In 2010 the Pensions and Insurance unit contributed with a net attributable profit of €191m, 28.4% more than in the previous year. There was positive progress in the pensionfund business (€126m, up 19.3%) and the insurance business (€64m, up 50.9%).

Pensions

The year was positive for the pension fund business, despite the more moderate performance of the financial markets compared with 2009. The recovery of the labor markets in the region has improved the volume of fund revenues, which has in turn boosted net fee income in the sector. This has been in an environment in which the impact of regulatory changes in some countries has been negative. At the close of the year, assets under management by all fund managers amounted to €48,800m (up 17.1%), while the funds attracted over the year were up by 16.6% on the figure for 2009. BBVA thus remains the largest pension business group in the region.

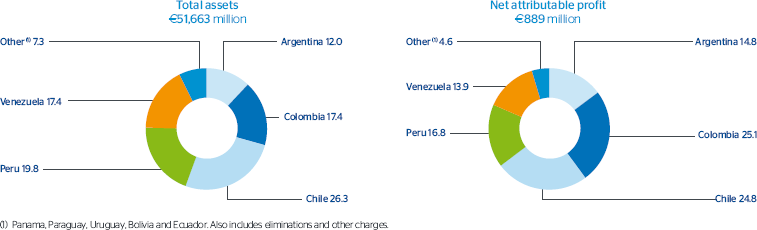

In 2010, AFP Provida in Chile has transformed its models of customer relationship, with particular focus on pension advice and building customer loyalty, strengthening links with the highest-income segments and providing a range of new voluntary pension savings products. It generated a profit of €89m, 20.8% more than in the previous year, thanks to increased fund revenues (up 9.9%) and its positive effect on the institution’s net fee income (up 21.5%). Funds under management increased by 14.0%. AFP Horizonte in Colombia increased its assets by 24.3%, its number of pension-savers by 3.8%, and its fund revenues by 32.9%. Profit was €26m. Finally, AFP Horizonte in Peru had a profit of €16m, and also increased its fund revenues (up 9.0%), number of pension savers (up 5.3%) and assets under management (up 25.8%).

Insurance

The insurance business also had a very positive year. The BBVA companies were very buoyant commercially (with the launch of new products) and their new distribution and sales channels were consolidated. Thanks to this, the volume of written premiums by all the companies (excluding Colombia, which decreased due to strategic reasons) increased by 28.2% over the year. Combined with the moderate levels of claims and expenses, the result was a net attributable profit of €64m, of which €26m were from the Grupo Consolidar in Argentina, €17m from the Group’s companies in Chile, €13m from the Colombian companies and €8m from Seguros Provincial in Venezuela.