In this difficult economic scenario, BBVA generated a cumulative net attributable profit of €1,510m. Excluding the charge due to the higher impairment of assets related to the real estate business in Spain, the figure is €2,374m. This is a high-quality result, as explained previously, since it is based on a very positive performance of the most recurring revenue.

By business areas, Spain recorded a €221m loss due to the worsening of the country’s macroeconomic conditions, as explained above. Excluding the impairment of assets related to the deterioration of the real estate sector, the area generated cumulative adjusted earnings of €567m to June. Eurasia contributed €576m, Mexico €865m, South America €703m and the United States €245m.

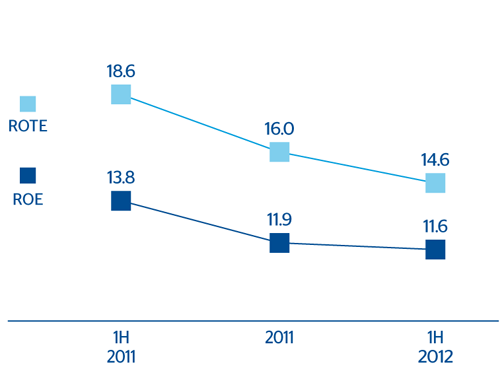

As a result, earnings per share (EPS) for the first half of the year were €0.29 (€0.45 adjusted), return on total average assets (ROA) 0.61% (0.90% adjusted), return on equity (ROE) 7.4% (11.6% adjusted) and return on tangible equity (ROTE) 9.3% (14.6% adjusted).