The most significant events in the first quarter of 2013 as regards the Group’s capital base are:

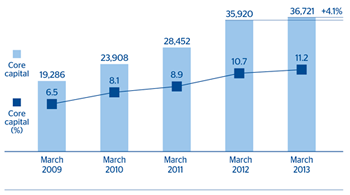

- BBVA has improved its core capital ratio under Basel II by 42 basis points on the figure reported at the end of December 2012 to 11.2%, thanks to the strong earnings generated in the period.

- In addition to organic capital generation, the capital gain from the sale of the Afore in Mexico has a positive impact of 25 basis points on the Group’s capital base.

- Risk-weighted assets (RWA) remain at levels very similar to 31-Dec-2012. The decline in lending in Spain and in the CIB portfolios was offset by business activity in emerging markets.

- Positive impact in the quarter from exchange rates. The effect of the devaluation of the Venezuelan bolivar is practically neutral on the capital ratios.

As a result, at the end of March the capital base stood at €44,305m, up 3.4% over the quarter. Of this amount, €36,721m correspond to core capital and Tier I capital, which grew 3.6% over the same period, and €7,584m to Tier II capital, which rose 2.7% quarter-on-quarter. This slight increase is due basically to the issue of subordinated bonds in Colombia. The RWA figure has barely changed since the end of 2012.

To sum up, the Group has strengthened its core capital and Tier I ratios thanks to organic capital generation and to the capital gains from the sale of the pension business in Mexico. They closed the quarter at 11.2%. The Tier II ratio ended the quarter at 2.3% (2.2% as of 31-Dec-2012). The BBVA Group’s BIS II ratio as of March 31, 2013 stood at 13.5%, 49 basis points above the figure reported at the close of 2012.

Core capital evolution (BIS II Regulation)

(Million euros and percentage)

RWA evolution

(Billion euros)

Capital base (BIS II Regulation)

(Million euros)

|

|

31-03-13 | 31-12-12 | 30-09-12 | 30-06-12 | 31-03-12 |

|---|---|---|---|---|---|

| Core capital | 36,721 | 35,451 | 36,075 | 35,924 | 35,290 |

| Capital (Tier I) | 36,721 | 35,451 | 36,075 | 35,924 | 35,290 |

| Other eligible capital (Tier II) | 7,584 | 7,386 | 8,393 | 6,841 | 8,241 |

| Capital base | 44,305 | 42,836 | 44,467 | 42,765 | 43,531 |

| Risk-weighted assets | 328,002 | 329,033 | 335,203 | 332,036 | 329,557 |

| BIS ratio (%) | 13.5 | 13.0 | 13.3 | 12.9 | 13.2 |

| Core capital (%) | 11.2 | 10.8 | 10.8 | 10.8 | 10.7 |

| Tier I (%) | 11.2 | 10.8 | 10.8 | 10.8 | 10.7 |

| Tier II (%) | 2.3 | 2.2 | 2.5 | 2.1 | 2.5 |