In 2013

Optimism recovers

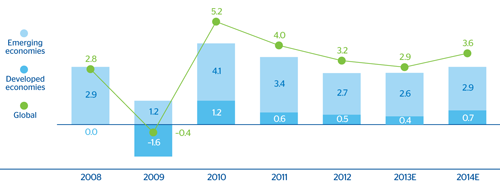

The global economy closed 2013 with a growth of nearly 3%, a few tenths of a percentage point below the figure for 2012. The slowdown was caused by the weakness of developed economies in the first part the year, particularly in Europe, as emerging markets continued to grow at a relatively strong pace. However, this trend began to change halfway through the year, when there was a significant improvement in the global mood, above all after Europe began to show some signs of recovery and of emerging from the recession.

The financial markets also performed better in 2013 than the previous year. Europe has not been a source of systemic financial tension, and confidence in the currency has been restored. The euro has emerged strengthened after the reforms adopted and the commitment to move toward banking union in the zone. In contrast, there have been some difficulties in the United States in reaching long-term agreements to resolve the fiscal deficit crisis, leading to the “fiscal cliff” at the start of the year (with the resulting rise in taxation and general reduction in public spending) and the temporary shutdown of the federal government in the fall. Globally, markets (particularly assets in emerging markets) were affected by the announcement by the Federal Reserve that it was considering gradually withdrawing its monetary expansion policy in a process known as “tapering”. As a result, global financial conditions are now tighter, and emerging countries have been affected by reductions in asset prices, capital outflows and currency depreciation.

Global GDP growth

(Percentage)

Less global risk from Europe

The recession that hit Europe in 2012 (a GDP fall of 0.6% year-on-year) extended through much of 2013, so this year as a whole the European economy has declined by around 0.4% year-on-year. However, its tone has improved steadily over the year all across the board, i.e. not only limited to core countries. In fact, the peripherals have also improved their activity and some have even emerged from the recession and posted positive growth rates. Two factors lie behind this improvement.

One is that the process of fiscal consolidation has been less of a drain on the economy following the relaxation of the fiscal deficit targets. The second reason is that financial tensions have been kept tightly in check. It is worth noting that part of the improvement in confidence with respect to the euro has come from the efforts to improve governance in Europe; in particular, the attempts to create a real banking union on which the European authorities have been working throughout 2013 and which will be established over various stages over the next few years. However, the situation is still weak, inflation continues to be very low and there is significant financial fragmentation. As a result, the European Central Bank (ECB) has lowered interest rates to all-time lows and declared it would take into consideration new measures to provide long-term liquidity for the financial system if necessary. This is closely related to a test in 2014 of the soundness of the European banking system, both in terms of the quality of its capital, the sufficiency of its provisions and its resilience to stress scenarios.

The beginning of the recovery in Spain

In the latter part of 2013 the Spanish economy put an end to the long period of recession that has led it to accumulate a further year-on-year fall of 1.2%. The incipient recovery is based on sustained growth in exports and on a less contractionary domestic demand. The fiscal consolidation targets have been relaxed, while market confidence has improved. As a result, there has been no major financial tension, the risk premium on sovereign debt has fallen significantly and the economy has opened up to international financial flows. Even so, the recovery has started from low levels, particularly in terms of unemployment, which is still over 25% of the active population.

The United States face the end of its extraordinary monetary and fiscal policies

Economic activity in the United States has also gained strength over 2013, although the less positive figures at the start of the year have led to a slowdown in GDP in year-on-year terms from 2.8% in 2012 down to a figure of 1.8%. Nonetheless, the trend is positive. Consumption and residential lending remain solid, while in the labor market employment continues its moderate growth, and thus unemployment is falling. However, uncertainties have continued to affect the economy, in particular about how soon the authorities were going to limit the expansive tone of fiscal and monetary policies. In fiscal policy, negotiations have been prolonged throughout the year to achieve a comprehensive plan that can address fiscal consolidation with a long-term perspective. This has increased uncertainty and led to a partial shutdown of the federal government in the fall, although in the end the impact on the economy was limited. In monetary policy, tapering was accompanied by an upturn in market interest rates in the United States, which limited the strength of investment in housing. This is despite the fact that the Fed was very clear that this process would only be introduced if the economy continued on a path of sustained growth. In the end, the start of tapering has been postponed until January 2014, and the Fed has been particularly careful to emphasize its intention of keeping interest rates firmly anchored at low levels until it is sure that the improvement underway is sustainable and strong.

The emerging economies: between the volatility caused by tapering and robust growth

For emerging economies, 2013 has been similar to 2012, with some occasional exceptions. Overall, growth in Latin America has remained at 2.2%, with the slowdown of the Mexican economy being offset by the partial recovery of Brazil. At the same time, the Asia/Pacific region has once more recorded growth at a few tenths of a percentage point above 5% (or around 3.5% excluding China). However, the positive growth data cannot conceal the fact that the region has been affected by the volatility derived from the announcement of a possibly lower pace of monetary expansion in the United States. This has resulted in reductions in asset prices, currency depreciations and capital outflows, particularly in countries with structural weaknesses and high short-term foreign-currency funding needs. Nevertheless, part of these capital outflows reversed once the Fed conveyed more information on its plans.

