The highlight in the third quarter of 2013 as regards credit risk has been the application of the different European supervisors’ recommendations on the classification of refinanced loans. It is important to note that this application entails no changes in BBVA’s management criteria, as it only involves the implementation of stricter accounting standards that will enable greater comparability with the system as a whole, once the banks have implemented these changes. The most significant aspects of the implementation of these recommendations are described below:

- €4,281m increase in the Group’s balance of non-performing loans since the end of the first half of 2013, of which €3,864m correspond to the reclassification of refinanced loans in Spain. This increase is concentrated mainly on the residential retail mortgage and the real-estate portfolios.

- The volume of loans reclassified as non-performing as a result of the application of the European regulators’ recommendations is classified as subjective non-performing loans, since they correspond to customers who are currently up to date with their payments. Thus, 48% of the balance of non-performing mortgage loans or 38% of the non-performing loans of the banking and real-estate business in Spain overall are current.

- In terms of loan-loss provisions, the application of this recommendation has resulted in an additional provisioning of €600m against impairment losses on financial assets in the quarter.

- The increase in the amount of non-performing loans, together with the reduction in lending, are the two main elements that explain the increase in the Group’s NPA ratio over the quarter, from 5.5% as of 30-Jun-2013 to 6.7% at the close of September. Similarly, 98 basis points of the NPA ratio correspond to the customers who are currently up to date with their payments mentioned above.

- The same trends in terms of credit risk metrics seen in previous quarters have been maintained in the rest of the geographical areas.

The BBVA Group has closed the third quarter with a volume of total risks with customers (including contingent liabilities) of €393,556m. This represents a 2.1% decrease compared with the figure for the end of June 2013, as a result of the decline in the portfolios in Spain and Europe and the negative impact of exchange rates. These two factors are in stark contrast with the strong activity registered in the emerging markets.

Credit risk management (1)

(Million euros)

|

|

30-09-13 | 30-06-13 | 31-03-13 | 31-12-12 | 30-09-12 |

|---|---|---|---|---|---|

| Non-performing assets | 26,508 | 22,226 | 21,808 | 20,603 | 20,114 |

| Total risks | 393,556 | 401,794 | 410,840 | 407,126 | 417,405 |

| Provisions | 15,777 | 15,093 | 15,482 | 14,804 | 13,877 |

| Specific | 12,439 | 11,084 | 10,578 | 9,752 | 8,503 |

| Generic and country-risk | 3,338 | 4,009 | 4,904 | 5,052 | 5,374 |

| NPA ratio (%) | 6.7 | 5.5 | 5.3 | 5.1 | 4.8 |

| NPA coverage ratio (%) | 60 | 68 | 71 | 72 | 69 |

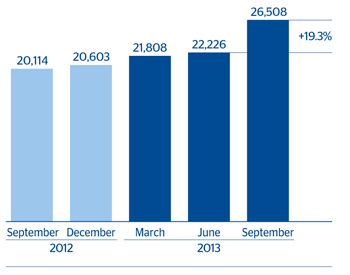

Non-performing assets ended the period at €26,508m, up 19.3% on the figure as of 30-Jun-2013. As mentioned earlier, this increase continues to be concentrated in Spain, where the NPA ratios have been particularly affected during the quarter by the application of the European supervisors’ recommendations on refinanced loans.

Non-performing assets evolution

(Million euros)

|

|

3Q13 | 2Q13 | 1Q13 | 4Q12 | 3Q12 |

|---|---|---|---|---|---|

| Beginning balance | 22,226 | 21,808 | 20,603 | 20,114 | 16,481 |

| Entries | 7,094 | 4,075 | 3,603 | 4,041 | 3,634 |

| Recoveries | (1,956) | (1,964) | (1,659) | (2,400) | (1,883) |

| Net variation | 5,138 | 2,112 | 1,944 | 1,642 | 1,751 |

| Write-offs | (817) | (1,282) | (655) | (1,172) | (1,096) |

| Exchange rate differences and other | (39) | (412) | (84) | 19 | 2,979 |

| Period-end balance | 26,508 | 22,226 | 21,808 | 20,603 | 20,114 |

| Memorandum item: |

|

|

|

|

|

| Non-performing loans | 26,109 | 21,810 | 21,448 | 20,287 | 19,834 |

| Non-performing contingent liabilities | 399 | 416 | 361 | 317 | 280 |

Non-performing assets

(Million euros)

The Group’s NPA ratio as of 30-Sep-2013 was 6.7%, 120 basis points above the figure as of June 30. It has also been greatly conditioned by the application of the European regulators’ recommendations and the decline in lending, basically in Spain. In fact, the NPA ratio of the banking business in Spain stands at 6.2%, up 152 basis points over the quarter, while that of real-estate activity is 55.3% (43.7% as of 30-Jun-2013). In the United States it has improved to 1.5%. In Eurasia, Mexico and South America, the indicator remains very stable: 2.9%, 4.1% and 2.2%, respectively, practically the same figures as at the close of the first half of 2013.

Coverage provisions for customer risk increased 4.5% over the quarter to €15,777m. The Group’s NPA coverage ratio has declined over the last three months and closed at 60% as of 30-Sep-2013. By business area, banking activity in Spain had a ratio of 41% (45% as of 30-Jun-2013) and real-estate activity posted a figure of 62% (75% at the close of June 2013). The figure in Mexico is 105% (109% as of 30-Jun-2013), in South America 137% (136% three months earlier), in Eurasia 91% (88% at the close of the first half of 2013) and in the United States 120% (118% at the end of June).

NPA and coverage ratios

(Percentage)