Materiality and dialog with stakeholders

Communication and dialog tools

At BBVA we have a broad range of consultation and dialog tools with all our stakeholders in each country and business area in which we operate.

These tools guarantee two things: that stakeholders have the proper service channels available and BBVA has sufficient sources of information to know what their priorities and expectations are and can thus respond to their needs.

Customers and society

| Communication and dialog tools | Scope |

|---|---|

| Satisfaction and recommendation survey for customers and other qualitative and quantitative quality and satisfaction research by our Customer Solutions area | BBVA Group |

| Customer service and complaints and claims analysis committees | BBVA Group |

| Customer ombudsman | BBVA Group |

| External reputation survey of customers and the general public (RepTrak) | BBVA Group |

| Continuous tracking or monitoring of advertising and the brand | BBVA Group |

| Focus groups and workshops with customers to learn their opinions on specific issues (in addition to service quality) | BBVA Group |

|

Analysis of our presence on the social networks (Facebook, Twitter, etc.) and online media:

|

BBVA Group |

| Analysis of our presence on the media | BBVA Group |

| Direct dialog with NGOs, the media, experts and academic and research centers | BBVA Group |

| Secondary sources for trends and expectations in public opinion and civil society organizations | BBVA Group |

| Involvement in Corporate Responsibility and Reputation events and forums | BBVA Group |

| BBVA Research | BBVA Group |

| Communication and Responsible Business / Corporate Responsibility and Reputation Department. It uses most of these tools/sources, acting as a “radar” | BBVA Group |

Employees

| Communication and dialog tools | Scope |

|---|---|

| Employee Care Service | BBVA Group |

| Employee satisfaction surveys | BBVA Group |

| Internal reputation survey, RepTrak | BBVA Group |

| TÚ&BBVA magazine - Passion for People | BBVA Group |

| Employee Portal: TÚ&BBVA | BBVA Group |

| Genera Portal | BBVA Group |

| Interviews setting objectives, competencies and feedback | BBVA Group |

| Talent & Culture managers | BBVA Group |

| Google+ communities | BBVA Group (except United States) |

| Digital magazine | Spain |

| Apúntate | BBVA Group |

| Department of Labor Relations and liaison with workers' representatives | Spain |

| Works Committees | Spain |

| Equality Committee | Spain |

| Health and Safety Committee | Spain |

| Apartments Committee | Spain |

| Pension Fund Control Committee | Spain |

| Technical Pension Fund Committee | Spain |

| European Works Committee | Spain |

| Results presentation meeting | BBVA Group |

Shareholders and investors

| Communication and dialog tools | Scope |

|---|---|

| Annual General Meeting of Shareholders | BBVA Group |

| Website (accionistaseinversores.bbva.com) | BBVA Group |

| Annual report, quarterly reports and significant events | BBVA Group |

| Constant contact with shareholders and investors (email and telephone helplines, events in branches, etc.) | BBVA Group |

| Roadshows and meetings with shareholders and investors | BBVA Group |

| Attendance at conferences for shareholders and investors | BBVA Group |

| Communication with analysts and rating agencies | BBVA Group |

| Alert services and distribution of relevant information | BBVA Group |

| Analysis of the expectations and priorities of sustainability analysts (MSCI, RobecoSAM, Sustainalytics, Vigeo, CDP, GS Sustain, Oekom, EIRIS) and investors interested in the issue | BBVA Group |

Regulators

| Communication and dialog tools | Scope |

|---|---|

| Institutional Relations: Coordinates the Bank’s participation in formal and informal forums to gain a better understanding of regulators’ concerns | BBVA Group |

| Departments involved in managing relations with regulators: General Secretary, Legal & Compliance, Global Economics Regulation & Public Affairs, Internal Audit, Global Risk Management, Group Executive Chairman's Office | BBVA Group |

|

Reports on regulatory trends:

|

BBVA Group |

Suppliers

| Communication and dialog tools | Scope |

|---|---|

| BBVA supplier mailbox | BBVA Group |

| Supplier satisfaction survey | BBVA Group |

| Global supplier helpdesk | BBVA Group |

Materiality analysis

This year, the process of defining material issues has been bottom-up: in other words, each of the countries has carried out its materiality exercise taking into account the local reality. All the exercises have then been consolidated to give a global vision of the Group. This methodology has been prepared following the recommendations on disclosure in the GRI G4 sustainability reporting guidelines.

