Global Markets ended 2013 with a year-on-year significant increase in gross income of 26.1% to €1,282m. This increase is largely the result of its customer-centric business model, whereby customers are able to make the most of the business opportunities that arise, within the broad range of markets in which BBVA operates. It also carefully examines the sustainability of each proposal using stringent risk control and an efficient use of liquidity. The success of the Global Markets strategy has been recognized by a number of awards. Euromoney recently ranked BBVA CIB as the “Best Investment Bank in Spain” and LatinFinance chose BBVA Bancomer as the “Best Investment Bank in Mexico” (as mentioned in the section on Mexico).

By geographical areas, in Europe there has been excellent performance in the equity business and increased activity in the global public finance segment (up 73% year-on-year) thanks mainly to the increasingly sound customer franchises built in France and Great Britain.

In Spain, BBVA is once again at the top of the Spanish Stock Market ranking, with a market share of more than 18%, and is the leader in debt capital markets, with a market share of 14% in total issues and 24% in public sector issues. Structured Products has also ranked it as the “Best Financial Institution in Spain for Structured Products”. Gross income has risen 14.1% in Spain over the last twelve months to €425m. In the rest of Europe the volume of revenue (gross income) was €180m, equivalent to a year-on-year growth of 25.2% at constant exchange rates.

CIB. Market shares evolution in Spanish equities brokerage

(Percentage)

|

|

|---|

In Asia, the level of activity with corporates was outstanding (up 12% year-on-year) and income from lending was up 14%, which has generated cumulative gross income through December 2013 of €27m (€3m in 2012).

In Mexico, Global Markets has consolidated its leadership in the country and has reported positive performance in customer revenue, thanks to the synergies with the networks. By product, equity brokerage revenue has been outstanding (up 75% year-on-year). Thus, Mexico closed the year with gross income of €300m and year-on-year growth of 18.4% at constant exchange rates.

In South America, Global Markets continues to develop its local capabilities to make the most of the region’s growth and increased activity. This effort has been reflected in a significant year-on-year increase in gross income to €374m, up 53.3% on the figure for 2012 at constant exchange rates. The strong performance in foreign-exchange revenue (up 67% year-on-year) and the growing penetration in the institutional customers (up 10%) and corporates (up 9%) segments are particularly noteworthy.

Lastly, in the United States there has been a significant increase in the contribution from the institutional customers segment (up 42% year-on-year in revenue). Gross income in the geographical area was €82m (a year-on-year decline of 11.1%).

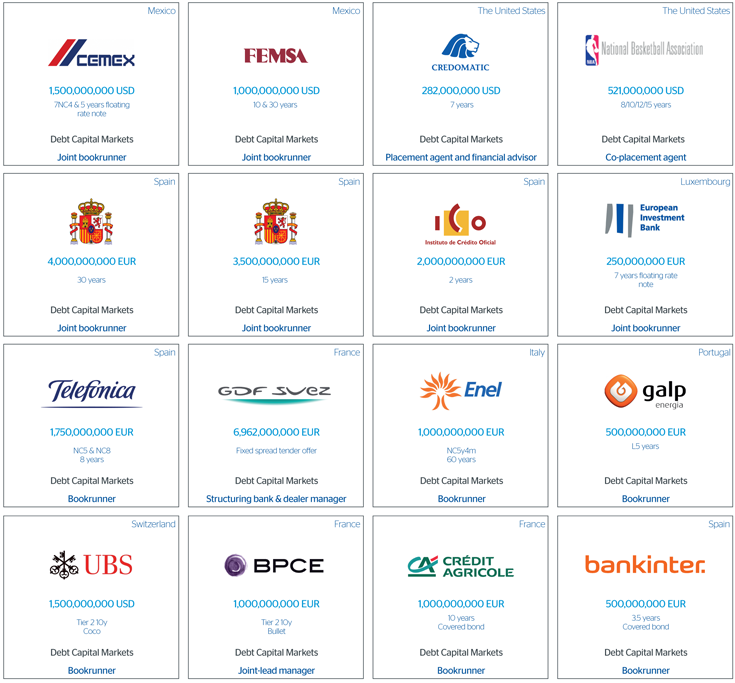

Main Deb Capital Markets transactions in 2013