There has been an upturn in BBVA’s commercial activity in Mexico during 2013, despite the slower growth in GDP. Performing loans have risen in the latter part of the year, and at the close of 2013 stood at €38,678m, up 9.8% on the close of 2012.

Mexico. Key activity data

(Million euros at constant exchange rate)

| (1) At current exchange rate: +4.4%. |

(2) Including all the repos. (3) At current exchange rate: +1.0%. |

|---|

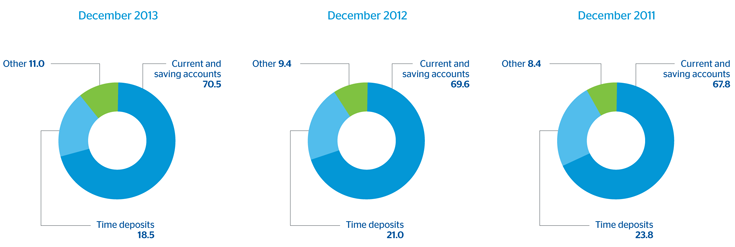

Mexico. Performing loans breakdown

(Percentage)

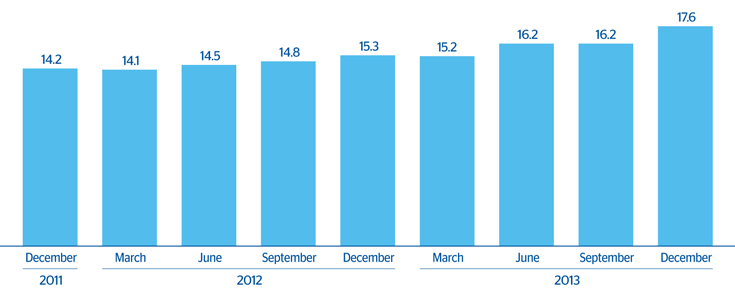

The biggest growth in the latter part of the year was posted by the wholesale portfolio, at 14.7% year-on-year. Outstanding in this portfolio is the increase in financing to medium-sized enterprises (up 20.2%). Corporate lending also performed well. In addition, the area has played an active role in placing its customer’ shares and fixed-income instruments. As a result, BBVA Bancomer has maintained its leading position in the Mexican capital market, with a market share of 15% in local issues, according to cumulative data through December 2013 from the Mexican Stock Exchange (BMV). As a result, it has been named “Best Investment Bank in Mexico” by LatinFinance magazine. Lastly, there has also been a marked recovery in lending to government bodies, above all in the last two quarters of 2013, with growth of 5.3% year-on-year.

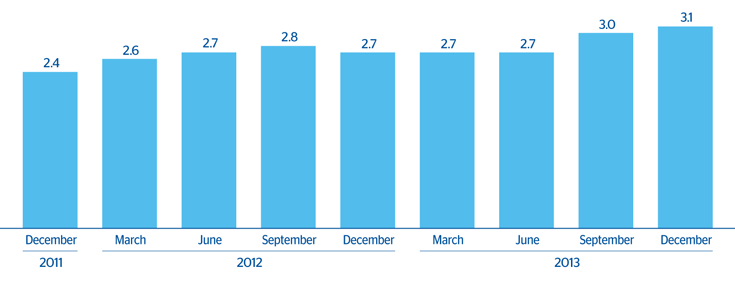

Mexico. Wholesale portfolio evolution

(Billion euros at constant exchange rate)

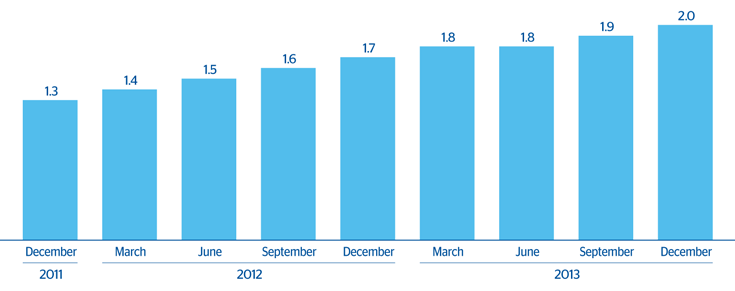

The retail portfolio segments reported growth of 6.7% over the year, with financing to small businesses performing particularly well, up 21.9% year-on-year. The Bank has launched the new “Red PyME” (SME Network) in this segment, which has extended the specialized business centers to cover the whole of Mexico. This new service model includes commercial alliances to drive lending and, using BBVA Group’s customer-centric approach, offer customers products that best fit their needs. Within the consumer portfolio, the successful pre-approved loan campaigns significantly boosted lending, above all in the second half of the year. 2013 closed with a rise of 15.3% on the previous year’s balance and a rise in market share of over 50 basis points since June 2013, according to the latest information available from the CNBV as of December 2013.

Mexico. Lending to small businesses evolution

(Billion euros at constant exchange rate)

Mexico. Consumption portfolio evolution

(Billion euros at constant exchange rate)

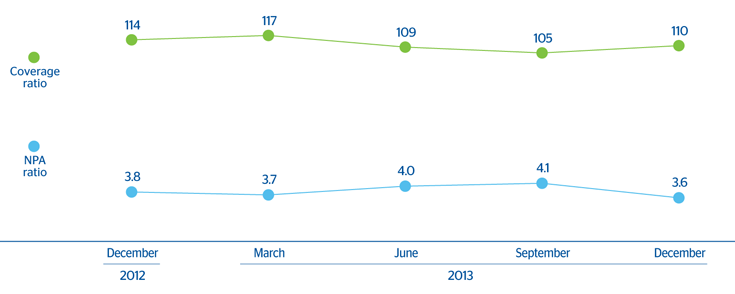

The area’s asset quality indicators have also been positive, and improved over the year. At year end, the NPA ratio was 3.6% (3.8% at end of December 2012) and the coverage ratio stood at 110% (compared with 114% as of 31-Dec-2012).

Mexico. NPA and coverage ratios

(Percentage)

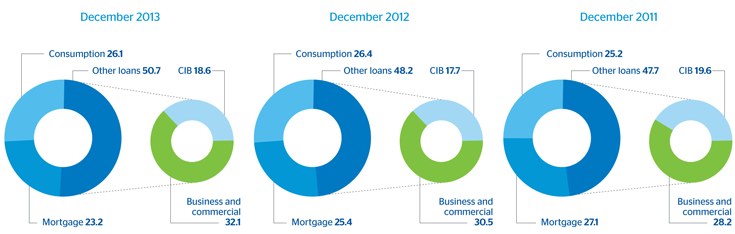

Customer funds, which include demand deposits, time deposits, repos, mutual funds and other off-balance-sheet funds, totaled €60,489m at the end of 2013, with a year-on-year rise of 5.5%. This amount has been highly conditioned by the area’s policy in 2013 of increasing the profitability of liabilities. As a result, BBVA in Mexico has an adequate fund mix, with a higher relative weight of demand deposits, which have performed well with growth of 10.6% over the year.

Mexico. Breakdown of customer deposits under management

(Percentage)