At the close of 2013, activity in South America was once more buoyant in practically all the countries where BBVA operates, both with respect to the loan book and in on-balance-sheet customer funds.

BBVA Group. Business share ranking in

South America in 2013 (1)

Download Excel

Download Excel

|

|

Loan | Deposit |

|---|---|---|

| Argentina | 4th | 3rd |

| Chile | 5th | 5th |

| Colombia | 4th | 4th |

| Paraguay | 4th | 4th |

| Peru | 2nd | 2nd |

| Uruguay | 2nd | 3rd |

| Venezuela | 3rd | 3rd |

South America. Key activity data

(Million euros at constant exchange rates)

| (1) At current exchange rates: –0.5%. |

(2) Excluding repos and including specific marketable debt securities. (3) At current exchange rates: +3.4%. |

|---|

The balance of performing loans as of 31-Dec-2013 closed at €47,753m, a year-on-year growth of 21.7%. Lending to the retail segment performed outstandingly well, particularly consumer finance (up 23.6%), credit cards (up 43.5%) and to a lesser extent mortgage lending (up 14.2%). This is reflected in a year-on-year gain in market share of 24 basis points in the individual segment, according to the latest available information as of November 2013.

South America. Performing loans breakdown

(Percentage)

This rise in lending activity has been coupled with strict risk admission policies and a good management of recoveries. These lines of action, which are closely in line with those for the corporate segment, have maintained the main risk indicators stable over the year. The NPA ratio as of 31-Dec-2013 stood at 2.1% and the coverage ratio at 141% (2.1% and 146%, respectively, at the close of December 2012).

South America. NPA and coverage ratios

(Percentage)

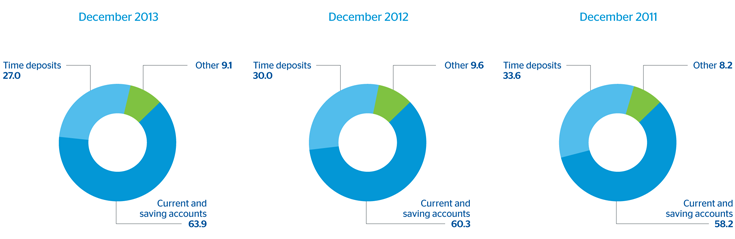

Customer deposits under management closed December at €58,881m, and have continued to increase their year-on-year rate of growth to 30.0%. Lower-cost transactional items (current and savings accounts) have driven this growth, with a rise of 42.6% over the period and a market share gain of 37 basis points from November 2012 to November 2013. Including assets under management by mutual funds, customer funds managed by the banks in South America totaled €61,833m, up 28.3% on the same date the previous year, with a rise in market share over the year of 10 basis points, again using data for November 2013, the latest information available.

South America. Breakdown of customer deposits under management

(Percentage)

With respect to activity related to corporate responsibility in the region, it is worth highlighting the significant work carried out by the BBVA Microfinance Foundation in the area. This entity continues to contribute with its activity to boost the economic and social development of the countries in South America where it operates. The goal is to provide access to financial services for the most disadvantaged members of society so that they can undertake sustainable productive activities that allow them to improve their own standard of living and that of their families. As of 31-Dec-2013, it had 1,493,709 customers, with an impact on the lives of 6 million people. It has granted €1,016m in microcredits over the year, and a cumulative total since 2007 of €4,416m.