As of 30-Jun-2012 total customer funds totaled €428 billion and remained at very similar levels to those in the previous quarter, with a year-on-year rise of only 1.2%.

On-balance sheet customer funds totaled €274 billion, down 1.5%, both year-on-year and quarter-on-quarter. This fall was influenced by the drop in time deposits in the domestic and non-domestic sector. The main reasons for this drop were as follows:

- There has been a fall in certain wholesale customer deposits closely linked to and dependent on ratings.

- The substitution of time deposits by other alternative products, such as promissory notes in Spain.

- Current and savings accounts increased across the board in all the geographical areas as a result of the prioritization on price management. This evolution has a positive impact on both the composition of liabilities and the reduction of their cost.

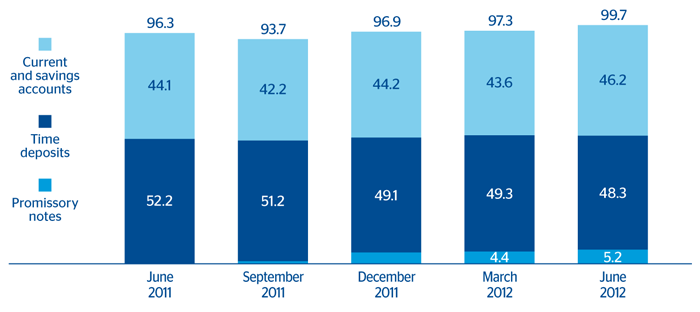

All in all, BBVA maintains intact its high capacity to gather deposits and the capillarity of its commercial network. Retail deposits (including promissory notes) were up 3.2% over the quarter and 9.2% in the last 12 months (up 1.2% and 5.2% respectively at constant exchange rates), with rises in both the domestic and non-domestic sectors. The breakdown on the evolution of customer deposits in the retail segment of the domestic sector is in the chart.

Off-balance sheet customer funds amounted to €154 billion as of 30-Jun-2012, a year-on-year rise of 6.3%, and 1.8% quarter-on-quarter. By type of product, there was notable performance in pension funds (up 12.6% year-on-year and 2.5% quarter-on-quarter). By geographical area, in Spain these funds were down 6.8% on the close of the first half of 2011 and 4.2% on the figure for March. In contrast, funds from the rest of the world were up 13.7% on 30-Jun-2011 and 4.9% on 31-March-2012. The rises were across the board in all items (mutual funds, pension funds and customer portfolios) and due largely to the positive impact of exchange rates.