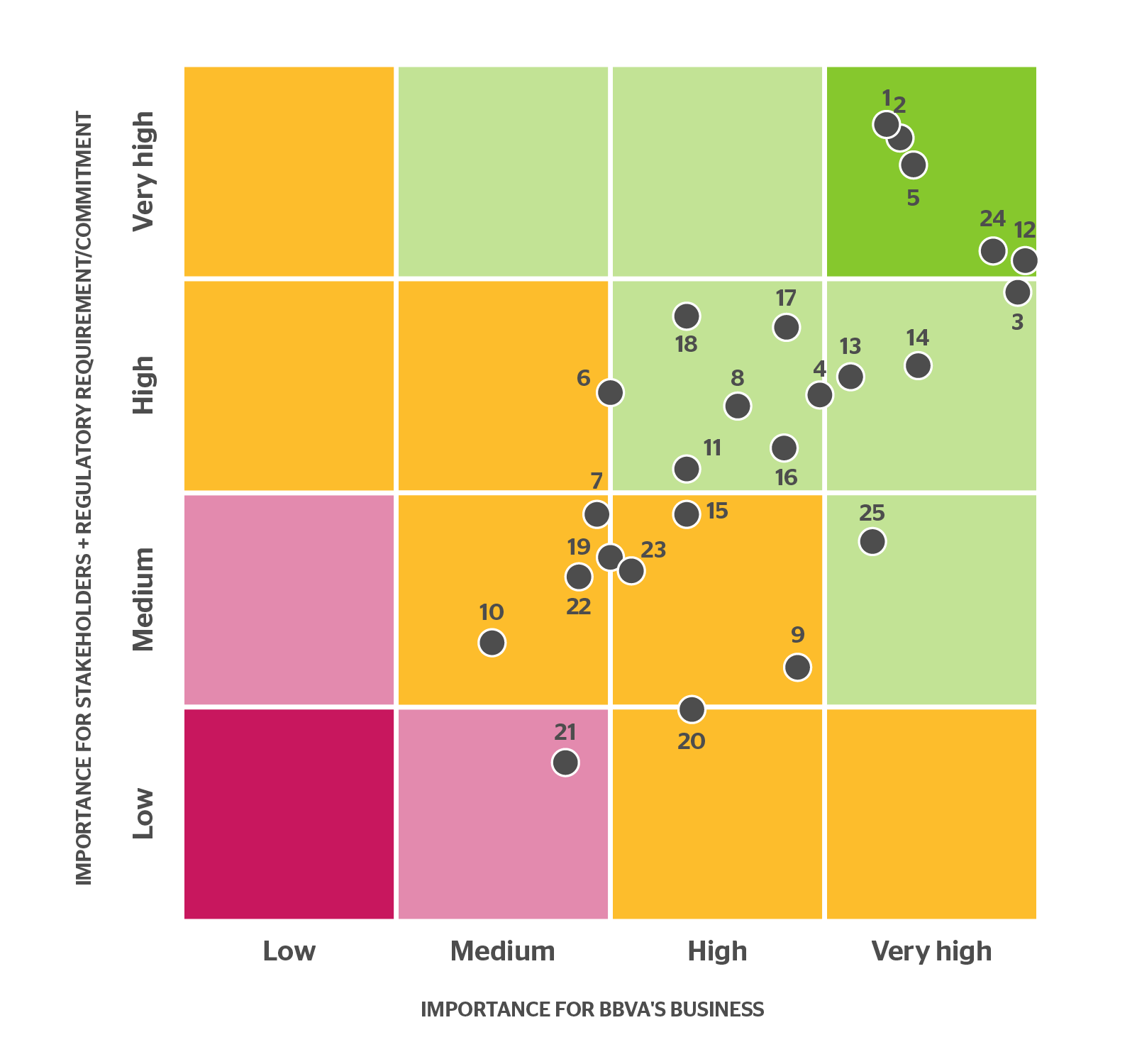

The final result of the process is a materiality matrix in which each of the relevant issues identified is classified according to two variables: importance for stakeholders and importance for the BBVA business.

1. Process of defining material issues

a) Identification of material issues:

To draw up the final list of material issues, we have used those issues that have been defined as reputational risks for BBVA and identified other material issues that do not represent a risk.

In both cases the sources used have been:

- Research and contacts that provide information on stakeholder perceptions through the consultation tools described in the above section.

- Analysis of information from expert observers (NGOs, sustainability analysts, labor unions and other civil associations) that assess company behavior.

- Regulatory trends in the sector.

- Analysis of competitors: the most relevant issues or controversial subjects that affect them and that may also affect us.

- Analysis of the media and social networks: negative news, trending topics, social concerns, etc.

b) Prioritization of material issues:

We have analyzed two aspects for prioritizing material issues: relevance for stakeholders and relevance for the BBVA business.

- Relevance for stakeholders: To measure the relevance of these issues for stakeholders, we have taken into account how important the issues are for these groups, as well as whether there are legal requirements or related commitments entered into by BBVA. Thus, an issue is more relevant:

- The greater the number of stakeholders affected and the greater the importance of these stakeholders for BBVA.

- The greater the impact of the issues for the stakeholders affected.

- When there are legal requirements or commitments by BBVA related to the issue.

- Relevance for the business: The relevance for the business involves determining the impact the issue has on BBVA's current and future business. The global Responsible Business Department identifies those responsible for managing each issue at global level and they then identify their local counterparties. These counterparties are those who have calculated the impact on the business of the issues within their area of management.

In 2015, the definition of material issues has been bottom-up and its final result has been a materiality matrix in which the relevant issues are classified according to the importance for stakeholders and the BBVA business

2. Materiality matrix

In accordance with this process, we have built a materiality matrix for each country. This has then been used to obtain a global materiality matrix for the whole Group.

The consolidation process has been carried out by taking a weighted average of the relevance for the stakeholders and for the business in all the countries. The weighting used has been the gross income in each country.

The resulting global materiality matrix is as follows:

- Products with good value for money (without abusive clauses).

- Communication and commercialization practices: foster informed decisions.

- Quality of customer care and service.

- Response to the demand for credit in society.

- Customer security, privacy and protection (including big data).

- A solution for customers in a difficult situation.

- Quality of employment (temporary, outsourcing, relocation, etc.).

- Respect for employee rights.

- Talent attraction, development and retention.

- Remuneration policy for senior management and the Board of Directors.

- Social and environmentally responsible finance.

- Prevention of money laundering and terrorist financing.

- Compliance with the tax code.

- Ethical behavior.

- Responsible procurement and outsourcing.

- Good corporate governance.

- Financial solvency and management.

- Respect for human rights.

- Contribution to the development of local communities (job creation, support for SMEs, etc.).

- Financial inclusion.

- Community involvement not linked to the business.

- Diversity and work/life balance.

- Eco-efficiency and the environment.

- Digitalization: providing customers with the benefits of digitalization.

- Financial literacy.