BBVA Group Performance in 2013

Print this page

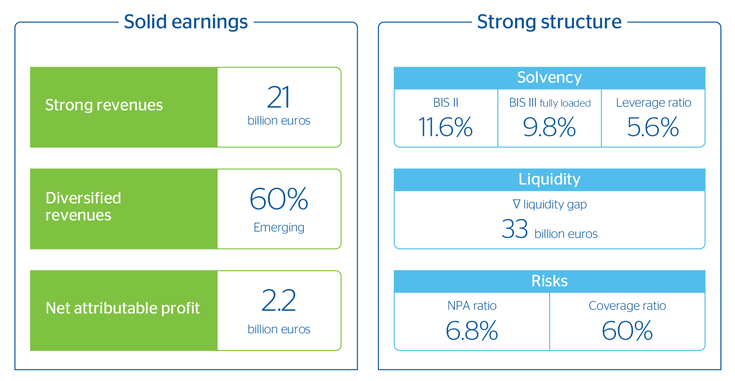

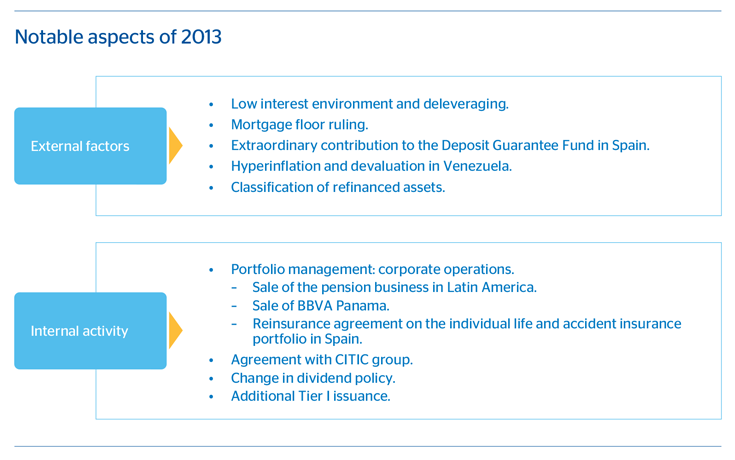

BBVA posts net attributable profit up 32.9% in a complex environment

Recurring revenues

Returning to normal levels

Suitable funding structure

A sound bank

Management and strong capital

-

-

EARNINGS

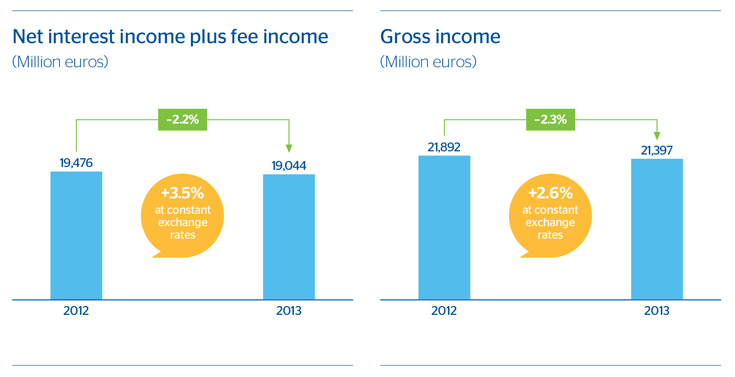

Recurring revenues…

-

EARNINGS

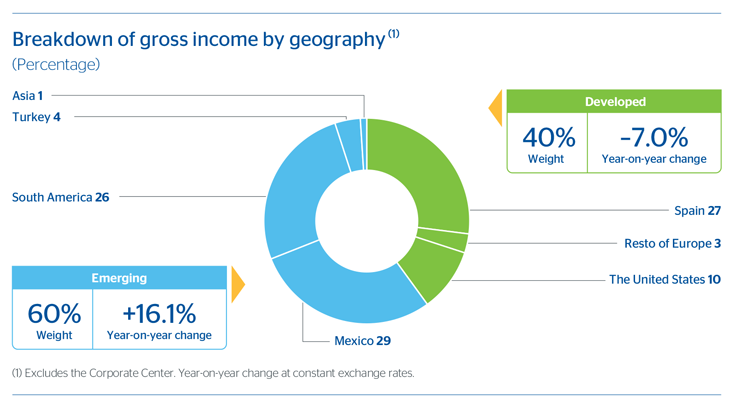

…supported by diversification

-

EARNINGS

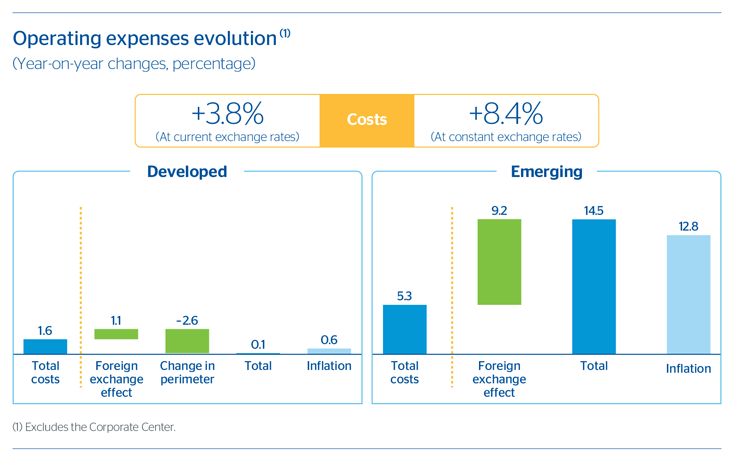

Costs management adapted to each region

-

EARNINGS

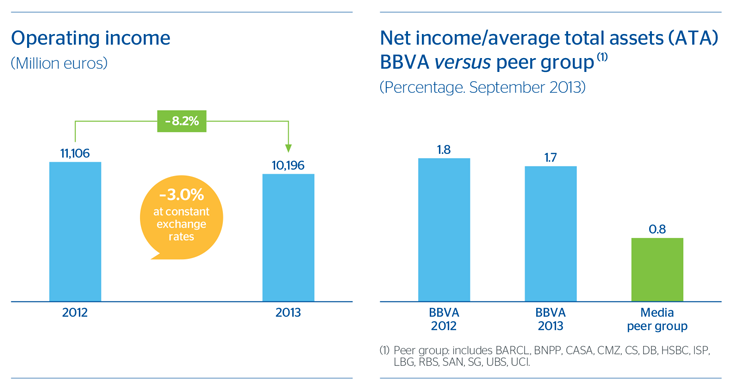

