The highlights of the balance sheet and business activity of the BBVA Group at the end of the third quarter of 2013 were as follows:

- Widespread depreciation in exchange rates against the euro during the quarter, which has a negative impact on the Group’s balance sheet and business activity.

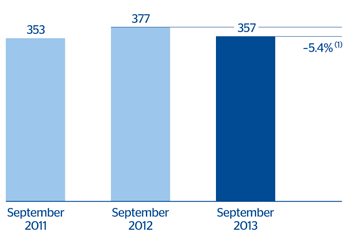

- Fall in gross lending to customers during both the quarter (–2.1%) and in the last 12 months (–5.4%), strongly determined by the deleveraging process being carried out by business in Spain, and largely overshadowing the more positive tone seen in the rest of the Group’s franchises.

- Quarterly increase in non-performing loans, focused on Spain and strongly relating to the application of the different European supervisors’ recommendations regarding the classification of refinanced loans. The impact of these recommendations has been felt particularly strongly in the retail mortgage portfolio, even though, at the present date, a high percentage of that portfolio is held by customers who are up to date with their payments.

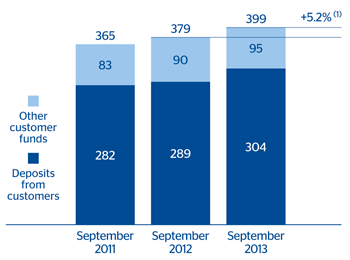

- Further increase in customer deposits in all geographical areas in which BBVA operates, particularly retail segment deposits, although the stability observed in the overall balance of wholesale customers is also beneficial. Consequently, there has been an improvement in the Group’s commercial gap and liquidity.

- It has also been a positive quarter for off-balance sheet funds (managed customer portfolios, mutual funds, investment companies and pensions) in each of BBVA’s areas.

- Stability in total equity during the quarter. The positive impact of the earnings generated (once the last dividend payment is deducted) is offset by the negative impact of exchange rates.

Consolidated balance sheet (1)

(Million euros)

|

|

30-09-13 | Δ % | 30-09-12 | 30-06-13 | 31-12-12 |

|---|---|---|---|---|---|

| Cash and balances with central banks | 27,926 | (1.0) | 28,207 | 24,926 | 37,434 |

| Financial assets held for trading | 71,409 | (14.4) | 83,449 | 72,833 | 79,954 |

| Other financial assets designated at fair value through profit or loss | 2,774 | (20.7) | 3,499 | 2,937 | 2,853 |

| Available-for-sale financial assets | 80,948 | 13.5 | 71,329 | 75,492 | 71,500 |

| Loans and receivables | 373,919 | (5.2) | 394,223 | 382,208 | 383,410 |

| Loans and advances to credit institutions | 27,845 | 4.0 | 26,777 | 27,401 | 26,522 |

| Loans and advances to customers | 341,553 | (6.1) | 363,818 | 350,071 | 352,931 |

| Other | 4,521 | 24.6 | 3,629 | 4,736 | 3,957 |

| Held-to-maturity investments | - | - | 10,118 | 9,755 | 10,162 |

| Investments in entities accounted for using the equity method | 6,920 | 3.6 | 6,681 | 6,962 | 6,795 |

| Tangible assets | 7,574 | (9.8) | 8,396 | 7,678 | 7,785 |

| Intangible assets | 8,255 | (6.7) | 8,849 | 8,612 | 8,912 |

| Other assets | 27,452 | (10.6) | 30,696 | 27,101 | 28,980 |

| Total assets | 607,177 | (5.9) | 645,447 | 618,503 | 637,785 |

| Financial liabilities held for trading | 47,826 | (18.6) | 58,740 | 50,280 | 55,927 |

| Other financial liabilities at fair value through profit or loss | 2,791 | 12.0 | 2,491 | 2,865 | 2,516 |

| Financial liabilities at amortized cost | 480,708 | (5.3) | 507,764 | 490,018 | 506,487 |

| Deposits from central banks and credit institutions | 86,262 | (23.5) | 112,738 | 80,053 | 106,511 |

