Roland Berger in their studies.

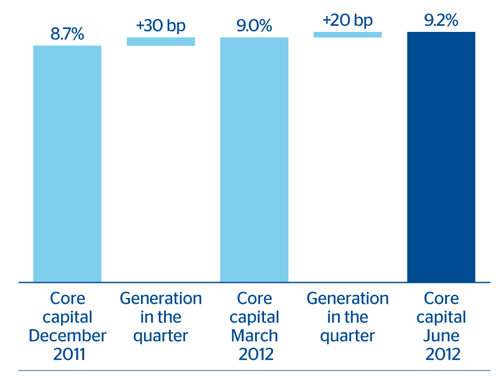

- It is also worth noting that the Group continues to meet comfortably the EBA’s capital recommendations, with a core capital ratio according to EBA’s criteria of 9.2%.

The capital base in accordance with Basel II stands at €42,765m, 1.8% down on the close of the first quarter of 2012, due to the amortization of subordinated bonds eligible as Tier II. This has affected other eligible capital (Tier II). However, both core capital and bank capital (Tier I) increased by 1.5% on the figure for 31-Mar-2012.

Risk weighted assets (RWA) totaled €332,036m, a very similar level to March 2012 and December 2011. The appreciation of the currencies with greatest influence on the Group’s financial statements, together with the strong performance of lending in emerging regions, has been offset by the decline of loans in Spain (owed to the financial deleveraging process of the country’s economy), and thus explain the flat evolution of RWA.

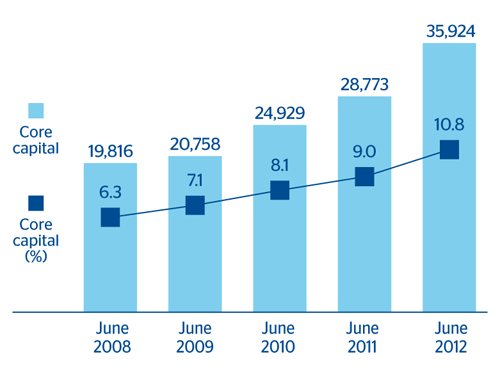

With regard to the different components of the capital base, as of 30-Jun-2012 core capital amounted to €35,924m, €634m more than on 31-Mar-2012. This, combined with the RWA, meant that the core ratio stood at 10.8% (10.7% at the close of the first quarter of 2012). As a result, Tier I has moved in the same direction as the core capital, and also closed at 10.8%.

Other eligible capital (Tier II) totaled €6,841m, down on the figure for March 2012, due to the amortization of subordinated bonds mentioned above.

As a result, the BIS ratio as of 30-Jun-2012 stood at 12.9% (13.2% as of 31-Mar-2012).