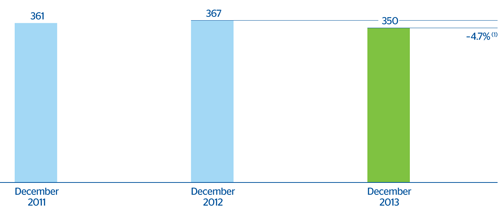

Loans and advances to customers (gross) closed December 2013 at €350 billion. This represents a decline over the year of 4.7% (a fall of 0.8% at constant exchange rates).

Loans and advances to customers

(Million euros)

Download Excel

Download Excel

|

|

31-12-13 | Δ % | 31-12-12 | 31-12-11 |

|---|---|---|---|---|

| Domestic sector | 167,670 | (12.1) | 190,817 | 192,442 |

| Public sector | 22,128 | (12.9) | 25,399 | 25,509 |

| Other domestic sectors | 145,542 | (12.0) | 165,417 | 166,933 |

| Secured loans | 93,446 | (11.6) | 105,664 | 99,175 |

| Other loans | 52,095 | (12.8) | 59,753 | 67,758 |

| Non-domestic sector | 156,615 | 0.2 | 156,312 | 153,222 |

| Secured loans | 62,401 | 1.0 | 61,811 | 60,655 |

| Other loans | 94,214 | (0.3) | 94,500 | 92,567 |

| Non-performing loans | 25,826 | 27.3 | 20,287 | 15,647 |

| Domestic sector | 20,985 | 38.4 | 15,159 | 11,042 |

| Non-domestic sector | 4,841 | (5.6) | 5,128 | 4,604 |

| Loans and advances to customers (gross) | 350,110 | (4.7) | 367,415 | 361,310 |

| Loan-loss provisions | (15,366) | 6.1 | (14,484) | (9,410) |

| Loans and advances to customers | 334,744 | (5.2) | 352,931 | 351,900 |

BBVA Group. Loans and advances to customers (gross)

(Billion euros)

By headings there has been a general decline in each of the items of the domestic sector, as a result of the deleveraging process in the Spanish economy mentioned above and the early repayment under the Supplier Payment Fund. The non-domestic sector was negatively affected by the depreciation of exchange rates over the year.

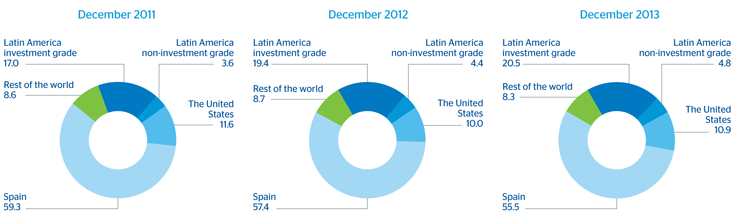

By geographical areas there was a decline in Spain and in the wholesale business in Europe, but an increase in the United States (thanks to the good performance of the target portfolios: commercial, residential real estate and, to a lesser extent, consumer finance), renewed progress in Turkey, as well as the strength of Mexico and South America.

BBVA Group. Geographical breakdown of loans and advances to customer (gross)

(Percentage)

Finally, non-performing loans increased by 27.3% since 2012 up to €26 billion. This rise is above all the result of increased balances in the domestic sector (up 38.4% year-on-year), which has been strongly influenced by the classification of refinanced loans made in the third quarter in Spain. The impact of the classification has been felt particularly strongly in the retail mortgage portfolio, even though at the present date a high percentage of that portfolio is held by customers who are up to date with their payments. The volume in the non-domestic sector has fallen by 5.6% due once more to the influence of exchange rates.