Credit risk

In 2015, the main variables related to the Group’s credit risk management have continued to be positive in general terms and compared to the previous year. The year-on-year changes are affected both by the incorporation of CX and by the effects resulting from the purchase of an additional 14.89% stake in Garanti.

- The positive trend in activity in the quarter explains the 1.6% increase in the Group’s credit risk from 30-Sep-2015. It has increased by 19.5% over the last twelve months. Excluding the impact of exchange rates, there has been a quarterly increase of 0.7% and a year-on-year increase of 23.6%.

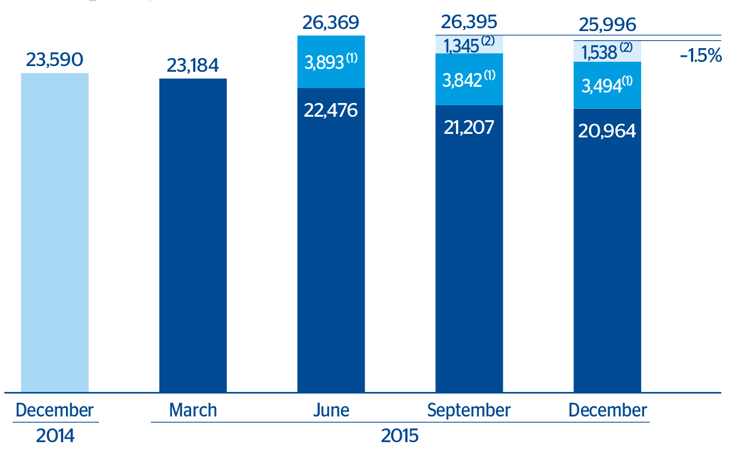

- Non-performing loans, which account for 5.4% of total credit risk, maintain their downward trend. They are down 1.5% over the quarter, strongly affected by their performance in Banking Activity in Spain (down 1.5%) and Real-estate Activity in Spain (down 7.3%). In year-on-year terms, this heading has increased by 10.2%, basically as a result of the incorporation of the balances from CX (excluding this effect, there has been a 4.6% decrease).

Non-performing loans

(Million euros)

Download Excel

Download Excel

|

|

Million euros | ||||

|---|---|---|---|---|---|

| Credit risks (1) | 31-12-15 | 30-09-15 | 30-06-15 | 31-03-15 | 31-12-14 |

| Non-performing loans and contingent liabilities | 25,996 | 26,395 | 26,369 | 23,184 | 23,590 |

| Credit risks | 482,518 | 474,693 | 430,870 | 413,687 | 403,633 |

| Provisions | 19,405 | 19,473 | 18,909 | 15,002 | 15,157 |

| NPL ratio (%) | 5.4 | 5.6 | 6.1 | 5.6 | 5.8 |

| NPL coverage ratio (%) | 74 | 74 | 72 | 65 | 64 |

| NPL ratio (%) (excluding Catalunya Banc) | 4.9 | 5.0 | 5.5 | - | - |

| NPL coverage ratio (%) (excluding Catalunya Banc) | 69 | 68 | 65 | - | - |

Download Excel

Download Excel

|

|

Million euros | ||||

|---|---|---|---|---|---|

| Non-performing loans evolution | 4Q15 | 3Q15 | 2Q15 | 1Q15 | 4Q14 |

| Beginning balance | 26,395 | 26,369 | 23,184 | 23,590 | 24,405 |

| Entries | 2,944 | 1,947 | 2,223 | 2,359 | 2,363 |

| Recoveries | (2,016) | (1,549) | (1,643) | (1,751) | (1,935) |

| Net variation | 928 | 398 | 580 | 608 | 427 |

| Write-offs | (1,263) | (1,483) | (1,105) | (1,152) | (1,248) |

| Exchange rate differences and other (1) | (63) | 1,111 | 3,709 | 138 | 5 |

| Period-end balance | 25,996 | 26,395 | 26,369 | 23,184 | 23,590 |

| Memorandum item: | |||||

| Non-performing loans | 25,333 | 25,747 | 25,766 | 22,787 | 23,164 |

| Non-performing contingent liabilities | 664 | 647 | 602 | 398 | 426 |

- Loan-loss provisions remain at levels similar to those registered at the close of the third quarter (down 0.3%). Compared to the amount registered at the end of 2014, there has been a 28.0% increase, due partly to the aforementioned CX operation.

