Results

For 2015

- Earnings influenced by the incorporation of Catalunya Banc (CX) on April 24, and since the third quarter of 2015, the purchase of an additional 14.89% stake in Garanti.

- Negative effect of the exchange rates of the main currencies against the euro.

- Overall, without considering the impact of the Garanti deal (henceforward, Turkey on an ongoing basis), 2015 closed with good performance of the more recurring revenue, an increase in operating expenses in line with that accumulated in the first nine months of 2015 and impairment losses on financial assets below those for the previous year, with a very positive impact on the Group’s cost of risk.

For the guarter

- Good performance of income from fees and commissions and net trading income.

- Dividend received from Telefónica.

- Booking of the whole contribution to the Deposit Guarantee Fund (FGD) in Spain and the National Resolution Fund, which has had a negative effect on the earnings from Banking Activity in Spain of some €291m before tax.

Balance sheet and business activity

- Figures affected by changes in the scope of consolidation, as mentioned above.

- Taking Turkey on an on-going basis, there has been continued growth in gross customer lending, with a positive performance in loan production and customer funds in all geographical areas.

- The Group’s non-performing loans have maintained the downward trend of the last few quarters.

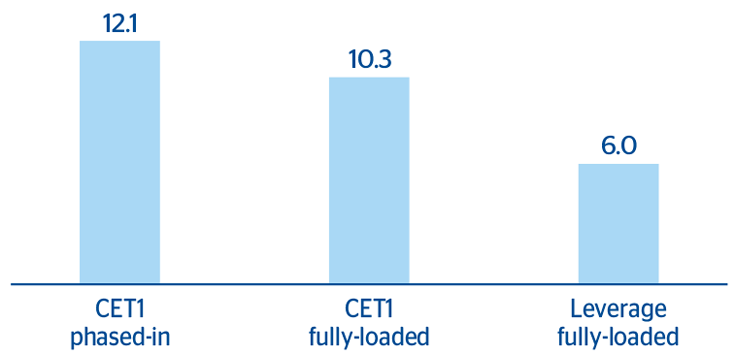

Solvency

- Comfortable capital position (phased-in CET1 ratio of 12.1% and fully-loaded ratio of 10.3% as of the close of December 2015), above regulatory requirements, and with good quality (the fully-loaded leverage ratio is 6.0% as of the same date).

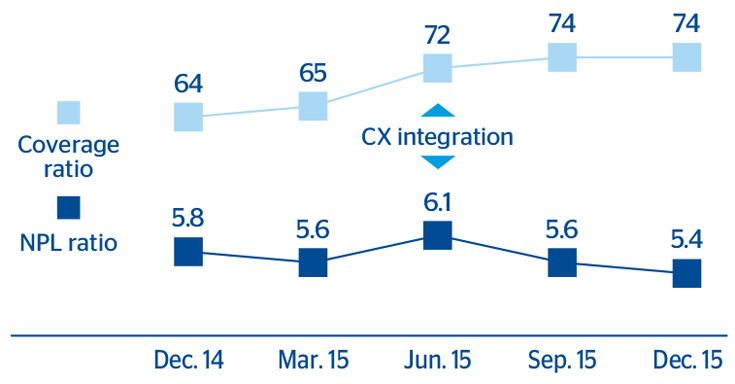

Risk management

- Favorable performance of the main asset-quality indicators: lower NPL ratio, increased coverage ratio and reduced cost of risk.

The BBVA share

- Distribution in cash on 12-Jan-2016 of an interim amount against the dividend for 2015, at a gross €0.08 for each outstanding share.

Business areas

- Reclassification from the Corporate Center to Banking Activity in Spain of some operating expenses related to Technology, as a result of the transfer of management, resources and responsibilities. As a result, BBVA has modified the 2014 and 2015 income statements for these two business areas in order to provide a basis for comparison. This reassignment of expenses also affects CIB, but it has a neutral effect on the Group’s consolidated income statement.

Other matters of interest

- BBVA continues to make progress in its digital transformation. As of 30-Nov-2015 it had 14.6 million digital customers. Of these, over 8.3 million are mobile banking customers.

- BBVA has formalized its bid for the British market with the 29.5% stake it acquired in the share capital of Atom Bank, the first exclusively mobile bank in the United Kingdom, for GBP 45m.

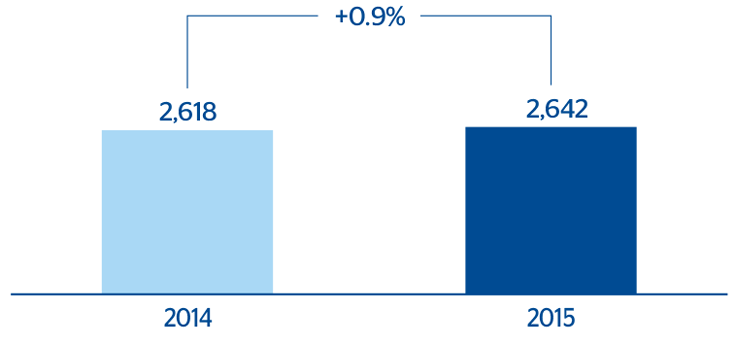

Net attributable profit

(Million euros)

Capital and leverage ratios

(Percentage as of 31-12-2015)

NPL and coverage ratios

(Percentage)

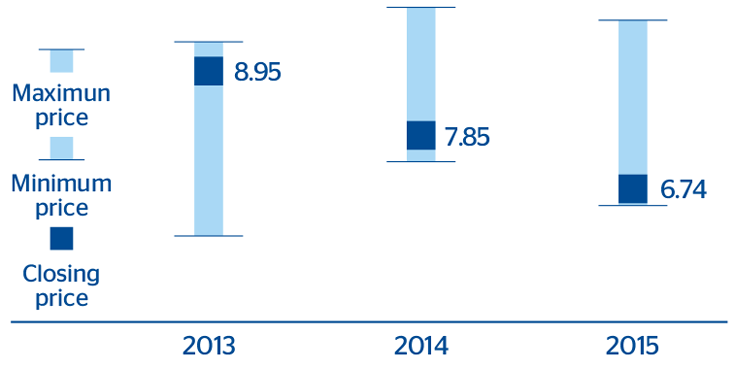

BBVA share

(Euros)

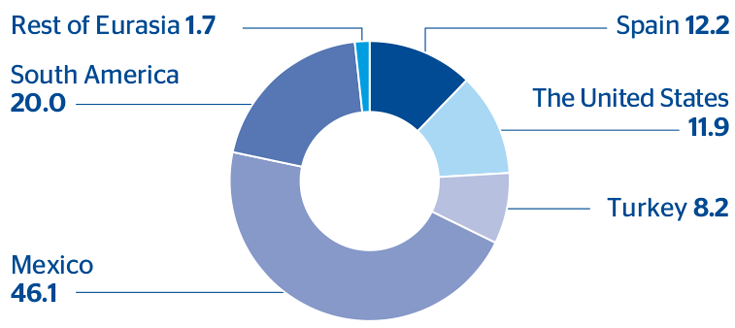

Net attributable profit breakdown (1)

(Percentage)