At the end of 2013, the Group’s main asset quality indicators have evolved as forecast:

- Uptick in the NPA ratio in Spain to 10.3% (6.4% excluding real-estate activity) due, on the one hand, to the classification of refinanced loans in the third quarter of 2013 and, on the other, to the decline in the loan book. The coverage ratio stands at 50% (41% without taking into account real-estate activity).

- In the rest of the geographical areas, improvement in the asset quality indicators in the United States and Mexico, slight deterioration in Eurasia (due to the deleveraging process in Europe and the exchange-rate effect in Turkey) and stability in South America.

As a result, the Group ended 2013 with its main risk indicators as expected and comparing positively with those of most of its peers. As of 31-Dec-2013, the NPA ratio stood at 6.8% (4.6 % excluding the real-estate activity in Spain), the coverage ratio at 60% (59% excluding the real-estate activity in Spain) and the cumulative risk premium at 1.59% (1.50% excluding the real-estate activity in Spain).

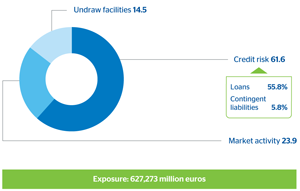

BBVA’s exposure to credit risk stood at €627,273m at the close of December 2013, with a year-on-year decrease of 3.2%. Customer credit risks (including contingent liabilities), which account for 61.6% of total credit risk, decreased by 5.1% over the same time period. This decrease was due to the aforementioned decline in the loan book in Spain and in the wholesale portfolios in Europe, which has been partly offset by the growth in lending activity in the emerging economies and in the United States. Potential exposure to credit risk in market activities (23.9% overall), including potential exposure to derivatives (once netting and collateral agreements are considered), declined by 3.1%, while undrawn facilities (14.5% of the total) increased by 5.5%.

BBVA Group. Exposure to credit risk

(Million euros)

Download Excel

Download Excel

|

|

31-12-13 | 31-12-12 | 31-12-11 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

Banking activity in Spain |

Real-estate activity in Spain |

The United States |

Eurasia(1) | Mexico | South America |

Corporate Center |

Total Group |

Total Group |

Total Group |

| Gross credit risk (drawn) |

194,099 | 16,684 | 41,166 | 39,529 | 40,963 | 53,493 | 467 | 386,401 | 407,126 | 400,709 |

| Customer lending (gross) | 178,335 | 16,085 | 38,173 | 28,117 | 40,610 | 48,466 | 431 | 350,218 | 367,719 | 361,310 |

| Contingent liabilities | 15,764 | 599 | 2,992 | 11,412 | 353 | 5,027 | 36 | 36,183 | 39,407 | 39,398 |

| Market activity | 91,837 | 234 | 8,762 | 5,795 | 27,275 | 14,576 | 1,457 | 149,935 | 154,689 | 134,937 |

| Credit entities | 14,376 | 232 | 1,179 | 1,763 | 2,407 | 2,229 | 2,016 | 24,203 | 26,522 | 26,107 |

| Fixed income | 64,870 | 2 | 7,282 | 4,031 | 24,094 | 10,193 | (559) | 109,913 | 110,505 | 88,621 |

| Derivatives | 12,591 | 0 | 301 | 0 | 774 | 2,153 | 0 | 15,820 | 17,662 | 20,209 |

| Undrawn facilities | 31,043 | 4,746 | 24,568 | 15,272 | 15,933 | 6,290 | (6,915) | 90,937 | 86,223 | 88,978 |

| Maximum exposure to credit risk | 316,978 | 21,664 | 74,496 | 60,595 | 84,172 | 74,359 | (4,991) | 627,273 | 648,039 | 624,624 |

BBVA Group. Exposure to credit risk. Breakdown by type of risk(31-12-2013. Percentage)  |

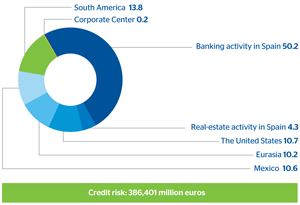

BBVA Group. Exposure to credit risk. Breakdown by business area(31-12-2013. Percentage)  |

|---|

BBVA Group. Loan book exposure. Breakdown by portfolio

(31-12-2013. Percentage)

The exposure breakdown by rating of the parent company and subsidiaries in Spain (including real-estate activity), which comprises corporations, financial institutions, and sovereign institutions and customers, shows 52.6% of A or better ratings. Also shown is the breakdown by rating of the business and developer segments in Spain, and of the loan book with corporates and financial institutions in Mexico.

Breakdown by rating in Spain(1)

(Exposure as of 31-12-2013)

Breakdown by rating. Corporate and developers in Spain(1)

(Exposure as of 31-12-2013)

Breakdown by rating in Mexico

(Exposure as of 31-12-2013)