The standout performance of BBVA continued in 2013 thanks to its approach to banking

Despite the difficult environment in some markets in 2013, the standout performance of BBVA Group has continued thanks to its approach to banking, which is based on four pillars, with very clear mandates.

BBVA, a banking model based on 4 pillars

Portfolio model

BBVA, a balanced and diversified portfolio model based on solid franchises

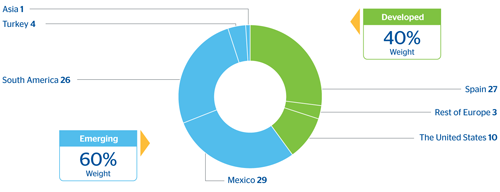

Diversification is essential for ensuring resilience in any environment. The BBVA’s model offers a highly balanced mix in terms of geographical areas, businesses and segments. This diversification has enabled it to maintain a high level of recurrent income, despite the environment and the economic cycle. In 2013, 60% of the Group’s gross income was originated in emerging countries.

BBVA Group. Gross income breakdown by geographical areas (1)

(Percentage)

The Group is made up of sound franchises, with a sufficiently large customer base, leadership positions in all markets (Spain, Mexico, South America and the Sunbelt region in the United States) and major stakes and strategic alliances in Turkey and in China, in addition to two global franchises: Retail Banking (retail business) and CIB (wholesale business).

BBVA actively manages its portfolio with the aim of maximizing shareholder value

BBVA is continuously analyzing the market in search of attractive and profitable investment opportunities as part of its policy of active portfolio management, in order to generate maximum shareholder value. The Bank has a clearly defined plan for analyzing such opportunities and carrying out transactions based on certain requirements and with minimum criteria in terms of return, size and stability, among the main ones.

The implementation of this mid and long-term strategy carried out BBVA to realize several transactions. The Group completed the sale of its pensions business in Latin America, which it announced in 2012. The last transaction was closed in October with the sale of the entire stake in the Chilean company Administradora de Fondos de Pensiones Provida S.A. to MetLife Inc. subsidiaries. Furthermore, BBVA sold its subsidiary in Panama to Leasing Bogotá S.A., a subsidiary of Grupo Aval Acciones y Valores S.A. And in October 2013, the Group signed a new agreement with CITIC Group which includes the sale of 5.1% of the stake in China Citic Bank Corporation Limited (CNCB) to its partner, CITIC Group. After this sale, BBVA remains a major shareholder in CNCB with a 9.9% stake. This transaction enables the Group to anticipate future regulatory requirements, improving its fully-loaded BIS III core capital ratio by 71 basis points.

BBVA is very clear about its strategic roadmap for the future: to make the most of its businesses, customers and footprint. Diversification will continue to be the catalyst that fuels the Group’s income, taking advantage of growth in emerging markets and gaining market share in developed regions. The goal is to continue to build a well-balanced business portfolio, with growth potential, consistent with the size, growth and risk/return targets set and taking into account that resources are limited.

Business model

BBVA’s customer-centric approach ensures recurrence in earnings and stability in funding

BBVA’s business model is focused on the customer, not only in the retail world, but also in wholesale banking, i.e. it is based on stable and lasting relationships with the Group’s approximately 50 million customers across the world. This ensures a high level of recurrence in earnings and very stable funding in the form of customer deposits.

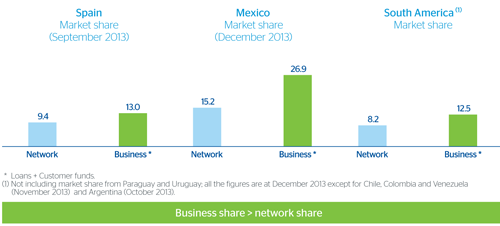

The Group also has a high-capillarity distribution network which is also the market leader in terms of efficiency. Indeed, once again this year BBVA’s share of business has been greater than its network share in its main franchises.

Business and network shares in the main BBVA franchises

(Percentage)

To achieve good efficiency levels, BBVA has been firmly committed to technology and innovation for several years. The Bank invests mainly in four core areas within its technological plan:

- Improving customer experience.

- Increasing commercial productivity.

- Encouraging operational efficiency.

- Reducing risk.

BBVA wants to achieve a customer-centric business model which is more innovative, more efficient and of higher quality. To this end it has implemented very significant investment plans, such as those announced for Mexico and South America this year, focused on growth, technological development and improving and expanding its distribution networks. These investments are in addition to those already made in Spain and the United States. BBVA has launched a number of initiatives in 2013, including the following:

- “BBVA Wallet”, an app that allows BBVA’s mobile banking customers in Spain to manage all his credit cards, check balances, finance purchases, create virtual cards and pay by phone, among other features, in an easy and safe way.

