Consumer Finance

The Consumer Finance unit manages consumer finance as well as equipment leasing activities, through Finanzia, Uno-e and other subsidiaries in Spain, Portugal and Italy. The unit had an operating profit of €231m in 2010, which represents a year-onyear growth of 21.3%. The net attributable profit stands at –€6m (–€172m in 2009), as a result of the increase in provisions associated with the new regulatory requirements. At the same time, this has allowed the unit to increase its coverage ratio by 16.3 percentage points.

The loan-book under management totaled €5,546m in Spain (down 1.5% year-on-year). The car loan unit, through prescription, was able to respond to the market’s needs using the Cero Pelotero campaign that facilitated the purchase of automobiles after the disappearance of government aid. At the same time, it was able to increase crossselling thanks to its high level of assurance. The marketing of new Inditex and Repsol credit cards was noteworthy in Portugal, with a loan-book of €461m (down 3.3%). In Italy, the loan-book reached €663m (up 41.3% year-on-year).

BBVA Portugal

BBVA Portugal closed 2010 with a net interest income of €87m (up 2.5% year-on-year), a 14.8% improvement in fees and commissions income and a net attributable profit of €15m (€23m in 2009).

In an environment marked by the slowdown in lending, this unit progressed positively in 2010, with a commercial policy focused on the customer relationship, innovation and service quality and prudent risk management. Thus, total lending to customers rose to €7,448m (up 22.8%), boosted by the increased mortgages (up 26.0%) and corporate lending (up 16.2%) as a result of the various campaigns launched during the year, such as Hipoteca Blue BBVA and Nos Adaptamos. Customer funds in 2010 closed up 10.7%, due to the increased demand for customer deposits under management (up 16.7%).

Insurance

This unit comprises several large companies and has the strategic objective of being the leader in the insurance business. It manages an extensive range of insurances through direct insurance, brokerage and reassurance, using different networks.

In total the unit obtained revenues of €370m for the Group in 2010 from in-house policies and €19m in brokerage on third-party policies. The net attributable profit was down 4.1% year-on-year to €251m.

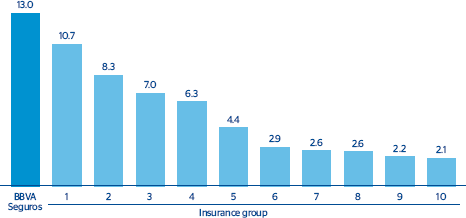

A total of €1,084m was written in premiums over the year, of which €900m corresponds to the individual business (life and non-life) and €184m to groups. The life and accident insurance business remains positive, which contributed €365m in premiums (up 9.1% year-on-year), boosted by the activity in payment protection products. BBVA Seguros is the market leader in individual life and accident insurance policies, with a market share of 13.0% as of September 2010 (latest data available). In non-life policies, the €186m (up 1.7% year-on-year) from multirisk home and fire insurance stand out. The volume of funds under management in private savings policies reached €8,140m, of which €3,115m correspond to individual clients and the rest to company insurance schemes. Moreover, BBVA has brokered premiums for €180m.

In order to provide greater service to its customers, BBVA Seguros has included new modalities into its range for individual customers, such as Seguro Financiado Vivienda BBVA (a single premium multi-risk home insurance) and Rentas Diferidas BBVA (BBVA deferred income), as a comprehensive savings solution. New value-added services at no cost to the insured party have also been added, including the Manitas and Pack Dependencia BBVA Class services, thus boosting customer loyalty. A coinsurance agreement was also signed between BBVA Seguros and Sanitas for the marketing of health insurance. Within the framework of BBVA’s sponsorship of the Jacobean Year 2010, the “Seguro del Peregrino” (Pilgrim Insurance) was launched. BBVA Seguros has received an award for most innovative product for Seguro Afición, in the II Award for Innovation in Insurance granted by ICEA (Investigación Cooperativa entre Entidades Aseguradoras) and Accenture.

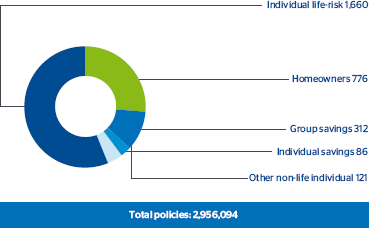

The unit achieved more than 2.9m policyholders, with an increased quality of service, as reflected by the complaint-free resolution of more than 97% of life insurance claims reported and the complaint-free resolution of 96% of home insurance policies. Periodic independent measurements grant the home insurance policies a score of 7.5 out of 10 for service received during the claims process.