At the end of the first quarter of 2013, the BBVA Group’s balance sheet and business activity closely reflected the trends mentioned over the course of 2012:

- Increase of gross lending to customers in the quarter due to the positive impact of exchange rates, the temporary rise in the most volatile balances from repo agreements related to market operations in Spain and stronger activity in emerging economies. All this in a context of reduced lending activity in Spain and in the Group’s CIB portfolios.

- Growth of customer deposits, basically from the retail segment, which have risen in all the geographical areas.

- In short, this was yet another quarter of improvement in the Group’s liquidity and funding structure.

- A rise in total equity over the quarter due to the high earnings generated over the period.

- Off-balance sheet funds performed outstandingly well in the quarter in all the regions where the Group operates, in mutual funds, pension funds and managed customer portfolios.

- Finally, there was a positive impact from exchange rates during the year and in the quarter.

Consolidated balance sheet (1)

(Million euros)

|

|

31-03-13 | Δ % | 31-03-12 | 31-12-12 |

|---|---|---|---|---|

| Cash and balances with central banks | 30,208 | 21.4 | 24,873 | 37,434 |

| Financial assets held for trading | 75,750 | 6.4 | 71,208 | 79,954 |

| Other financial assets designated at fair value through profit or loss | 3,079 | (3.9) | 3,204 | 2,853 |

| Available-for-sale financial assets | 74,135 | 9.5 | 67,728 | 71,500 |

| Loans and receivables | 387,551 | 2.1 | 379,579 | 383,410 |

| Loans and advances to credit institutions | 26,383 | (4.4) | 27,609 | 26,522 |

| Loans and advances to customers | 357,490 | 2.4 | 348,964 | 352,931 |

| Other | 3,678 | 22.4 | 3,006 | 3,957 |

| Held-to-maturity investments | 9,734 | (5.2) | 10,268 | 10,162 |

| Investments in entities accounted for using the equity method | 6,991 | 18.2 | 5,913 | 6,795 |

| Tangible assets | 7,831 | 6.2 | 7,374 | 7,785 |

| Intangible assets | 8,952 | 4.7 | 8,550 | 8,912 |

| Other assets | 28,843 | 32.4 | 21,780 | 28,980 |

| Total assets | 633,073 | 5.4 | 600,477 | 637,785 |

| Financial liabilities held for trading | 54,894 | 11.3 | 49,308 | 55,927 |

| Other financial liabilities at fair value through profit or loss | 3,001 | 49.9 | 2,002 | 2,516 |

| Financial liabilities at amortized cost | 499,038 | 3.3 | 482,921 | 506,487 |

| Deposits from central banks and credit institutions | 91,277 | (7.9) | 99,101 | 106,511 |

| Deposits from customers | 304,574 | 9.4 | 278,445 | 292,716 |

| Debt certificates | 83,813 | 0.8 | 83,177 | 87,212 |

| Subordinated liabilities | 12,009 | (21.6) | 15,313 | 11,831 |

| Other financial liabilities | 7,364 | 6.9 | 6,886 | 8,216 |

| Liabilities under insurance contracts | 10,314 | 28.1 | 8,049 | 9,032 |

| Other liabilities | 19,253 | 14.4 | 16,835 | 20,021 |

| Total liabilities | 586,500 | 4.9 | 559,115 | 593,983 |

| Non-controlling interests | 2,362 | 16.8 | 2,022 | 2,372 |

| Valuation adjustments | (1,005) | (61.0) | (2,577) | (2,184) |

| Shareholders’ funds | 45,216 | 7.9 | 41,916 | 43,614 |

| Total equity | 46,573 | 12.6 | 41,361 | 43,802 |

| Total equity and liabilities | 633,073 | 5.4 | 600,477 | 637,785 |

| Memorandum item: |

|

|

|

|

| Contingent liabilities | 38,195 | (9.2) | 42,046 | 39,407 |

Customer lending (gross)

(Billion euros)

Customer lending

(Million euros)

|

|

31-03-13 | Δ % | 31-03-12 | 31-12-12 |

|---|---|---|---|---|

| Domestic sector | 192,543 | 1.5 | 189,742 | 190,817 |

| Public sector | 25,799 | (0.3) | 25,877 | 25,399 |

| Other domestic sectors | 166,744 | 1.8 | 163,865 | 165,417 |

| Secured loans | 103,373 | 5.1 | 98,367 | 105,664 |

| Other loans | 63,371 | (3.2) | 65,499 | 59,753 |

| Non-domestic sector | 158,640 | 3.8 | 152,800 | 156,312 |

| Secured loans | 64,809 | 5.6 | 61,386 | 61,811 |

| Other loans | 93,831 | 2.6 | 91,415 | 94,500 |

| Non-performing loans | 21,448 | 35.1 | 15,880 | 20,287 |

| Domestic sector | 16,184 | 45.8 | 11,101 | 15,159 |

| Non-domestic sector | 5,263 | 10.1 | 4,779 | 5,128 |

| Customer lending (gross) | 372,630 | 4.0 | 358,422 | 367,415 |

| Loan-loss provisions | (15,140) | 60.1 | (9,458) | (14,484) |

| Customer lending (net) | 357,490 | 2.4 | 348,964 | 352,931 |

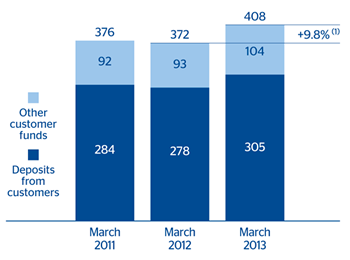

Customer funds

(Billion euros)

Customer funds

(Million euros)

|

|

31-03-13 | Δ % | 31-03-12 | 31-12-12 |

|---|---|---|---|---|

| Deposits from customers | 304,574 | 9.4 | 278,445 | 292,716 |

| Domestic sector | 146,359 | 12.4 | 130,240 | 141,169 |

| Public sector | 21,646 | (6.8) | 23,219 | 21,807 |

| Other domestic sectors | 124,713 | 16.5 | 107,021 | 119,362 |

| Current and savings accounts | 48,290 | 10.8 | 43,589 | 48,208 |

| Time deposits | 66,789 | 35.4 | 49,312 | 61,973 |

| Assets sold under repurchase agreement and other | 9,634 | (31.8) | 14,119 | 9,181 |

| Non-domestic sector | 158,215 | 6.8 | 148,205 | 151,547 |

| Current and savings accounts | 97,419 | 10.2 | 88,406 | 98,169 |

| Time deposits | 53,514 | (1.6) | 54,360 | 48,691 |

| Assets sold under repurchase agreement and other | 7,282 | 33.9 | 5,438 | 4,688 |

| Other customer funds | 103,501 | 11.2 | 93,100 | 98,240 |

| Spain | 52,855 | 3.9 | 50,853 | 51,915 |

| Mutual funds | 19,259 | (2.5) | 19,747 | 19,116 |

| Pension funds | 18,779 | 6.8 | 17,590 | 18,313 |

| Customer portfolios | 14,817 | 9.6 | 13,517 | 14,486 |

| Rest of the world | 50,647 | 19.9 | 42,247 | 46,325 |

| Mutual funds and investment companies | 23,808 | 16.6 | 20,416 | 22,255 |

| Pension funds (1) | 10,803 | 18.8 | 9,095 | 10,418 |

| Customer portfolios | 16,036 | 25.9 | 12,735 | 13,652 |

| Total customer funds | 408,076 | 9.8 | 371,544 | 390,956 |