- “ABIL 2”, the new ATM in Spain, a state-of-the-art terminal, which can be accessed with the national identity card or introducing the username and password of bbva.es, operate with contactless cards (NFC), etc.

- Mobile banking in several Southern American countries.

- “Mobile Deposit” and “Picture Bill Pay” in the United States. These two initiatives are targeted at the SME segment. Through “Mobile Deposit”, users can make deposits simply by taking a picture of their checks with their smartphones. “Picture Bill Pay” refers to bill payment, also through taking pictures of printed bills.

- “Proyecto Ulises” in Mexico, a branch model based on self-service and multi-channel banking with differentiated customer service.

BBVA is evolving toward a more digital Organization because it wants to lead the banking of the future

Here, the Group has set itself two very ambitious goals:

- To become the most recommended bank of our customers.

- To double the on-line customer base and increase the number of mobile banking users fourfold by 2016.

BBVA has set very ambitious goals

Management model

A prudent and cross-cutting management model

BBVA has implemented a management model based on prudence, anticipation and a global outlook.

Prudence is materialized basically in structural and credit risk management, capital management and corporate operations management.

Anticipation is also crucial in terms of the need to anticipate events and to have the flexibility to easily adapt to them. This ability to anticipate has been key to the Bank’s performance over these difficult years, and will continue to be essential in an increasingly global and complex future.

Lastly, the global vision, and the underlying cross-cutting approach, involves exploiting all the potential of BBVA’s businesses, customers and current footprint.

A more global and cross-cutting organization

In 2013, the Group has continued to promote the cross-cutting management of its businesses to generate significant synergies, through:

- The Group’s wholesale businesses, Corporate & Investment Banking (CIB), with a customer-centric, diversified, efficient and low-risk model and with a strategy that will enable the Bank to offer a differential service to its customers, leading to:

- A global and specialized coverage model.

- A value offer for all customer segments.

- A comprehensive catalog of high value-added products and services and a high-level platform.

Retail businesses, through Retail Banking, responsible for identifying best practices and spreading them from one geographical area to another. It also has the aim of boosting the development of the Group’s global business lines (consumer finance, insurance, asset management and payment channels). It is also in charge of designing the Bank’s omni-channel strategy, carrying out global initiatives and promoting innovation beyond the borders of conventionalism.

Principles adjusted return model

A return model adjusted to the principles of integrity, prudence and transparency

The current environment undoubtedly represents a challenge for the financial sector. The social legitimacy of financial activity has been eroded on a global scale, and this is combined with a growing demand for accountability. In addition, there is increasing regulatory pressure in the sector, particularly in customer protection. Against this backdrop, BBVA believes in a differential approach to banking. The Entity is aware that there is much room for improvement, but also that being profitable does not mean doing business at all costs. That is why principles adjusted return is important.

BBVA firmly believes that putting principles first in the Group’s governance management is a competitive advantage in itself. Principles are vital to maintaining trust and the value of the franchise, thus ensuring long-term sustainability. It is important to achieve the goals set by the Group every year. But it is even more important to do so playing by the rules, following very sound principles and putting people at the heart of the business.

For BBVA, the crucial asset in the banking business is the trust of its customers, shareholders, employees, regulators and society at large. The Bank has a very clear vision, “Working for a better future for people”. This has motivated BBVA to work hard on a strategy of responsible business, approved in 2013. This new strategy has been created to meet a challenge: to set us apart and win back society’s trust. The Responsible Business Plan establishes three strategic priorities:

- Transparent, clear and responsible communication (“TCR” communication). The crisis has undermined people’s trust in banks, complaints about misleading information have surged and tougher regulation has been introduced in the sector on customer protection and transparency. Customers perceive that we use terms which are overly technical and difficult to understand. It is not simply a question of making sure customers are told everything - they have to be told everything in a clear way. Communicating with customers in a transparent, clear and responsible language helps them make an informed decision and is a key lever for winning back and maintaining their trust. This is why BBVA is developing a policy and working on various initiatives in order to make the bank-customer relationship “more TCR” before, during and after the contract is signed.

-

Education. Education is the main strategic priority of the Group’s social programs. Within this line, three areas are distinguished:

- Financial literacy, which together with “TCR” communication is the other element that helps customers make informed decisions.

- Training for SMEs, which play an important role in the development of the country’s economic-business network.

- Education for social integration and training on values for children and young people.

- Products with a high social impact. A great social impact is already being generated through daily activity. Think about all the people who are financed with mortgages from the Bank or the growth and employment created by companies with funding from BBVA. The Group thus has a great opportunity to design products and services with a greater social impact, taking into account customers’ needs and the context in which they live.

Responsible Business Plan