- Consequently, further improvement in the Group’s NPL ratio which closed at 5.4% and continues to decline with respect to the close of the previous quarter. Stability in the coverage ratio, at 74%. In the year-on-year comparison, the incorporation of CX has increased the NPL ratio, but also the coverage ratio.

- Lastly, there is a positive trend in the cost of risk compared to the cumulative figures to September 2015 and December 2014.

Structural risks

Liquidity and funding

Management of liquidity and funding aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of finance.

A core principle in BBVA’s management of the Group’s liquidity and funding is the financial independence of its banking subsidiaries abroad. This principle prevents the propagation of a liquidity crisis among the Group’s different areas and ensures that the cost of liquidity is correctly reflected in price formation.

During 2015 the liquidity and funding conditions have remained comfortable across BBVA’s global footprint. Specifically, in the latter part of the year:

- BBVA S.A. has had recourse to the long-term wholesale funding markets, with two successful operations that have attracted the attention of the most important investors: senior debt in the United States market for US$ 1,000m at 5 years; and a mortgage-covered bond in the euro market for €1,250m with a maturity of 5.5 years.

- The long-term wholesale funding markets have remained stable in the other geographical areas where the Group operates.

- Short-term funding has also continued to perform extremely well, in a context marked by a high level of liquidity. • In general, the financial soundness of the Group’s banks is based on the funding of lending activity, basically through the use of customer funds.

- With respect to the new regulatory LCR ratios, BBVA has levels that are clearly higher than demanded by regulations, both at Group level and in all its banking subsidiaries.

Foreign exchange

Foreign-exchange risk management of BBVA’s long-term investments, basically stemming from its franchises abroad, aims to preserve the Group’s capital adequacy ratios and ensure the stability of its income statement.

2015 was characterized by some volatility of the currencies of emerging economies, affected by weak global growth and the fall in oil prices, which was reversed to some extent in the fourth quarter. In this context, BBVA has maintained a policy of actively hedging its investments in Mexico, Chile, Colombia, Turkey and the dollar area. In addition to these hedges done at corporate level, dollar positions are held at local level by some of the subsidiary banks. The currency risk of the earnings expected from abroad for the last 12 months has also been managed.

Interest rates

The aim of managing interest-rate risk is to maintain sustained growth of net interest income in the short and medium term, irrespective of interest-rate fluctuations.

During 2015, the results of this management have been satisfactory, with limited risk strategies in all the Group’s banks. The amount of NTI generated in Europe, the United States and Mexico is the result of prudent portfolio management strategies, particularly in terms of sovereign debt, in a context marked by low interest rates.

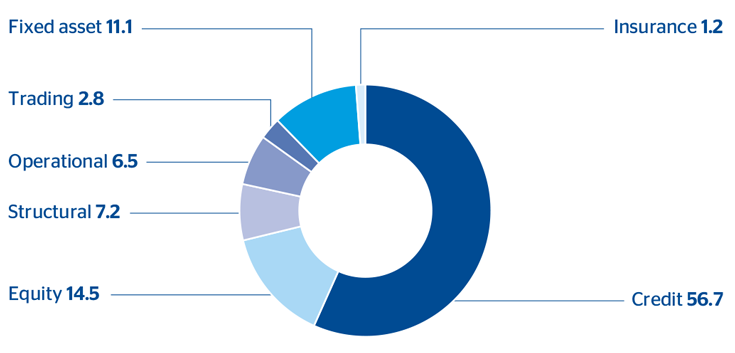

Economic capital

Attributable economic risk capital (ERC) consumption at the end of December stood at €32,278m. Over the last twelve months, the decline in equity ERC is the result of the reduction in the stake in CNCB. The integration of CX (which mainly affects credit and fixed-asset risk) and the effect of the Garanti deal have resulted in an increase in ERC, which nevertheless has been partly offset by the depreciation against the euro of the main currencies of emerging markets in 2015. The year-on-year rate of change in ERC is therefore +5.7%.

Attributable economic risk capital breakdown

(Percentage as of December 2015)