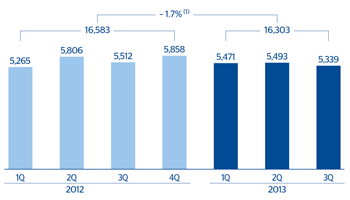

Gross income

(Million euros)

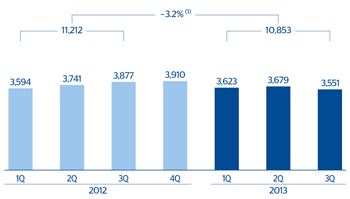

Net interest income in the third quarter totals €3,551m, slightly below the figure reported between April and June 2013. This heading was also affected by the negative effect of exchange rates, the elimination of the mortgage floors mentioned above (this quarter it had an effect on the entire period, unlike the previous one, when it was accounted for 53 days only) and, to a lesser extent, by the impact that the interest hike in Turkey had on Garanti’s customer spread. These negative elements have been offset to a great extent by the improved cost of funding (wholesale and retail), basically in the euro balance sheet, and strong activity in emerging economies. Cumulative net interest income for the first nine months of the year stands at €10,853m, down 3.2% on the figure for the same period in 2012. Excluding the exchange-rate effect, this heading grew by 1.4% over the same period.

Net interest income

(Million euros)

Breakdown of yields and costs

|

|

3Q13 | 2Q13 | 1Q13 | 4Q12 | 3Q12 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

| Cash and balances with central banks | 4.2 | 0.89 | 4.2 | 0.99 | 5.2 | 0.95 | 4.8 | 1.19 | 4.2 | 0.82 |

| Financial assets and derivatives | 27.0 | 2.74 | 27.4 | 2.78 | 26.8 | 2.77 | 26.9 | 2.89 | 26.8 | 2.85 |

| Loans and advances to credit institutions | 4.5 | 1.28 | 4.4 | 1.57 | 4.4 | 1.54 | 4.0 | 1.58 | 4.4 | 1.80 |

| Loans and advances to customers | 56.5 | 5.50 | 56.2 | 5.58 | 55.9 | 5.55 | 56.5 | 5.83 | 57.1 | 5.60 |

| Euros | 33.3 | 2.65 | 33.4 | 2.97 | 34.0 | 3.08 | 34.2 | 3.20 | 34.4 | 3.23 |

| Domestic | 27.1 | 3.09 | 27.6 | 3.41 | 28.1 | 3.47 | 28.2 | 3.71 | 28.2 | 3.78 |

| Other | 6.2 | 0.72 | 5.8 | 0.85 | 5.8 | 1.23 | 6.1 | 0.85 | 6.3 | 0.77 |

| Foreign currencies | 23.3 | 9.58 | 22.8 | 9.43 | 22.0 | 9.37 | 22.3 | 9.88 | 22.6 | 9.20 |

| Other assets | 7.8 | 0.27 | 7.8 | 0.25 | 7.7 | 0.29 | 7.8 | 0.58 | 7.5 | 0.33 |

| Total assets | 100.0 | 3.97 | 100.0 | 4.03 | 100.0 | 3.99 | 100.0 | 4.24 | 100.0 | 4.10 |

| Deposits from central banks and credit institutions | 14.3 | 1.90 | 14.1 | 2.00 | 16.0 | 1.87 | 17.0 | 2.02 | 19.6 | 1.90 |

| Deposits from customers | 49.5 | 1.64 | 48.1 | 1.70 | 46.7 | 1.70 | 45.1 | 1.89 | 43.9 | 1.82 |

| Euros | 25.9 | 1.21 | 24.6 | 1.35 | 24.0 | 1.28 | 23.3 | 1.39 | 22.4 | 1.25 |

| Domestic | 18.6 | 1.39 | 17.7 | 1.56 | 16.6 | 1.51 | 15.4 | 1.58 | 14.7 | 1.47 |

| Other | 7.2 | 0.75 | 7.0 | 0.83 | 7.3 | 0.77 | 7.9 | 1.04 | 7.6 | 0.83 |

| Foreign currencies | 23.6 | 2.11 | 23.5 | 2.06 | 22.7 | 2.13 | 21.8 | 2.41 | 21.6 | 2.41 |

| Debt certificates and subordinated liabilities | 15.4 | 2.83 | 16.2 | 2.77 | 16.5 | 2.73 | 16.8 | 2.69 | 15.8 | 2.69 |

| Other liabilities | 13.0 | 1.04 | 14.0 | 0.88 | 13.7 | 1.06 | 14.1 | 1.14 | 13.8 | 0.89 |

| Equity | 7.8 | - | 7.6 | - | 7.2 | - | 7.0 | - | 6.8 | - |

| Total liabilities and equity | 100.0 | 1.66 | 100.0 | 1.67 | 100.0 | 1.69 | 100.0 | 1.81 | 100.0 | 1.72 |

| Net interest income/Average total assets (ATA) |

|

2.31 |

|

2.36 |

|

2.30 |

|

2.43 |

|

2.38 |

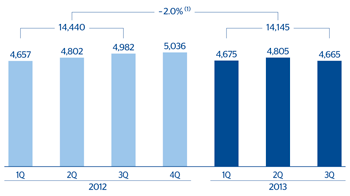

Quarterly income from fees and commissions, at €1,114m, is similar to the figure posted between April and June 2013, and slightly higher than the figure for the third quarter of 2012. This positive performance was achieved despite reduced seasonal activity in several geographical regions, including Turkey during Ramadan. Cumulative income from fees and commissions as of September totals €3,292m, up 2.0% on the same period in 2012.

Net interest income plus fees and commissions

(Million euros)

NTI totaled €569m over the quarter, below the high figures posted in the first and second quarters of the year, which included significant capital gains from the rotation of portfolios. The Global Markets unit and management of structural risks on the balance sheet once again performed well (especially in Europe). Cumulative NTI to September stands at €1,918m, a figure significantly higher than the €1,121m reported in the same period of 2012 (up 71.2% year-on-year).

Dividends amounted to €56m in the quarter and €122m for the nine months through September, significantly lower than the €373m posted in the first nine months of 2012, due basically to the temporary suspension of the payment of dividends by the Telefónica group.

Income by the equity method, which basically includes the contribution from the stake in CNCB, stands at €162m in the quarter, which represents a cumulative volume through September of €376m. According to current accounting standards, the recent agreement to sell 5.1% of this stake will involve a change in the accounting criterion applicable to the stake, which will be considered a non-significant financial investment available for sale. This change in the accounting criterion will be included in the fourth quarter results.

Lastly, the other operating income and expenses heading amounted to a negative €113m between July and September (a negative €153m in the second quarter of the year) due to a great extent to a less negative adjustment for hyperinflation in Venezuela. The insurance business continues to grow in the different geographical regions where the Group operates. In the nine months through September, this heading stands at a negative €259m.

Overall, gross income in the third quarter of 2013 totals €5,339m, in line with previous quarters, despite the negative impacts mentioned before. The figure for the first nine months of 2013 stands at €16,303m, which represents a year-on-year decline of 1.7%, but a 1.9% increase excluding the exchange-rate effect.