The following are the most important figures related to earnings in the first quarter of 2013 in this area:

- Net interest income continues to be under strong pressure from the deleveraging process underway, the current environment of low interest rates and more expensive wholesale funding. The figure for the area is €1,071m, 8.8% down on the first quarter of 2012.

- Slight improvement in income from fees and commissions, with a rise of 1.1% year-on-year to €345m, largely due to its good performance in CIB thanks to strong activity in the corporate finance and global transactional banking businesses.

- There was a significant contribution from NTI as a result of favorable market activity and good management of the structural risks on the balance sheet. This item amounted to €220m in the first quarter of 2013, €95m more than in the same period in 2012.

- Other income/expenses contributed €33m to the area’s income statement. This contribution is down on the first quarter of 2012 due to the reinsurance operation (which generated capital gains recorded in extraordinary earnings, but lower revenue from the insurance business). It also includes the higher contribution to the Deposit Guarantee Fund compared with the same period the previous year.

- Operating expenses are up 10.6% on the figure recorded in the first three months of 2012 to €768m, due mainly to the impact of the incorporation of Unnim.

- Impairment losses on financial assets increased by 37.6% year-on-year to €618m, highly concentrated in the commercial portfolio.

- The provisions (net) and other gains (losses) heading registered €540m, compared with the negative €34m in the same period in 2012, basically due to the reinsurance deal for 90% of the individual life-accident portfolio.

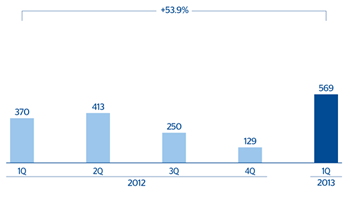

- Overall, the net attributable profit was €569m (€370m in the same period in 2012).

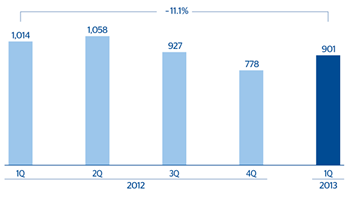

Spain. Banking activity. Operating income(Million euros) |

Spain. Banking activity. Net attributable profit(Million euros) |

|---|---|

|

|