In an environment where the market’s benchmark interest rate has dropped to a new all-time low (4%) and the economic cycle continues its gentle slowdown, earnings in Mexico were highly resilient in the first quarter of 2013.

Net interest income stands at €1,088m, up 5.2% on the figure for March 2012, and has grown at a rate similar to that of lending activity. Profitability, calculated as net interest income over ATA, was stable. Using data for the year 2012, this ratio compares well with its main competitors. Income from fees and commissions is up 4.8% thanks mainly to the credit and debit card business and management of mutual funds. NTI improved over the first quarter compared to the last three months of the previous year. The above, together with the positive performance of the insurance business, which explains the 43.5% year-on-year increase in the other income/expenses heading, has resulted in gross income of €1,516m, up 6.1% on the figure posted a year earlier.

The 6.2% year-on-year increase in operating expenses is due mainly to the significant depreciation resulting from the investments made, since recurrent expenses evolution is below inflation rate thanks to adequate cost control. These figures for revenue and expenses make the efficiency ratio one of the best in the Mexican system, at 38.2% in the first quarter of 2013. Operating income totaled €937m, up 6.1% on the figure for the same period in 2012.

Impairment losses on financial assets increased at a rate similar to the figure posted at the end of 2012, at 9.8% year-on-year to €351m. BBVA’s asset quality indicators remain stable as of 31-Mar-2013. The risk premium stands at 3.56%, the NPA ratio at 3.7% and the coverage ratio at 117%.

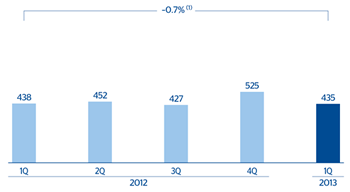

As a result, the net attributable profit in the area is €435m, very similar to the figure for the previous year.

Mexico. Operating income(Million euros at constant exchange rate) |

Mexico. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: +8.1%. |

(1) At current exchange rate: +1.2%. |