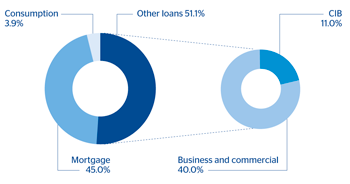

BBVA’s banking activity in Spain continues to be affected by the deleveraging process underway in the economy. The area’s balance of performing loans as of 30-Sep-2013 stood at €173,837m, down 4.8% over the quarter and 9.7% compared with the figure at the close of September 2012.

As we have just mentioned, the quality of the area’s loan portfolio has been affected by the application of the new recommendations on refinanced loans, which has resulted in an increase of €2,778m (up 28.5%) in the balance of non-performing loans over the quarter, although the main part of this increase, 88% (i.e. €2,453m), corresponds to refinanced loans reclassified as subjective risk and which are currently up to date on payments. Together with the reduction in lending, this has a clear impact on the area’s NPA ratio, which as of 30-Sep-2013 stands at 6.2%. The coverage ratio has fallen slightly to 41% (45% at the close of the first half of 2013).

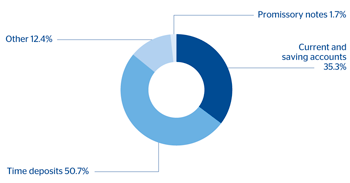

BBVA has a volume of €184,092m in customer funds in Spain, including customer deposits, promissory notes, mutual funds and pension funds. This heading has grown 12.4% year-on-year and 0.4% in quarterly terms.

Customer deposits under management amounted to €143,723m at the close of September, up 13.1% on the same date last year, despite the high volume of maturities registered throughout this last quarter. Once more, time deposits performed very well, with year-on-year growth of 25.3% (2.6% over the last three months).

These changes in lending and on-balance sheet customer funds have reduced the loan-to-deposits ratio (1) in the domestic sector to 127% as of 30-Sep-2013. Including mortgage-covered bonds, the ratio stands at 99%.

(1) The ratio excludes securitizations and repos and includes promissory notes placed in the retail network.

Spain. Banking activity. Performing loans breakdown(September 2013) |

Spain. Banking activity. Deposits from customers(September 2013) |

|---|---|

|

|

Off-balance sheet funds continued the positive trend of previous quarters, with increases in both mutual funds (up 4.3% since the end of June 2013) and pension funds (up 3.1% over the last three months). As a result, BBVA has retained its privileged position in asset management, with market shares of 14.4% in mutual funds and 19.9% in pensions, according to the latest available figures from Inverco (August and June, respectively).