Outlook for 2014

Global economic growth is speeding up, with a greater contribution from developed regions

Economic recovery in 2014 will continue to gain strength thanks to the range of measures taken. Growth of the global economy is expected to accelerate to around 3.6%, mainly due to the improved outlook of developed economies. Both the United States and the Eurozone will make greater progress in 2014; the United States by 2.5% and the Eurozone by around 1% (similar to the increase expected for the Spanish economy). In addition, emerging regions, which will continue to be the greatest contributors to progress in global growth, will remain at their current rates of growth. Latin America will accelerate its growth to rates of around 2.5%, while Asia will continue to grow at above 5%, driven by China, where a rise of more than 7.5% is expected. The growth in Turkey will go slower at levels of 1.5%.

Global GDP growth and inflation in 2013 and the outlook for 2014

(Percentage real growth)

Download Excel

Download Excel

|

|

2013 | 2014E | ||

|---|---|---|---|---|

|

|

GDP | Inflation | GDP | Inflation |

| Global | 2.9 | 3.8 | 3.6 | 4.1 |

| Euro Zone | (0.4) | 1.4 | 1.1 | 1.0 |

| Spain | (1.2) | 1.4 | 0.9 | 0.5 |

| The United States | 1.8 | 1.5 | 2.5 | 2.3 |

| Mexico | 1.2 | 3.8 | 3.4 | 4.3 |

| Latin America (1) | 2.2 | 8.9 | 2.5 | 11.6 |

| Turkey | 3.9 | 7.6 | 1.5 | 8.2 |

| China | 7.7 | 2.6 | 7.6 | 3.3 |

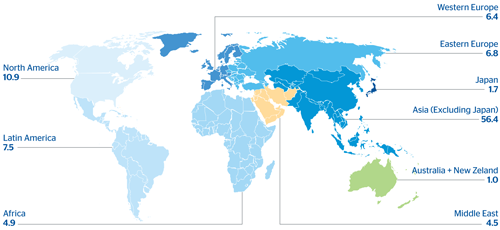

Contribution to global growth between 2011 and 2021

(Percentage of total)

Exchange rates

Throughout this year, currency movements have been determined by expectations of the withdrawal of monetary stimuli by the main central banks and its impact on global liquidity. Thus, the liquidity injections by the Fed and the Bank of Japan maintained the trend for appreciation of most currencies with a significant positive impact on the Group’s financial statements in the initial months of the year. The only exceptions were the Argentinean peso, the Venezuelan bolivar (which suffered a devaluation in February) and, to a lesser extent, the U.S. dollar.

However, starting in May 2013 the Fed suggested the possibility of a gradual reduction of monetary stimuli. This fact led to a reversal of part of the capital flows that had been entering emerging markets over recent years, with the resulting depreciation of their currencies. In contrast, the reduction in financial tensions in the Eurozone meant that the area became one of the major recipients of flows, leading to a further appreciation of the euro in the second half of 2013.

In all, in terms of final exchange rates, the euro has appreciated against the main currencies in both developed and emerging countries. In terms of average exchange rates, there has also been a general appreciation of the euro against nearly all of the currencies that affect the Group’s financial statements, except for the Mexican peso, whose rate remained practically stable, as can be seen in the accompanying table. In short, the impact of currencies is negative on both the income statement and BBVA Group’s balance sheet and activity.

In 2014 the dollar is expected to appreciate slightly against the euro, and in general against the currencies of emerging regions. This appreciation could be more pronounced against the currencies of countries with less solid fundamentals.

Exchange rates

(Expressed in currency/euro)

Download Excel

Download Excel

|

|

Year-end exchange rates | Average exchange rates | ||||||

|---|---|---|---|---|---|---|---|---|

|

|

31-12-13 | Δ% on 31-12-12 |

31-12-12 | Δ% on 31-12-11 |

2013 | Δ% on 2012 |

2012 | Δ% on 2011 |

| Mexican peso | 18.0731 | (4.9) | 17.1845 | (0.1) | 16.9627 | (0.3) | 16.9033 | 1.9 |

| U.S. dollar | 1.3791 | (4.3) | 1.3194 | (6.2) | 1.3281 | (3.2) | 1.2850 | 4.8 |

| Argentinean peso | 8.9890 | (27.9) | 6.4768 | (38.1) | 7.2767 | (19.7) | 5.8434 | (21.0) |

| Chilean peso | 722.54 | (12.3) | 633.31 | (6.6) | 658.33 | (5.1) | 625.00 | 2.1 |

| Colombian peso | 2,659.57 | (12.4) | 2,331.00 | (5.5) | 2,481.39 | (6.9) | 2,309.47 | 3.6 |

| Peruvian new sol | 3.8535 | (12.6) | 3.3678 | (9.5) | 3.5903 | (5.6) | 3.3896 | 6.7 |

| Venezuelan bolivar fuerte | 8.6775 | (34.8) | 5.6616 | (36.0) | 8.0453 | (31.4) | 5.5187 | (25.7) |

| Turkish lira | 2.9605 | (20.4) | 2.3551 | (17.5) | 2.5339 | (8.7) | 2.3139 | (7.7) |

| Chinese yuan | 8.3491 | (1.5) | 8.2207 | (2.3) | 8.1644 | (0.7) | 8.1063 | 10.2 |