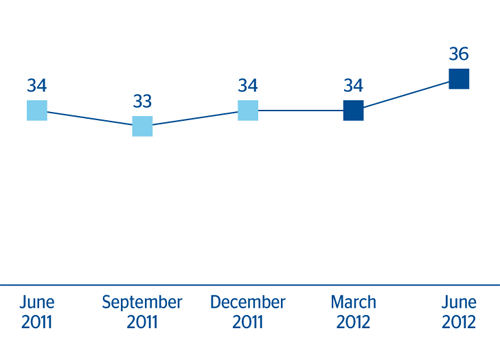

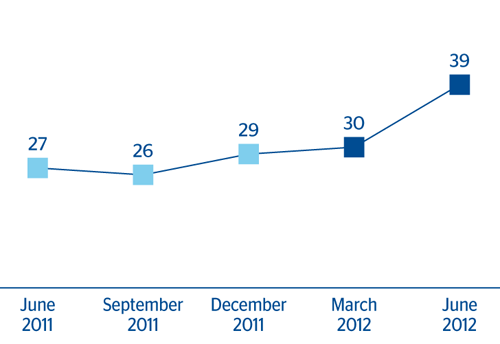

The most important aspect in the quarter with respect to exposure to the real estate sector in Spain, as mentioned earlier, is the increased impairment in the value of assets associated with this portfolio owed to the country’s worsening economic situation. As a result, additional funds have been set aside, resulting in an increase over the quarter of coverage of non-performing and substandard loans of 9 percentage points to 39%, and also increased coverage of foreclosures and asset purchases of 1.6 percentage points to 36%.

Exposure to the real estate sector in Spain

Detail of real estate developers lending

(Million euros)

|

|

30-6-12 | % Weighting |

|---|---|---|

| With collateral | 12,633 | 91.1 |

| Finished properties | 6,838 | 49.3 |

| Construction in progress | 1,952 | 14.1 |

| Land | 3,843 | 27.7 |

| Without collateral and other | 1,241 | 8.9 |

| Total | 13,874 | 100.0 |

Coverage of real estate developers exposure

(Million euros at 30-06-12)

|

|

Risk amount | Shortfall over collateral (1) | Provision | % Coverage over shortfall | % Coverage over risk |

|---|---|---|---|---|---|

| NPL | 4,750 | 2,413 | 2,190 | 91 | 46 |

| Substandar | 1,729 | 880 | 306 | 35 | 18 |

| Total | 6,479 | 3,293 | 2,496 | 76 | 39 |

Foreclosures and asset purchases

(Million euros at 30-06-12)

|

|

Gross amount | Provision | % Coverage | Net amount |

|---|---|---|---|---|

| From real estate developers | 5,752 | 2,044 | 36 | 3,708 |

| From Dwellings | 1,791 | 542 | 30 | 1,249 |

| Other | 1,216 | 570 | 47 | 646 |

| Total | 8,759 | 3,156 | 36 | 5,603 |

Coverage of NPLs and substandar real estate developer’s exposure

Coverage of foreclosures and asset purchases

(Percentage)