There are two very different realities for the Group within the real-estate sector. On the one hand, net exposure to the developer segment (lending to developers plus the foreclosed assets resulting from this lending) has been falling every quarter, and will continue to decline in the future. On the other, there are retail foreclosures, i.e. those from private mortgage loans, whose increase is linked to the gross additions to NPA in 2008 and 2009. Although they are expected to continue to rise in the short term, the volume of additions has fallen in the last quarter, partly due to seasonal factors, thus reversing the rising trend seen in this heading in the first half of the year. However, despite the seasonality, sales in the third quarter were at similar levels as in previous quarters.

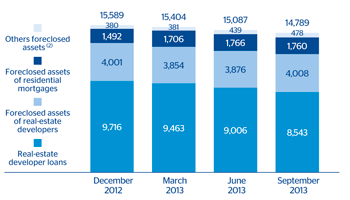

Overall, BBVA’s net exposure to the real-estate sector in Spain is still declining. As of 30-Sep-2013, the balance stands at €14,789m, down 2.0% on the close of the previous quarter and 5.1% lower on the figure at the end of 2012. There has been an increase in the balance of non-performing developer loans during the quarter, basically due to the application of the recommendations issued by the European regulators on the classification of refinanced loans. Following this new classification, 34% of the area’s non-performing loans correspond to subjective NPLs and are currently up to date with their payments.

Coverage of total real-estate exposure closed the quarter at 45% (44% at the close of June 2013).

Within the exposure to the Spanish real-estate sector, property securing mortgage loans to individuals is at a very similar level to the close of the first half of 2013.

Sales of owned real-estate assets in the third quarter of 2013 amounted to 3,130 units, a cumulative total through September of 9,747 units. In the third quarter of 2012 a total of 1,529 units were sold, giving a cumulative total in the first nine months of the year of 4,447 units.

Spain. Real-estate. Net exposure to real-estate (1)

(Million euros)

Coverage of real estate exposure in Spain

(Million of euros as of 30-09-13)

|

|

Risk amount | Provision | % Coverage over risk |

|---|---|---|---|

| NPL + Substandard | 9,519 | 4,772 | 50 |

| NPL | 8,821 | 4,547 | 52 |

| Substandard | 698 | 225 | 32 |

| Foreclosed real estate and other assets | 12,829 | 6,583 | 51 |

| From real estate developers | 9,006 | 4,998 | 55 |

| From dwellings | 2,957 | 1,197 | 40 |

| Other | 866 | 388 | 45 |

| Subtotal | 22,348 | 11,355 | 51 |

| Performing | 4,455 | 659 | 15 |

| With collateral | 3,967 |

|

|

| Finished properties | 2,649 |

|

|

| Construction in progress | 596 |

|

|

| Land | 722 |

|

|

| Without collateral and other | 488 |

|

|

| Real estate exposure | 26,803 | 12,014 | 45 |