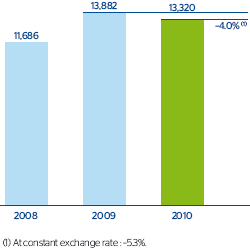

The Group’s net interest income in 2010 stood at €13,320m, only 4.0% down on the figure for 2009. This once more shows its high level of resistance against a backdrop of rising interest rates, more expensive wholesale funds and the gradual change of the composition of the portfolio towards items with less risk and spread, but with higher loyalty. The Entity’s solid geographic structure is also a contributing factor. In this regard, the Americas present positive performance of net interest with year-on-year growth, at constant exchange rates, of 3.2%. This is particularly important in the case of South America (up 11.1%).

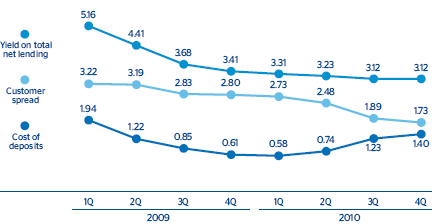

In terms of customer spreads in the euro zone, the average yield on loans stood at 3.19%, compared with 4.17% the previous year. It should be remembered in this respect that the change is closely linked to interest rates, which are passed on more slowly to loan yields. The major falls in interest rates in 2009 had an impact of –2.7% on loan yields over the year (from 6.11% in the fourth quarter of 2008 to 3.41% in the fourth quarter of 2009. In contrast, in the whole of 2010 the fall has only been of 29 basis points, and it is also important to note that yields have remained fairly stable in the second half of the year. All this because of the solid defense of spreads, despite the change in the mix towards lower risk and lower margin products, with progressive repricing of the loan portfolio (in particular, residential mortgages), as well as positive spreads of the new production. The cost of deposits at the close of 2010 stood at 1.02%, 12 basis points below the figure for the same time the previous year (1.14%). However, the figure increased over the year as a result of the change in interest rates mentioned above, together with the customer preference for term deposits and loyalty building campaigns carried out in 2010. Nevertheless, its rate of growth slowed notably over the last three months of the year compared with the previous quarters. As a result, average customer spread in 2010 fell by 86 basis points to 2.17%.

In Mexico, interbank base rates fell over the year (TIIE average 4.91% compared with 5.89% in 2009). This reduction was transferred to yields on loans, which fell by 144 basis points to 12.57%, and to the cost of deposits, which fell 49 basis points to 1.88%. Therefore, customer spread decreased 95 basis points to 10.69%. However, the gradual improvement in economic activity over 2010 means that the accumulated net interest income in the area is practically at the same levels as in 2009 (–0.7% year-on-year, but +11.5% with the exchange-rate effect).

In South America, the reactivation of activity has compensated for the effect the heightened competitive pressure in the region has had on spreads. The net interest income of €2,495m is up 11.1% over the levels of 2009 at constant exchange rates.

Finally, in the United States, the accumulated net interest income was up 1.3% year-on-year (up 6.8% including the effect of the currency), and was sustained primarily by the repricing efforts carried out in the year and due to the growth of lower-cost customer funds. The customer spread of BBVA Compass increased by 16 basis points over the year, as the rate paid on customer deposits has fallen less than the yield on loans.

Therefore, the Group’s net interest income is being increasingly generated by a balance sheet with more controlled liquidity and credit risk.