Earnings for the BBVA banking business in Spain in 2013 have been influenced by four exceptional factors. First, the elimination in May 9 of the so-called “floor clauses” from existing mortgage loans. Second, the temporary increase in loan-loss provisions as a result of the classification of refinanced loans in the third quarter. Third, the accounting for of the exceptional payment to the Deposit Guarantee Fund (FGD) in the fourth quarter in order to comply with Royal Decree-Law 6/2013. Lastly, the capital gains generated in the first quarter by the reinsurance operation on the individual life and accident insurance portfolio.

The area’s gross income totaled €6,095m in 2013 (down 8.5% year-on-year). At €3,830m, net interest income declined 19.3% year-on-year due to the elimination of “floor clauses”, weaker lending activity and the current environment of low interest rates, and thus narrow spreads. This has meant that earnings for the year clearly show the good price management in new lending operations and in renewals of deposits, which will lay the foundations for recovery in this margin in the coming years. Income from fees and commissions is up 2.5% during the same period to €1,376m, thanks to the positive performance of fees from fund management and wholesale banking transactions with clients. Lastly, the positive performance of the markets unit and good management of structural risks on the balance sheet against a background of low interest rates have had a positive impact on NTI generation in 2013. This strong performance has offset the decline in the “Other income and expenses” heading due to the one-off insurance operation performed in early 2013 and the exceptional payment made to the Deposit Guarantee Fund in the fourth quarter.

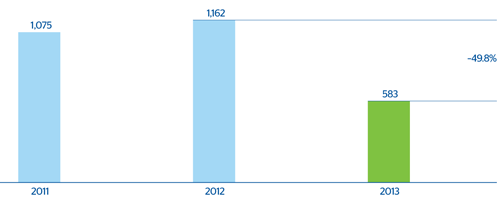

Operating expenses remain under control and show a substantial slowdown in their year-on-year rate of change. For the year as a whole, this heading amounts to €3,014m, up 4.4% on 2012, the year Unnim was incorporated (late July). As a result, operating income for the year totals €3,081m, compared to €3,778m in 2012.

Spain. Banking activity. Operating income

(Million euros)

Impairment losses on financial assets for the year total €2,577m, a rise of 39.1% year-on-year, due to the additional charge from classification of refinanced loans that reduces the future need for loan-loss provisions.

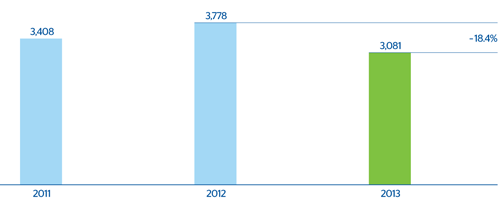

Lastly, the “Results from corporate operations” heading includes the capital gain from the reinsurance operation carried out in the first quarter of the year. Overall, banking activity in Spain generated a net attributable profit of €583m in 2013.

Spain. Banking activity. Net attributable profit

(Million euros)