1. Introduction, basis for the presentation of the consolidated financial statements, internal control of financial information and other information.

1.1 Introduction

Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter “the Bank” or “BBVA") is a private-law entity subject to the laws and regulations governing banking entities operating in Spain. It carries out its activity through branches and agencies across the country and abroad.

The Bylaws and other public information are available for inspection at the Bank’s registered address (Plaza San Nicolás, 4 Bilbao) as on its web site (www.bbva.com).

In addition to the transactions it carries out directly, the Bank heads a group of subsidiaries, joint venture and associates which perform a wide range of activities and which together with the Bank constitute the Banco Bilbao Vizcaya Argentaria Group (hereinafter, “the Group” or “the BBVA Group”). In addition to its own separate financial statements, the Bank is therefore required to prepare the Group’s consolidated financial statements.

As of December 31, 2015, the BBVA Group was made up of 373 consolidated entities and 116 entities accounted for using the equity method (see Notes 3 and 16 Appendices I to V).

The consolidated financial statements of the BBVA Group for the year ended December 31, 2014 were approved by the shareholders at the Annual General Meetings (“AGM”) on March 13, 2015.

BBVA Group’s consolidated financial statements and the financial statements for the Bank and most of the remaining entities within the Group have been prepared as of December 31, 2015, and are pending approval by their respective AGMs. Notwithstanding, the Board of Directors of the Bank understands that said financial statements will be approved without changes.

1.2 Basis for the presentation of the consolidated financial statements

The BBVA Group’s consolidated financial statements are presented in accordance with the International Financial Reporting Standards endorsed by the European Union (hereinafter, “EU-IFRS”) applicable as of December 31, 2015, considering the Bank of Spain Circular 4/2004, of 22 December (and as amended thereafter), and with any other legislation governing financial reporting applicable to the Group.

The BBVA Group’s accompanying consolidated financial statements for the year ended December 31, 2015 were prepared by the Group’s Directors (through the Board of Directors held February 2, 2016) by applying the principles of consolidation, accounting policies and valuation criteria described in Note 2, so that they present fairly the Group’s consolidated equity and financial position as of December 31, 2015, together with the consolidated results of its operations and cash flows generated during the year 2015.

These consolidated financial statements were prepared on the basis of the accounting records kept by the Bank and each of the other entities in the Group. Moreover, they include the adjustments and reclassifications required to harmonize the accounting policies and valuation criteria used by the Group (see Note 2.2).

All effective accounting standards and valuation criteria with a significant effect in the consolidated financial statements were applied in their preparation.

The amounts reflected in the accompanying consolidated financial statements are presented in millions of euros, unless it is more appropriate to use smaller units. Some items that appear without a total in these consolidated financial statements do so because how the units are expressed. Also, in presenting amounts in millions of euros, the accounting balances have been rounded up or down. It is therefore possible that the totals appearing in some tables are not the exact arithmetical sum of their component figures.

The percentage changes in amounts have been calculated using figures expressed in thousands of euros.

1.3 Comparative information

The information included in the accompanying consolidated financial statements and the explanatory notes referring to December 31, 2013 and 2014 are presented exclusively for the purpose of comparison with the information for December 31, 2015.

In the year ended December 31, 2015, the BBVA Group business segments have been changed with regard to the existing structure in 2014 (See Note 6). The information related to business segments as of December 31, 2014 and 2013 has been restated for comparability purposes, as required by IFRS 8 “Business segments”.

1.4 Seasonal nature of income and expenses

The nature of the most significant operations carried out by the BBVA Group’s entities is mainly related to traditional activities carried out by financial institutions, which are not significantly affected by seasonal factors.

1.5 Responsibility for the information and for the estimates made

The information contained in the BBVA Group’s consolidated financial statements is the responsibility of the Group’s Directors.

Estimates have to be made at times when preparing these consolidated financial statements in order to calculate the recorded amount of some assets, liabilities, income, expenses and commitments. These estimates relate mainly to the following:

- Impairment on certain financial assets (see Notes 7, 12, 13 and 16).

- The assumptions used to quantify certain provisions (see Notes 22 and 23) and for the actuarial calculation of post-employment benefit liabilities and commitments (see Note 24).

- The useful life and impairment losses of tangible and intangible assets (see Notes 15, 17, 18 and 20).

- The valuation of goodwill and price allocation of business combinations (see Note 18).

- The fair value of certain unlisted financial assets and liabilities (see Notes 7, 8, 10, 11, 12, and 14).

- The recoverability of deferred tax assets (See Note 19).

- The Exchange rate and the inflation rate of Venezuela (see Notes 2.2.16 and 2.2.20).

Although these estimates were made on the basis of the best information available as of December 31, 2015 on the events analyzed, future events may make it necessary to modify them (either up or down) over the coming years. This would be done prospectively in accordance with applicable standards, recognizing the effects of changes in the estimates in the corresponding consolidated income statement.

