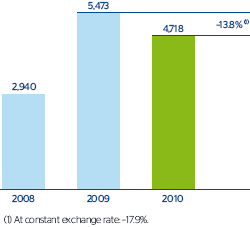

In 2010, impairment losses on financial assets, €4,718m, positively progressed and were down 13.8% compared to 2009. The above has enabled the risk premium for the period to continue its downward trend and closed at 1.3% (1.5% in 2009). The cause of this decrease is primarily due to the proactive measures carried out throughout the fourth quarter of 2009 in Spain and Portugal and in the United States. Considering the above, the percentage of the operating income allocated to covering these impairment losses stands at 39.5%, one of the lowest for its reference group. Finally, said fall in provisions did not prevent the improvement in the coverage ratio, which stood at 62% as of 31-Dec-2010, up by more than 4 percentage points compared to year-end 2009.

Provisions, whose main component is charges for early retirement, increased to €482m, as compared to the €458m in 2009. This was primarily the result of those for contingent liabilities, since there were recoveries in 2009 for the reduction of balances.

Lastly, other gains (losses) stood at –€320m, as compared to the –€641 in 2009. Greater provisions were incorporated for real estate assets in 2010 to maintain coverage above 30%. They also include capital gains generated in the third quarter from the sale and leaseback of commercial offices in Spain. In addition to these capital gains, in 2009 they mainly included the goodwill impairment charge in the United States.