Accumulated net attributable profit in the first quarter of 2012 totaled €576m, a 28.9% increase compared to the profit recorded in the same period last year. This was due to the positive contribution from Garanti and CNCB.

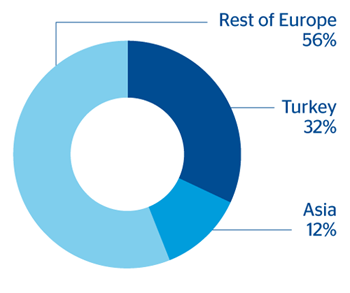

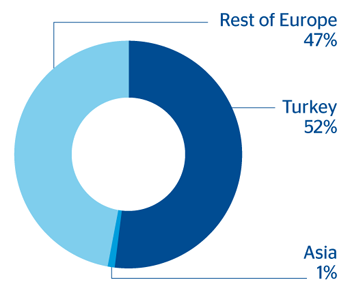

By business units, Europe represented 47% of the profits for the area in the 6-month period and showed an uneven performance. On the one hand, Turkey was up 127.4% in the last year thanks to the positive performance of Garanti which, in addition, contributed throughout the 6-month period in 2012 (it was incorporated in BBVA at the end of March 2011). On the other hand, the rest of Europe, where the main contribution comes from the wholesale business, saw lower performance due to lower activity and increased turmoil in the financial markets. In short, Europe generated an accumulated net attributable profit of €270m, 33.3% more than twelve months ago. Garanti contributed €176m and €93m came from the rest of Europe.

The most notable aspects regarding Garanti Bank in the six-month period are summarized below:

- With respect to the loan book, one noteworthy aspect was the bank’s superior growth over the six months in mortgages (+5.8% compared to +4.6% for the sector), car finance (+6.2% at Garanti and +4% in the sector), and in so-called “general purpose loans” (personal loans, which increased 9.9% at Garanti and 9.2% in the sector). In short, gross customer lending increased 4.3% since the end of December 2011. The bank continues to prioritize growth in high-yield products, emphasizing profitability over volume.

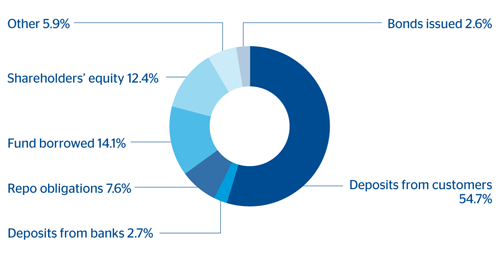

- On the liabilities side, focus continued set on more stable and lower-cost sources of finance. In this regard, a new increase in lira deposits (+5% for the six months) compared to a 2.5% rise in the rest of the sector is worth mentioning.

- Garanti has superior asset quality with a highly stable NPA ratio over the quarter (1.8% as of 30-Jun-2012). This ratio remained at 2.7% for the sector.

- In terms of solvency, the bank is one of the soundest in the country, with a capital ratio of 15.3% according to Basel II criteria.

- In terms of productivity per employee and branch, Garanti comes in top for the sector in Turkey.

- All the above has allowed for high earnings, with Garanti remaining the top bank in terms of profits. Regarding revenue, gross income increased at an average annual rate of 6% thanks to excellent price management, the positive performance in activity and good performance in income from fees and commissions (despite the coming into effect of new regulations establishing their accrual). This, combined with tight cost control (with a single-digit percentage rise), excellent asset quality and the non-existence of one-offs, explains the 7.6% drop in Garanti Group profits compared to 2011, totaling €763m in the first six months of 2012.

Lastly, Asia generated cumulative earnings of €306m and increased its weight to 53% of the profits reported by the area. Once again, the good performance of CNCB should be highlighted, which represents the largest part of the earnings posted by this unit. At the end of the first quarter of the year, the Chinese bank’s net attributable profit increased 32% year-on-year, with the loan book increasing 14% and customer deposits rising 13%.