Highly resilent operating income, able to absorb provisioning which positions BBVA as a leader in profitability

-

EARNINGS

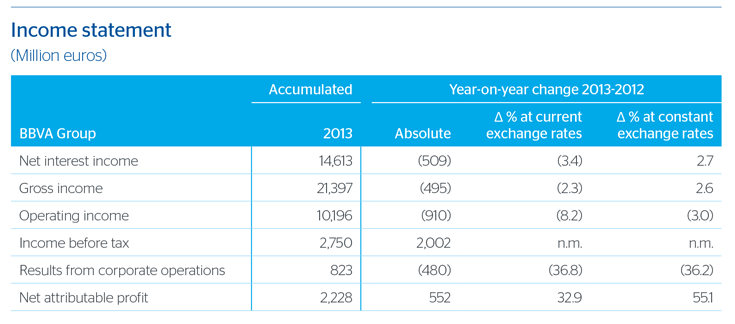

In summary, resilience in a difficult year

-

RISKS

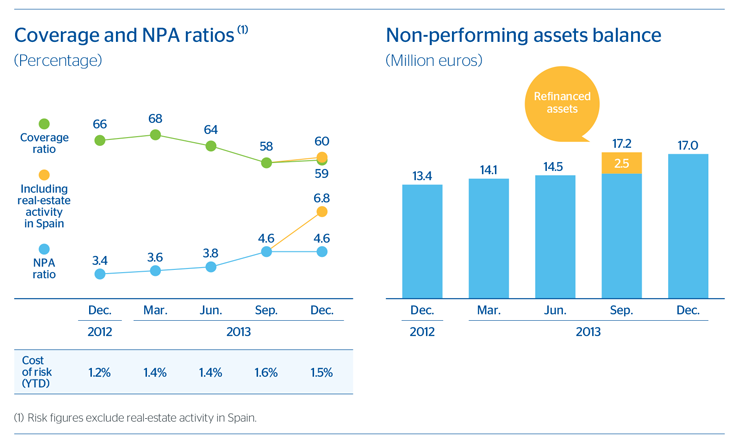

The Group's main asset quality indicators have evolved according to forecast

Cost of risk in Spain moving towards normal condition, after the impact of classifying refinanced loans

-

SOLVENCY

The Group’s capital ratios have performed well

Comfortable capital position

-

LIQUIDITY

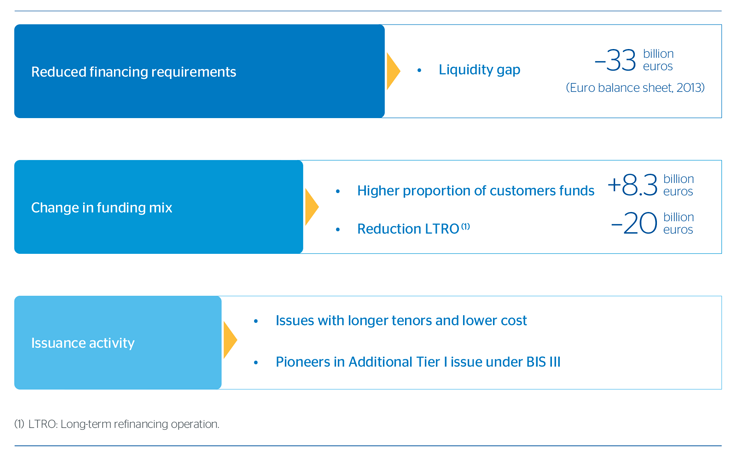

BBVA has improved his balance sheet structure in a complex environment

Solid liquidity position

-

A SOUND BANK

Once again, strong fundamentals