| Deposits from customers | 303,656 | 5.2 | 288,709 | 312,162 | 292,716 |

| Debt certificates | 73,619 | (13.4) | 85,053 | 80,604 | 87,212 |

| Subordinated liabilities | 9,909 | (27.3) | 13,636 | 10,197 | 11,831 |

| Other financial liabilities | 7,262 | (4.8) | 7,626 | 7,003 | 8,216 |

| Liabilities under insurance contracts | 9,869 | 9.7 | 8,994 | 10,038 | 9,032 |

| Other liabilities | 18,629 | (21.4) | 23,709 | 17,913 | 20,021 |

| Total liabilities | 559,821 | (7.0) | 601,697 | 571,114 | 593,983 |

| Non-controlling interests | 2,254 | (0.3) | 2,260 | 2,205 | 2,372 |

| Valuation adjustments | (3,328) | 44.7 | (2,300) | (2,922) | (2,184) |

| Shareholders’ funds | 48,429 | 10.6 | 43,789 | 48,106 | 43,614 |

| Total equity | 47,355 | 8.2 | 43,750 | 47,388 | 43,802 |

| Total equity and liabilities | 607,177 | (5.9) | 645,447 | 618,503 | 637,785 |

| Memorandum item: |

|

|

|

|

|

| Contingent liabilities | 36,813 | (8.1) | 40,062 | 37,098 | 39,407 |

Customer lending (gross)

(Billion euros)

Customer lending

(Million euros)

|

|

30-09-13 | Δ % | 30-09-12 | 30-06-13 | 31-12-12 |

|---|---|---|---|---|---|

| Domestic sector | 176,431 | (11.2) | 198,583 | 186,513 | 190,817 |

| Public sector | 25,269 | (8.5) | 27,614 | 26,057 | 25,399 |

| Other domestic sectors | 151,161 | (11.6) | 170,969 | 160,456 | 165,417 |

| Secured loans | 95,731 | (10.6) | 107,100 | 99,123 | 105,664 |

| Other loans | 55,431 | (13.2) | 63,869 | 61,333 | 59,753 |

| Non-domestic sector | 154,446 | (2.8) | 158,966 | 156,491 | 156,312 |

| Secured loans | 61,927 | (1.9) | 63,118 | 63,229 | 61,811 |

| Other loans | 92,519 | (3.5) | 95,848 | 93,263 | 94,500 |

| Non-performing loans | 26,109 | 31.6 | 19,834 | 21,810 | 20,287 |

| Domestic sector | 21,056 | 39.1 | 15,137 | 16,645 | 15,159 |

| Non-domestic sector | 5,053 | 7.6 | 4,697 | 5,165 | 5,128 |

| Loans and advances to customers (gross) | 356,986 | (5.4) | 377,383 | 364,815 | 367,415 |

| Loan-loss provisions | (15,433) | 13.8 | (13,565) | (14,744) | (14,484) |

| Loans and advances to customers | 341,553 | (6.1) | 363,818 | 350,071 | 352,931 |

Customer funds

(Billion euros)

Customer funds

(Million euros)

|

|

30-09-13 | Δ % | 30-09-12 | 30-06-13 | 31-12-12 |

|---|---|---|---|---|---|

| Deposits from customers | 303,656 | 5.2 | 288,709 | 312,162 | 292,716 |

| Domestic sector | 150,622 | 5.7 | 142,561 | 156,780 | 141,169 |

| Public sector | 19,278 | (30.7) | 27,800 | 22,609 | 21,807 |

| Other domestic sectors | 131,344 | 14.5 | 114,761 | 134,171 | 119,362 |

| Current and savings accounts | 50,296 | 6.6 | 47,188 | 50,296 | 48,208 |

| Time deposits | 70,246 | 22.7 | 57,236 | 68,006 | 61,973 |

| Assets sold under repurchase agreement and other | 10,802 | 4.5 | 10,337 | 15,868 | 9,181 |

| Non-domestic sector | 153,034 | 4.7 | 146,148 | 155,382 | 151,547 |

| Current and savings accounts | 97,738 | 6.9 | 91,413 | 98,688 | 98,169 |

| Time deposits | 47,819 | (4.4) | 50,016 | 49,794 | 48,691 |

| Assets sold under repurchase agreement and other | 7,478 | 58.5 | 4,719 | 6,899 | 4,688 |

| Other customer funds | 95,109 | 5.3 | 90,287 | 95,232 | 91,774 |

| Spain | 56,340 | 11.6 | 50,492 | 53,762 | 52,179 |

| Mutual funds | 20,492 | 7.9 | 18,987 | 19,651 | 19,116 |

| Pension funds | 19,877 | 12.3 | 17,695 | 19,272 | 18,577 |

| Customer portfolios | 15,971 | 15.7 | 13,810 | 14,839 | 14,486 |

| Rest of the world | 38,769 | (2.6) | 39,796 | 41,470 | 39,596 |

| Mutual funds and investment companies | 21,021 | (6.2) | 22,417 | 22,354 | 22,255 |

| Pension funds (1) | 3,989 | 12.1 | 3,560 | 3,973 | 3,689 |

| Customer portfolios | 13,759 | (0.4) | 13,819 | 15,142 | 13,652 |

| Total customer funds | 398,765 | 5.2 | 378,997 | 407,394 | 384,491 |