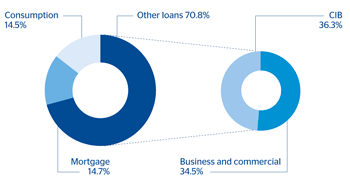

At the close of September 2013, performing loans in the area amounted to €28,956m, a year-on-year decline of 8.4% and a quarterly fall of 1.4%. This decline is significantly affected by the depreciation of the Turkish lira. Excluding this effect, the year-on-year decline is 3.3%. The quarter on quarter increase of 2.0% is affected by the behavior of balances of the wholesale banking business (down 17.4% on September 2012, but up 3.2% compared with the close of June 2013). The aforementioned depreciation of the Turkish lira against the euro masks the positive performance of lending activity in Garanti in local currency. In fact, growth in lending in liras in Garanti remains robust (up 23.2% on the close of 2012 and 5.1% on the figure for the close of the first half of 2013), particularly in the retail segment, and it continues to outperform the industry as a whole (up 22.1% compared with the close of 2012). There has also been an improvement in the foreign-currency portfolio, which is mainly geared to project finance deals (up 7.8% since 31-Dec-2012 and up 2.2% on the figure as of 30-Jun-2013).

Asset quality in the area remains stable compared with the data for previous quarters, closing September with an NPA ratio of 2.9% (the same as the one reported as of 30-Jun-2013) and a coverage ratio of 91% (88% at the close of the first half of 2013). Garanti’s NPA ratio has not changed significantly, and it stands at 2.0% at the end of the first nine months of 2013.

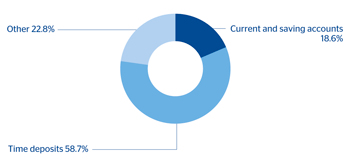

Customer deposits under management amounted to €17,257m as of 30-Sep-2013, registering a slight decline of barely 1.0% on the figure for the same date in 2012, but a rise of 4.5% compared with the figure at the close of the first half of 2013. At constant exchange rate this heading increases 8.3% year-on-year and 9.7% quarter-on-quarter. There has been a significant recovery in the balances from the wholesale segment, and positive performance by the retail business. Thus in Garanti, lira deposits increased by 4.6% on the figure for June 2013, a higher rate of growth than the industry as a whole (up 3.2%); and by 25.0% since the close of 2012 (up 11.0% in the industry). As a result, the bank has gained 120 basis points in market share since the close of 2012.

From the point of view of solvency, Garanti continues to have solid capital levels (bank-only CAR at 15.4% as of September 30), despite the aforementioned impact of the lira depreciation.

Eurasia. Performing loans breakdown(September 2013) |

Eurasia. Deposits from customers breakdown(September 2013) |

|---|---|

|

|

Eurasia. Lending breakdown by geography(30-09-2013) |

Eurasia. On-balance sheet customer funds breakdown by geography(30-09-2013) |

|---|---|

|

|