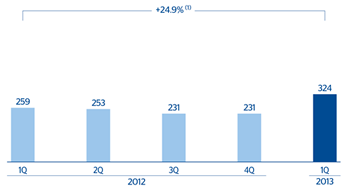

CIB reported net attributable profit of €324m in the first quarter of 2013, an increase of 24.9% year-on-year. The key factors behind this performance are as follows:

- Strength and quality in gross income, which has risen 20.6% over the last twelve months to €834m. This strong performance is underpinned by the good progress in the corporate finance, global transactional banking and global markets businesses. In addition, is worth mentioning the increased geographical diversification of CIB revenue thanks to the higher contribution from Mexico, South America and, to a lesser degree, Asia.

- Efforts in containing and controlling operating expenses, which rose 5.3% in the year. The heading which increases most is depreciation due to the investments being made in systems and in growth plans in emerging economies.

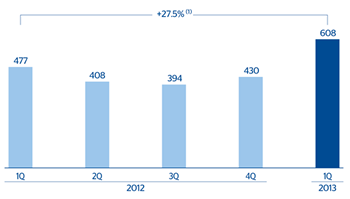

- In short, improvement in efficiency and generation of operating income, which is 27.5% higher than the figure reported in the same period of the previous year, amounting to €608m.

- Stable impairment losses on financial assets, which reduced the income statement by €62m and are up 3.8% in the year.

CIB. Operating income(Million euros at constant exchange rates) |

CIB. Net attributable profit(Million euros at constant exchange rates) |

|---|---|

(1) At current exchange rates: +25.0%. |

(1) At current exchange rates: +23.1%. |