In 2013 progress continued to be made on regulatory reforms, with some aspects still pending completion

The regulatory response to reinforce the financial system, initiated after the outbreak of the financial crisis in 2008 and led by the G-20, is forcing financial institutions to adapt to the numerous reforms already introduced and to those that will come into force soon. Although many of the changes have already materialized, the regulatory response is not complete. This means that the regulatory uncertainty with which financial institutions have had to live in recent years has not yet been fully dispelled.

In 2013 progress was made in developing macroprudential policies and strengthening the institutional framework for identifying systemic risks. Measures were also adopted for the resolution of credit institutions that allow swift action and a minimization of the costs to taxpayers.

In addition, the adoption by most of the countries of the new solvency regulation (Basel III) will serve to strengthen the capital of banks, as it is a stricter and more complete framework than the previous one. Its transposition to European law was completed in June. As this regulation is now directly applicable in all European Union countries, it promotes the harmonization of European prudential rules, which is a necessary requirement for the existence of a banking union in the region.

Even though the G-20 does not consider structural reforms as a specific part of its financial reform program, the national and European authorities have been very active in this field, making recommendations or suggesting the adoption of regulatory initiatives that impose new restrictions on the structure of their banks.

Structural reforms can be addressed from two different perspectives: by imposing a ban or through a separation of activities. On the one hand, the U.S. authorities have adopted the Volcker Rule, which prohibits proprietary trading activities for credit institutions. On the other, Europe is moving toward the separation between risky trading activities and traditional banking activities. In this regard, there has been a proliferation of divergent national initiatives in Europe: a) The United Kingdom is transposing into its Banking Act the Vickers recommendations, which propose a strict separation between wholesale and traditional banking activities, b) France and Germany have adopted a mild reform that limits the separation to proprietary trading for a limited sample of banks. In order to harmonize national initiatives and preserve the Single Market, the European Commission (EC) has published its own proposal. On the one hand, it prohibits the proprietary trading business and, on the other, it encourages a potential separation of trading activities. This proposal will be negotiated with the Parliament and the European Council, and an agreement is not expected to be reached before 2015. The reform would mainly affect investment banking.

At the same time, some regulatory proposals that have been put forward still have to be implemented. Among them are some aspects of the framework for resolution of systemic banks, the requirements for the capacity of absorbing losses, the mitigation of the systemic risks associated with shadow banking and the strengthening of security in derivatives markets.

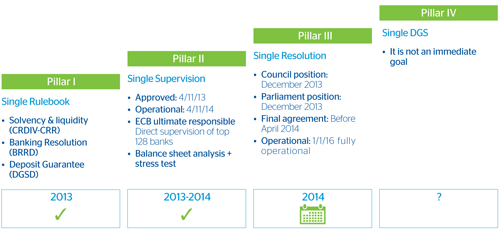

The accompanying chart includes the main regulatory initiatives currently being implemented in the European Union. However, from a European perspective, some uncertainties still have to be resolved, probably in 2014.

Regulatory initiatives in the European Union

The latter part of the year saw approval of the Spanish laws needed for the coming into force of the new prudential framework on January 1, 2014. This included approval of Royal Decree-Law 14/2013, while the law of regulation and solvency of credit institutions is in the process of being approved and the Bank of Spain has already issued its Circular 2/2014.

With the progress made in most of the regulatory proposals, the challenge will now be monitoring their implementation.

European banking union

In 2013, Europe has made firm progress in record time toward banking union

The European banking union is a historic and decisive project to halt financial fragmentation and guarantee the integrity of the Monetary Union. Now that the first two pillars (regulation and supervision) have been established, and with good prospects on a final agreement regarding the third (resolution, expected for the spring of 2014), the banking union should take off strongly in the second half of 2014, when the ECB takes on full supervision of the banking system.

The first pillar of the banking union (a single rulebook) was established with publishing the new package of capital requirements (the CRD IV Directive and the associated CRR Regulation) in June 2013, as well as the Recovery and Resolution Directive and the Deposit Guarantee Scheme Directive, both approved in December 2013.

The second pillar (a single supervisor) was implemented in November 2013 with the historic approval in record time of the Single Supervisory Mechanism (SSM), headed by the ECB.

Progress in banking union

The third pillar (single resolution) is the most difficult to achieve, but here too there has been very significant progress. The political agreement in the European Council, forged in December 2013, has moved matters into the final phase of the legislative process, which should conclude with an agreement between the European Council and Parliament by April 2014. The approval of the Single Resolution Mechanism (SRM) is fundamental for restoring the credibility and strength needed for the European project, and to generate financial integration, stability and economic growth.

Before the ECB takes on direct supervision of the 128 most important banks in the Eurozone, a satisfactory and final solution must be found to the question of legacy assets. To do so, the ECB is carrying out a sequential risk assessment exercise, a review of asset quality and, finally, a stress test, together with the European Banking Authority (EBA).

The results of the asset quality review and of the stress test will be published in October 2014 and will give rise to the mandatory recapitalization of any banks falling short of capital requirements, thus allowing the ECB to take on its new functions without legacy problems that could undermine its credibility as a supervisor. The final goal of the exercise is to bolster confidence in the banks and restore the normal flow of credit, drawing a clear dividing line between the problems of the past and the future (for which the SRM offers optimal management at European level of any banking resolution process). Aware of this, the European authorities aim to carry out a credible exercise, robust and transparent (in other words, it can be replicated by the markets). Also key for maintaining positive expectations regarding the success of the exercise has been the agreement reached at the ECOFIN meeting in November 2013 on the existence of public support of last resort. This covers cases when the various private forms of resolution (take-over of losses by shareholders and subordinate creditors, balance sheet restructuring or recourse to the markets) are insufficient to face the capital requirements estimated in the asset valuation exercise and the stress test. Thus, progress is being made on the roadmap to banking union. It is a historic project because of the surrender of sovereignty it implies, comparable to that involved with the creation of the euro. With it, the Eurozone is strengthening its integration and the future of the euro.