Capital base

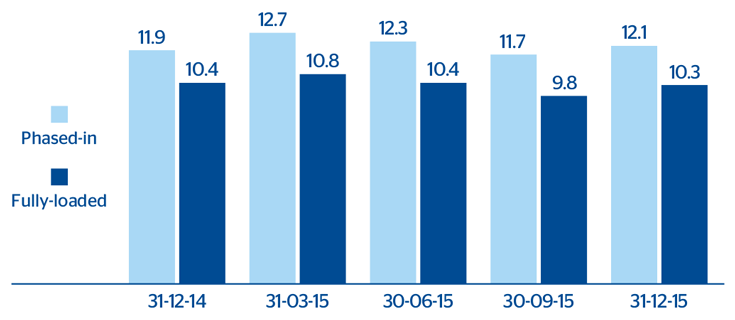

BBVA ended 2015 with a CET1 fully-loaded capital ratio of 10.3% and a leverage ratio of 6.0%, also fully-loaded. This continues to compare very favorably with the rest of its peer group. It is worth noting that the Group has waived the use of the so-called “national filter”, anticipating the proposal contained in the European Central Bank’s (ECB) draft regulation on the exercise of the options and powers available in EU law (November 2015), which is due to come into effect in March 2016. Additionally, the highlights in the period are:

- Distribution to shareholders on July 16, 2015 and January 12, 2016 of €0.08 gross per share in cash, which involved disbursements of €504.4m and €509.3m, respectively.

- The “dividend-option” programs, implemented in April and October, have had an excellent uptake (90.31% and 89.65%, respectively).

- Increase in risk-weighted assets –RWA– (up 14.5% in the year, 0.9% over the last three months).

- As a result of the above, the phased-in core capital ratio stands at 12.1%.

- BBVA Group continues to maintain a high leverage ratio: 6.3% under phased-in criteria.

The following is worth mentioning with respect to regulation:

- BBVA has published its prudential capital requirements applicable to the Entity, following the supervisory review and evaluation process (SREP), which established that BBVA maintain a phased-in core capital ratio of 9.5%, at both individual and consolidated level. In addition to this, an additional requirement has been added in 2016 at consolidated level for BBVA, as a global systemically important bank, consisting of an additional capital buffer of 0.25%. As a result, the minimum phased-in core capital required in 2016 will be 9.75%.

- This requirement as a global systemically important bank (G-SIB) will not be applicable from January 1, 2017, as the Financial Stability Board (FSB) has communicated its decision to exclude BBVA from the list of G-SIBs as of that date. However, instead of this, a 0.5% requirement covering “other systemically important banks” established by the Bank of Spain will be applicable by 2019, and implemented gradually over four years (0.25% in 2017).

Ratings

In 2015, BBVA’s rating has been positive, in line with that in 2014, as commented. The latest update has been that DBRS has upgraded BBVA’s rating (A) outlook from stable to positive.

CET1 ratio evolution

(Percentage)

Ratings

Download Excel

Download Excel

| Rating agency | Long term | Short term | Outlook |

|---|---|---|---|

| DBRS | A | R-1 (low) | Positive |

| Fitch | A– | F-2 | Stable |

| Moody’s (1) | Baa1 | P-2 | Stable |

| Scope Ratings | A | S-1 | Stable |

| Standard & Poor’s | BBB+ | A-2 | Stable |

Download Excel

Download Excel

|

|

Million euros | ||||

|---|---|---|---|---|---|

|

|

CRD IV phased-in | ||||

| Capital base | 31-12-15 | 30-09-15 | 30-06-15 | 31-03-15 | 31-12-14 |

| Common equity Tier I | 48,539 | 46,460 | 43,422 | 43,995 | 41,832 |

| Capital (Tier I) | 48,539 | 46,460 | 43,422 | 43,995 | 41,832 |

| Other eligible capital (Tier II) | 11,646 | 11,820 | 11,276 | 10,686 | 10,986 |

| Capital base | 60,185 | 58,280 | 54,698 | 54,681 | 52,818 |

| Risk-weighted assets | 401,346 | 397,936 | 352,782 | 347,096 | 350,803 |

| Total ratio (%) | 15.0 | 14.6 | 15.5 | 15.8 | 15.1 |

| CET1 (%) | 12.1 | 11.7 | 12.3 | 12.7 | 11.9 |

| Tier I (%) | 12.1 | 11.7 | 12.3 | 12.7 | 11.9 |

| Tier II (%) | 2.9 | 3.0 | 3.2 | 3.1 | 3.1 |