1.6 Internal Control of the BBVA Group’s financial reporting

The financial information prepared by the BBVA Group is subject to an Internal Financial Control System (hereinafter “"IFCS"), which provides reasonable assurance with respect to its reliability and integrity of the consolidated financial information and to ensure that the transactions are processed in accordance with applicable laws and regulations.

The IFCS was developed by the BBVA Group’s management in accordance with framework established by the “Committee of Sponsoring Organizations of the Treadway Commission” (hereinafter, "COSO"). The COSO framework stipulates five components that must form the basis of the effectiveness and efficiency of systems of internal control:

- Establishment of an appropriate control framework to monitor these activities.

- Assessment of the risks that could arise during the preparation of financial information.

- Design the necessary controls to mitigate the most critical risks.

- Establishment of an appropriate system of information flows to detect and report system weaknesses or flaws.

- Monitoring of the controls to ensure they perform correctly and are effective over time.

The current framework was released by COSO in May 2013, this updated version provided a broad framework (17 principles and 84 points of focus) and clarifies the requirements for determining what constitutes effective internal control. After analyzing the current version of the mentioned framework and its compliance level at BBVA, the internal control of financial information complies with the 2013 COSO model.

The IFCS is a dynamic framework that evolves continuously over time to reflect the reality of the BBVA Group’s business and processes at any time, together with the risks affecting it and the controls designed to mitigate these risks. It is subject to continuous evaluation by the internal control units located in the BBVA Group’s different entities.

These IFCS’ units are integrated into the framework of the BBVA Group’s internal control model which is based in two pillars:

- A control system with three lines of defense:

- The first line is made up of the Group's business units, which are responsible for identifying risks associated with their processes and for executing any measures established by higher management levels.

- The second line consists of the specialized control units (Legal Compliance, Global Accounting & Information Management/Internal Financial Control, Internal Risk Control, IT Risk, Fraud & Security, and Operations Control). This line defines the models and control policies for their areas of responsibility and monitor the correct implementation, the design and effectiveness of controls

- The third line is the Internal Audit unit, which conducts an independent review of the model, verifying the compliance and effectiveness of the model.

- A committee structure called Corporate Assurance that streamlines the communication to the management and the management of internal control issues at a Group level and also in each of the geographies where the Group operates.

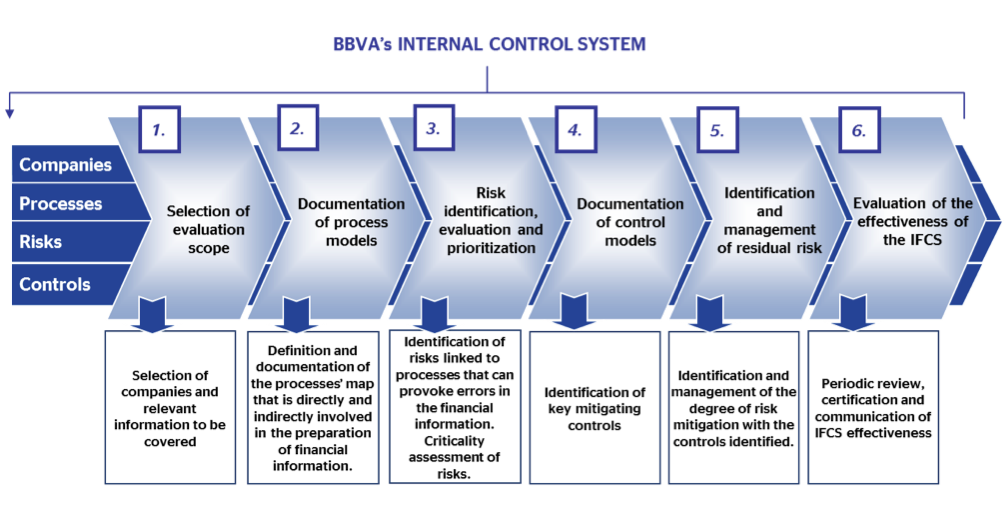

The Internal Control Units comply with a common and standard methodology established at Group level, as set out in the following diagram:

The Internal Control Units, IFCS Model is subject to annual evaluations by the Group’s Internal Audit Department and external auditors. It is also supervised by the Audit and Compliance Committee of the Bank’s Board of Directors.

The BBVA Group also complies with the requirements of the section 404 of the Sarbanes-Oxley Act (hereafter “SOX”) for consolidated financial statements as a listed company in the Securities Exchange Commission (“SEC”). The main senior executives of the Group take a part in the design, compliance and implementation of the internal control model to make it efficient and to ensure quality and accuracy of the financial information.

The description of the Internal Financial Control System for financial information is detailed in the Corporate Governance Annual Report, which is included within the Management Report attached to the consolidated financial statements for the year ended December 31, 2015.

1.7 Mortgage market policies and procedures

The information on “Mortgage market policies and procedures” (for the granting of mortgage loans and for debt issues secured by such mortgage loans) required by Bank of Spain Circular 5/2011, applying Royal Decree 716/2009, dated April 24 (which developed certain aspects of Act 2/1981, dated March 25, on the regulation of the mortgage market and other mortgage and financial market regulations), can be found in Appendix X.