Between July and September 2013, the global economic setting has shown a very similar trend to that remarked in the previous quarter. On the one hand, Europe begins to emerge from the recession and reports positive growth figures. On the other, private demand is strong in the United States, but this is also combined with a certain degree of fiscal uncertainty in the long term. Lastly, emerging economies have been affected by the tightening of financial conditions at global level, given the prospects of the Federal Reserve (the Fed) starting to reverse the exceptional liquidity injection measures in the United States. However, these uncertainties have gradually faded insofar as real activity in China has proven stronger than expected, and following the Fed’s latest statements about extending its current monetary policy until there is evidence of more marked signs of recovery sustainable over time.

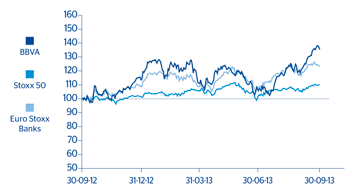

Against this backdrop, global financial markets have shown a more positive performance. The general European Stoxx 50 index registered a 6.6% quarterly gain at the close of September. The Ibex 35 and Euro Stoxx Banks registered even stronger gains of 18.3% and 24.1%, respectively, over the same period.

BBVA’s earnings for the second quarter of 2013 were favorably received by analysts, and stood out against the average earnings for the Spanish banking sector. The bank’s sound capital situation and liquidity are once again the most positively rated factors. Many analysts agree that the Group will comply with the European authorities’ and Basel III regulatory capital and liquidity requirements, which would put BBVA at the forefront of European banking in certain metrics. Furthermore, the market continues to take a positive view of BBVA’s strategy of balanced diversification between developed and emerging markets. In Spain, a major part of analysts consider BBVA to be the best bank in the sector and extremely well positioned in Spain to make the most of the opportunities afforded by the possible macroeconomic recovery and normalization of lending and asset quality.

The above factors have been reflected in the extremely positive performance of the BBVA share price during the third quarter of 2013: the share closed up 28.2% to €8.26 per share, equivalent to a market capitalization of €47,283m. This represents a price/book value ratio of 1.0, a P/E ratio of 13.7 (calculated on the median profit for 2013 estimated by the consensus of Bloomberg analysts) and a dividend yield of 5.1% (also obtained according to the median dividend per share forecast by analysts compared with the share price on September 30).

The average daily volume traded between July and September rose considerably, 31.0% more than in the previous quarter, both in terms of number of shares –to 65 million– and volume itself, up to €447m.

Lastly, in terms of shareholder remuneration, and in accordance with the Group’s dividend policy, a capital increase took place in October as part of the “dividend option” remuneration scheme. The percentage of shareholders who opted to receive newly issued BBVA shares was 88.3%, which once more confirms the popularity of the program.

The BBVA share and share performance ratios

|

|

30-09-13 | 30-06-13 |

|---|---|---|

| Number of shareholders | 980,481 | 1,019,346 |

| Number of shares issued | 5,724,326,491 | 5,724,326,491 |

| Daily average number of shares traded | 64,576,932 | 49,308,275 |

| Daily average trading (million euros) | 447 | 342 |

| Maximum price (euros) | 8.46 | 7.62 |

| Minimum price (euros) | 6.18 | 6.19 |

| Closing price (euros) | 8.26 | 6.45 |

| Book value per share (euros) | 8.27 | 8.28 |

| Market capitalization (million euros) | 47,283 | 36,893 |

| Price/book value (times) | 1.0 | 0.8 |

| PER (Price/earnings; times) | 13.7 | 9.5 |

| Yield (Dividend/price; %) | 5.1 | 6.5 |

Share price index

(30-09-12=100)