The key elements of the income statement for the first nine months of the year are as follows:

- On the revenue side, net interest income amounted to €1,056m, 7.9% down on the same period in 2012. It has continued to be affected by the low interest-rate environment and very flat curves, which have detracted from the positive impact of significant volumes of activity. Income from fees and commissions increased slightly over the quarter to a cumulative €424m through September. This improvement over the quarter is basically due to increased volumes of business activity and a larger number of transactions within the corporate and investment banking business. NTI totaled €119m, a rise of 7.1% year-on-year, thanks to good structural interest rate risk management. Lastly, other income/expenses stood at €5m through September 2013, compared with a negative €36m twelve months earlier (–€35m at constant exchange rate). As a result, cumulative gross income amounted to €1,603m, 3.1% down on the figure for the first nine months of 2012.

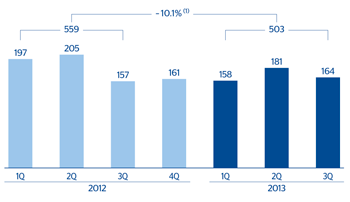

- Expenses continue to be held in check at very similar levels to the same period last year: €1,100m, a year-on-year rise of 0.4%. As a result, operating income amounted to €503m, a year-on-year decline of 10.1%.

- Lastly, impairment losses on financial assets stood at €68m through September 2013, a decline of 5.7% despite the increased volumes of lending. The cumulative risk premium through September 2013 remained at 0.24% (0.25% twelve months earlier). This positive performance is due to improved quality in the loan book in the area, as mentioned at the start of this chapter.

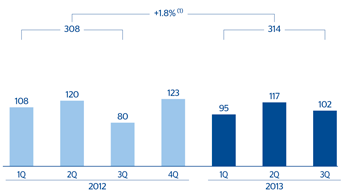

- To sum up, the United States has generated cumulative earnings of €314m, up 1.8% on the figure between January and September 2012, thanks to tight cost control and the good performance of provisions. Of this figure, 87% corresponds to BBVA Compass.

The United States. Operating income(Million euros at constant exchange rate) |

The United States. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: -12.6%. |

(1) At current exchange rate:-1.0%. |